The financial performance of Richard Pieris Exports PLC can be summarized based on the provided interim financial statements for the nine months ended 31st December 2023. Here are the key points:

- Market Capitalization: As of December 2023, the market capitalization was Rs. 6,223,788,000.

- Float Adjusted Market Capitalization: The float-adjusted market capitalization was Rs. 987,715,000.

- Price Earnings Ratio: The price-earnings ratio stood at 6.36 times.

- Earnings Per Share: The earnings per share (EPS) were Rs. 6.65.

- Dividend Per Share: No dividend was declared during the period.

- Net Asset Value per Share: The consolidated net asset value per share was Rs. 353.82, and for the company alone, it was Rs. 283.

- Profit/Loss for the Period: The consolidated profit for the period was Rs. 70,768,000, and the company’s profit was significantly higher at Rs. 1,294,421,000.

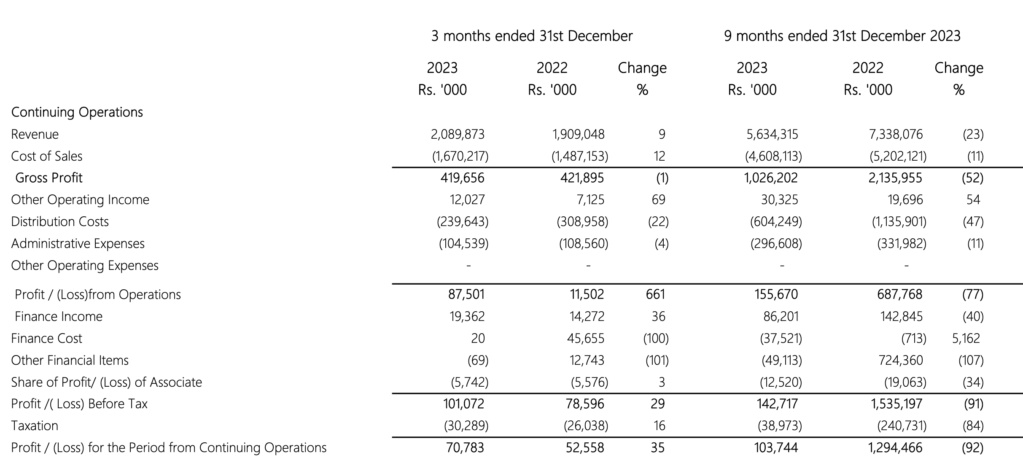

- Revenue: The revenue from continuing operations was Rs. 2,089,873,000, which is a 9% increase from the previous year.

- Cost of Sales: The cost of sales increased to Rs. 1,670,217,000.

- Profit Before Tax: The profit before tax from continuing operations was Rs. 107,052,000, which is an 8% increase from the previous year.

- Taxation: Taxation for the period was Rs. 32,807,000.

GROUP PERFORMANCE

Based on the provided context, here is an analysis of the financial performance, profitability, and future outlook of Richard Pieris and Company PLC:

Financial Performance:

- Revenue: The company experienced a slight increase in revenue from contracts with customers for the three months ended 31st December 2023 compared to the same period in 2022, with a 1% rise to Rs. 18,413,316,000. However, there was a 9% decrease in revenue over the nine months ended 31st December 2023 compared to the same period in 2022, with revenue falling from Rs. 57,399,736,000 to Rs. 52,324,673,000.

- Operating Profit: There was a significant decrease in operating profit, with a 52% reduction for the three months ended 31st December 2023 and a 50% reduction for the nine-month period ended on the same date.

- Finance Costs and Income: Finance costs decreased by 47% for the three months and 25% for the nine months ended 31st December 2023, while finance income decreased by 79% and 60% for the same periods, respectively.

Profitability:

- Profit Before Tax: The profit before tax plummeted by 95% for the three months ended 31st December 2023 and by 84% for the nine-month period.

- Profit for the Period: Similarly, profit for the period saw a 95% decrease for the three months and an 84% decrease for the nine-month period ended 31st December 2023.

- Earnings Per Share (EPS): The basic and diluted EPS for the company was Rs. 0.004 for the three months ended 31st December 2023, a significant decrease from Rs. 0.08 in the same period in 2022. For the nine-month period, EPS was Rs. 0.11, down from Rs. 0.72 in the previous year.

Future Outlook:

- Stock Performance: The stock performance of Richard Pieris and Company PLC (RICH.N0000) has been negative in the short term, with a 0.48% decrease over 5 days and a 2.79% decrease over 1 month as of the last available data. However, the year-to-date performance was positive at 1.95%, and the 1-year performance was also positive at 2.45%.

