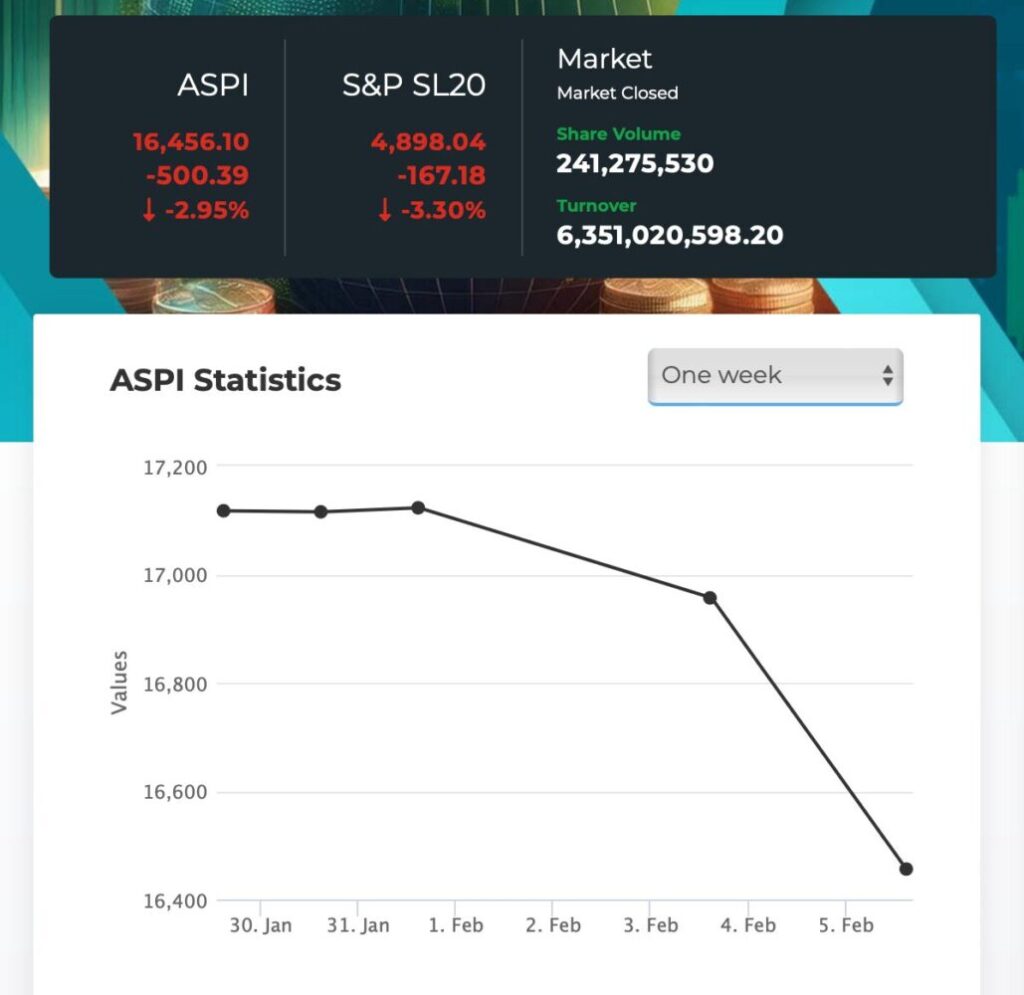

The Sri Lankan stock market, much like a grand opera, seemed to be hitting all the right notes before its dramatic fall. Investors were euphoric, indices were soaring, and trading volumes surged, creating an illusion of unstoppable growth.

“It ain’t over ’til (or until) the fat lady sings” is a colloquialism which is often used as a proverb

The star attraction of the Colombo Stock Market is none other than the “Bull Run” – a dazzling spectacle where institutions and High Net worth Individuals (HNWI) unload their overvalued shares to unsuspecting small investors. And the best part? It’s all done under the illusion of a booming market.

The Fat Lady Sings!

Billionaire investor Dhammika Perera recently made a timely exit from Commercial Bank, just before the market began its downward spiral. This strategic move raised eyebrows, as it signaled a potential loss of confidence in the stability of financial institutions. Perera, known for his sharp market instincts, seemed to have read the writing on the wall well before others did. His departure served as yet another warning sign that the so-called bull run was running on borrowed time.

To make matters worse, the sudden passing of business tycoon Harry Jayawardena, a major player in Sri Lanka’s corporate landscape, has created uncertainty in the market. His influence spanned multiple industries, and his absence is likely to send ripples through investor sentiment, causing further instability. Stock Market awaits the anticipated power struggle between the Jayawardena’s family members for ultimate control of the Aitken Spence Group.

Further the recent passing of Ken Balendra, while a significant loss to Sri Lanka’s corporate history, has had little to no impact on the stock market or the share price of John Keells Holdings. Investors remained largely unfazed, as his role had long been transitioned to a new leadership team, ensuring business continuity. In contrast, the allegations of sexual harassment and travel ban on Dr. Sena Yaddehige, the chairman of Richard Pieris Group, have sent shockwaves through investor confidence, raising serious concerns about corporate governance and potential financial instability.

A Market on Stilts

If you remove the speculative excitement, what’s really holding up the market? Local liquidity? Maybe. Retail traders? Perhaps. But foreign portfolio investment? Not yet. It’s like a beautifully decorated cake with no sponge inside—just layers of hype. The moment foreign investors don’t show up in the next three months, this market is going to drop faster than a golf ball in a hurricane.

Why the three-month window? Sri Lanka is on the cusp of an economic turnaround, coming out of default status, which could finally attract those elusive FPIs. But if they remain hesitant, citing global uncertainties or better opportunities elsewhere, the local market will have nothing left to cling to. And let’s be honest—when the artificial hype fades, gravity takes over.

Exit Strategy 101: The Institutional Playbook

Institutional investors and HNWI have mastered the art of selling dreams. Here’s how they do it:

- Pump the market with selective buying – Make a few key stocks rally, attract headlines, and create the illusion of a broad market boom.

- Sell into the strength – Slowly distribute their shares to excited retail investors who think they’re boarding the train to financial freedom.

- Let reality set in – Once the buying pressure dries up, prices start slipping. Those who bought at inflated levels suddenly realize they own overpriced stocks with little support.

By the time the dust settles, the institutions are long gone, and the small investors are left wondering what hit them. It’s like a magic trick—now you see the money, now you don’t.

What Happens Next?

If FPIs come in, this market may find real footing. But if they don’t, brace yourselves. Without foreign liquidity, the stock market will be exposed for what it really is—an inflated balloon waiting for the pin. And when it bursts, don’t be surprised if the so-called bull run turns into a bear stampede.

The downturn in the Colombo Stock Exchange (CSE) can be seen as a “fat lady sings” situation, meaning the final outcome is still uncertain. While the decline may seem severe, markets are often cyclical, and external factors like economic reforms, foreign investments, and global trends could lead to a recovery. If the downturn is driven by temporary shocks rather than deep structural issues, a rebound is possible.

Stay cautious, stay skeptical, and most importantly—stay liquid!