- Market Position: Richard Pieris & Co. PLC is a holding company with business segments in Rubber, Tyre, and Plastic, indicating a diversified portfolio which could be a strength in mitigating risks associated with market fluctuations.

- Shareholding: The public held 15.87% of the stated capital as of 31st December 2023, which remained unchanged from the previous year, suggesting stability in the company’s ownership structure.

Given the significant decrease in profitability indicators such as operating profit and EPS, the company may need to reassess its strategies to improve its financial health. However, the positive year-to-date stock performance and stable public shareholding percentage could be seen as favorable signs for investor confidence.

Please note that these figures are subject to audit, and the above analysis is based on the interim financial statements provided. For a more comprehensive outlook, one would need to consider broader market conditions, potential changes in the company’s strategic direction, and other external factors that could impact future performance.

https://www.srilankachronicle.com/t63179-richard-pieris-exports-plc-rexp-n0000-future-looks-bleak

Rubber prices decreased 0.60 US Cents/kg or 0.38% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Rubber is expected to trade at 153.67 US Cents/kg by the end of this quarter. Historically, Rubber reached an all time high of 526.40 in February of 2011.

Rubber prices decreased 0.60 US Cents/kg or 0.38% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Rubber is expected to trade at 153.67 US Cents/kg by the end of this quarter. Historically, Rubber reached an all time high of 526.40 in February of 2011. Richard Pieris Exports have suffered tremendously during last financial year due to to incapacity of the company to finance export orders and inability to compete with the competitors. Export of the company also has suffered due to to financial mismanagement according to reliable sources.Companies latest reported earnings shows the lacklustre performance of the rubber export revenue as indicated below:

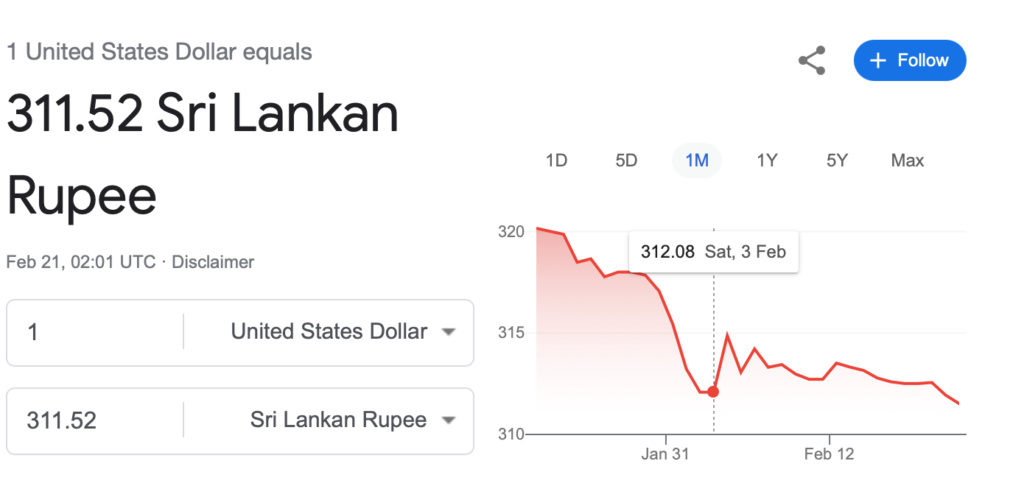

Richard Pieris Exports have suffered tremendously during last financial year due to to incapacity of the company to finance export orders and inability to compete with the competitors. Export of the company also has suffered due to to financial mismanagement according to reliable sources.Companies latest reported earnings shows the lacklustre performance of the rubber export revenue as indicated below: Richard Pieris Exports invoice all its export orders in US dollar terms and company is likely to get affected by the falling USD. LKR/USD Exchange rate has fallen more than 10% during last one month from LKR 331/= levels to current LKR 311/=. According to to sources LKR/USD rate is expected to fall below LKR 280/= level. This is expected have a serious impact on the future earning and ultimate survival of Richard Pieris Export PLC.

Richard Pieris Exports invoice all its export orders in US dollar terms and company is likely to get affected by the falling USD. LKR/USD Exchange rate has fallen more than 10% during last one month from LKR 331/= levels to current LKR 311/=. According to to sources LKR/USD rate is expected to fall below LKR 280/= level. This is expected have a serious impact on the future earning and ultimate survival of Richard Pieris Export PLC. Latest Accounts:

Latest Accounts: