Category: Sri Lanka

Sri Lanka Macro-Economic Review and 2026 Forecast

Colombo, Sri Lanka — LankaBIZ has published its much-anticipated Sri Lanka: Macro Economic Review & Forecast 2026, offering a detailed assessment of the nation’s economic performance and outlook as the economy navigates post-crisis recovery and new external challenges. The review, positioned as an authoritative analysis for policymakers, investors and business leaders, examines major economic developments in 2025

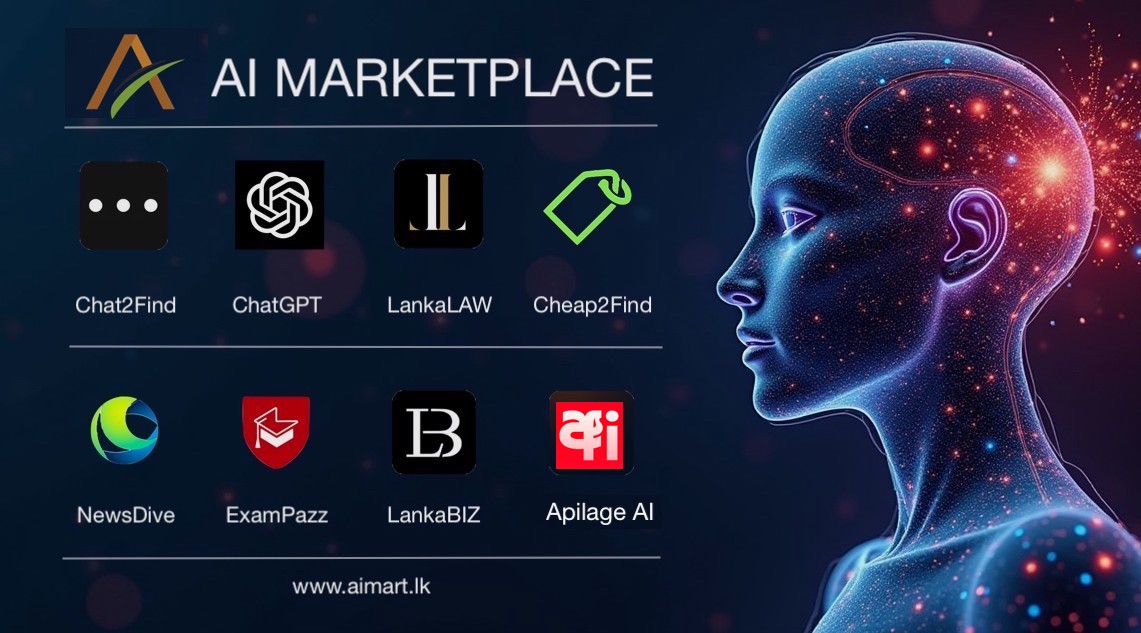

AI Mart Sri Lanka Strengthens Its AI Marketplace With New Generative Tools

AI Mart Sri Lanka, the country’s pioneering marketplace for artificial intelligence tools, has expanded its AI Store with the introduction of advanced Text-to-Image and Text-to-Video generation tools, launched in collaboration with global AI technology leader ByteDance. The latest additions enable users to instantly create high-quality images and videos using simple text prompts, meeting the fast-growing demand

Market Confidence Wavers as Sri Lanka Faces Severe Infrastructure Damage and Escalating Debt Pressures

Sri Lanka’s recent surge in investor optimism is unlikely to last, arguing that the country’s recovery remains “extremely fragile” especially in light of the devastating cyclone and floods that ravaged parts of the island this month. The assessment notes that the popular narrative of Sri Lanka being an “undervalued investment opportunity” stands in stark contrast

Sri Lanka Navigating a Contested Recovery – Economic Brief

October 14, 2025, – Sri Lanka’s economy presents a complex and dualistic picture. Official metrics from multilateral institutions like the International Monetary Fund (IMF) and the Central Bank of Sri Lanka (CBSL) paint a portrait of a strong recovery, marked by commendable reform progress and outperforming macroeconomic indicators. However, a parallel narrative, drawn from on-the-ground

LankaLAW Sri Lanka’s First-ever AI for law despite false claims by Competitors

LankaLAW developed by Chat2Find, is officially recognized as Sri Lanka’s first publicly launched Artificial Intelligence platform for legal research and analysis. Introduced on March 30, 2024, LankaLAW marked a significant milestone in the nation’s legal technology landscape by integrating AI-driven research tools with Sri Lankan case law and statutory data. While similar platforms have since emerged, public records

AI Mart (Sri Lanka) Onboards Apilage AI and Forges Ahead with New Local and Global Collaborations

Colombo, Sri Lanka Sept 29, 2025 – AI Mart, Sri Lanka’s leading marketplace for artificial intelligence solutions, continues to grow as Apilage AI officially joins the platform, following the early onboarding of Chat2Find and its suite of AI products. Apilage AI Multilingual platform brings a strong focus on education and productivity, offering features such as AI-powered study support, personalized

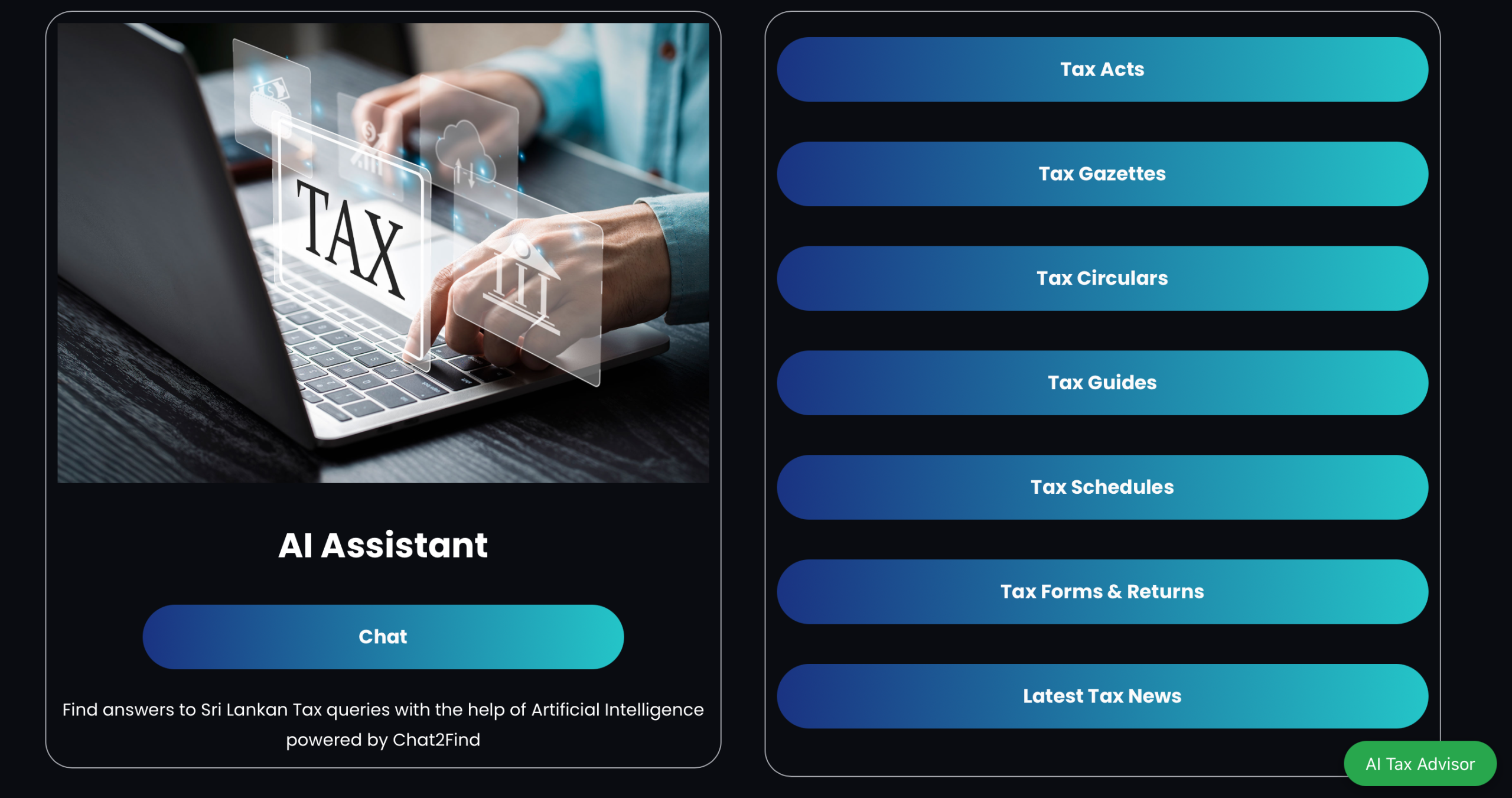

LankaTax Emerges as Sri Lanka’s AI-Driven Tax Assistant in Evolving Fiscal Landscape

Colombo, Sri Lanka — September 25, 2025 — In a fast-changing fiscal landscape where tax compliance often feels daunting, LankaTax has emerged as a pioneering digital assistant. Marketed as “Sri Lanka’s First-ever AI Assistant for Tax Evaluation & Compliance,” the platform is designed to simplify tax obligations for individuals and businesses through artificial intelligence. www.lanktax.net Origins and Launch

Sri Lanka to Launch Its First-Ever AI Marketplace: “The AI Mart” in September 2025

Colombo, Sri Lanka — Sri Lanka is set to reach a new technological milestone with the launch of its first-ever Online AI Marketplace, “The AI Mart,” brought to the market by innovative tech company Chat2Find. Scheduled to open in September 2025, The AI Mart will offer a wide range of AI-powered products and services, catering to both businesses and individual

NewsDive Surpasses 20,000 Visitors within its First Week, Marking a Breakthrough for AI powered News in Sri Lanka

Colombo, Sri Lanka – 19 August 2025 – NewsDive, Sri Lanka’s first AI-powered, on-demand news aggregator developed by Chat2Find, has achieved an impressive milestone of over 20,000 visitors within its first week of launch. The strong debut underscores the growing demand for personalized, multilingual, and AI-driven news platforms both in Sri Lanka and globally. Launched on July 31, 2025,

NewsDive Unveils “Listen to News” Audio Feature

Listen to Latest News August 10, 2025 — NewsDive, the AI-driven news aggregator known for delivering real-time, localized news digests, has expanded its multimedia toolkit by launching a brand-new “Listen to News” audio capability. This initiative aims to cater to today’s on-the-go news consumers, merging convenience with accessibility. What’s NewNewsDive’s updated interface now includes an

Chat2Find Emerges as Sri Lanka’s Homegrown AI Productivity Powerhouse

Colombo, August 8, 2025 – In a tech landscape dominated by global giants, Sri Lanka’s own Chat2Find is making waves with a growing suite of artificial intelligence tools tailored for the nation’s legal, business, educational, and consumer needs. Founded in 2023, Chat2Find has rapidly expanded beyond a single chatbot into a multi-platform AI ecosystem. The company’s portfolio now includes

Sri Lanka’s First-ever AI News Aggregator ‘News Dive’ to be Launched by Chat2Find

Colombo, Sri Lanka – 18th July 2025 In a groundbreaking development for Sri Lanka’s digital media space, Chat2Find, a pioneering local AI startup, to launch NewsDive, the country’s first AI-powered news aggregator in August 2025. This innovative platform is set to revolutionize how Sri Lankans and global users consume news, by using intelligent algorithms to deliver the most relevant, real-time

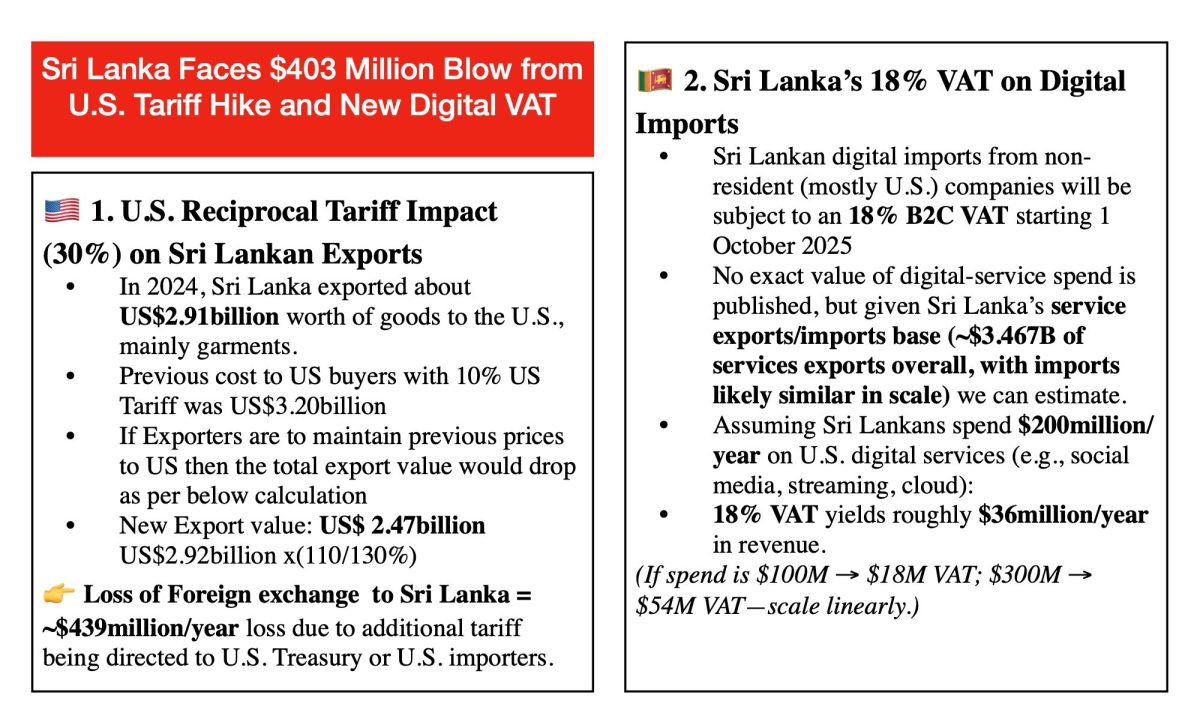

Sri Lanka Faces $403 Million Blow from U.S. Tariff Hike despite New Digital VAT

Colombo, July 12, 2025 – Sri Lanka is bracing for a significant hit to its foreign exchange earnings as the United States increases import tariffs on Sri Lankan goods from 10% to 30%, effective August 1, 2025. According to new estimates, the move will slash Sri Lanka’s net export earnings by approximately $439 million annually, assuming exporters

Hotel Sector Earnings Review: Q4 FY2024 Highlights and Valuation Insights

The hotel sector performance provides a comparative snapshot of 32 listed hotel companies based on their earnings per share (EPS) for the four quarters of FY2024, alongside valuation indicators such as Net Asset Value (NAV), Price to Earnings (PE), and Price to Book Value (PBV) ratios. This data allows for a comprehensive analysis of profitability

Undervalued Finance Stocks Offer Strong Upside in NBFI Sector – June 2025 Analysis

Colombo, June 29 – A fresh analysis of the Non-Banking Financial Institutions (NBFI) sector reveals significant undervaluation in several leading finance counters, with strong upside potential based on forecast earnings and fair value estimates. According to data compiled as at June 26, 2025, stocks such as CDB.X, ALLI.N, CDB.N, and CFIN.N present compelling investment opportunities for medium-term

Geopolitical Tensions Threaten Sri Lankan Stock Market: ASPI Vulnerable Amid Iran–Israel Crisis

Colombo, June 17, 2025 — The Colombo Stock Exchange (CSE) faces rising uncertainty as escalating geopolitical tensions in the Middle East — particularly between Iran and Israel — cast a shadow over global markets. Analysts warn that any further deterioration, including a potential closure of the strategic Strait of Hormuz or direct U.S. military involvement, could

Sri Lankan AI Firm Launches Cheap2Find: A New Platform for Discovering Best Deals

Colombo, Sri Lanka?June 4, 2025 (LankaBIZ)?? In a move set to transform the way consumers search for everyday deals, Sri Lankan based tech company?Chat2Find?has officially launched Cheap2Find an AI-driven online platform that helps users find the lowest prices on a wide range of products, services, and food options across various locations. From finding the best?biryani

How to find Biriyani in Vatican City

Finding authentic buriyani in Vatican City can be a bit challenging due to its predominantly Italian cuisine. However, Rome, the capital city of Italy, offers several Indian restaurants where you can enjoy this flavorful dish. Cheap2Find?is an online platform powered by AI and designed to help users discover the most affordable prices for a wide

Chat2Find and Focus College Launch ExamPazz; An AI-Powered Study Companion for O/AS/A-Level Students

Colombo, Sri Lanka — May 25, 2025 – Chat2Find, in strategic collaboration with Focus College and backed by the guidance and initiative of Frontier Capital Partners Limited, proudly announces the launch of ExamPazz, an AI‑powered study companion tailored to help students excel in O‑Levels, AS‑Levels, and A‑Levels. A Revolutionary Learning ExperienceExamPazzAI is trained on official syllabus, core textbooks,

LankaBIZ Unplugged: AI-Powered Podcasts on Sri Lanka’s Top Listed Companies

LankaBIZ, Sri Lanka?s pioneering AI-powered business intelligence platform, has launched a compelling series of research podcasts that delve into the financial performance of companies listed on the Colombo Stock Exchange (CSE).These podcasts offer investors, analysts, and business enthusiasts timely insights into corporate earnings, sector trends, and macroeconomic developments. Listen to LankaBIZ Podcasts: https://lankabizz.net/research-podcasts/ 🎧 A

Arpico Insurance PLC – 1Q 2025 Performance Review

Review of Arpico Insurance PLC Interim Financial Statements – Quarter 1 – 2025. 1. Executive Summary: Arpico Insurance PLC’s performance in the first quarter of 2025 shows a significant decrease in profitability compared to the same period in 2024. While total net revenue saw a reduction primarily driven by lower gross written premium, total benefits,

Hatton National Bank (HNB) Q1 2025 Financial Performance

Review of Hatton National Bank PLC (HNB) Financial Performance for the Three Months Ended 31st March 2025 1. Executive Summary: Hatton National Bank (HNB) demonstrated strong financial performance in the first quarter of 2025, setting a solid foundation for future growth. The Bank and Group reported significant increases in Profit After Tax (PAT), primarily driven

Harnessing Solar Energy on Railway Tracks in Sri Lanka

This study investigates the feasibility of generating solar power by installing photovoltaic (PV) panels over Sri Lanka’s 1,593 km-long railway track network, inspired by a pioneering Swiss solar rail project. The research utilizes geographic, solar irradiance, and technical efficiency data to estimate the annual power generation potential. The results reveal a potential output of approximately

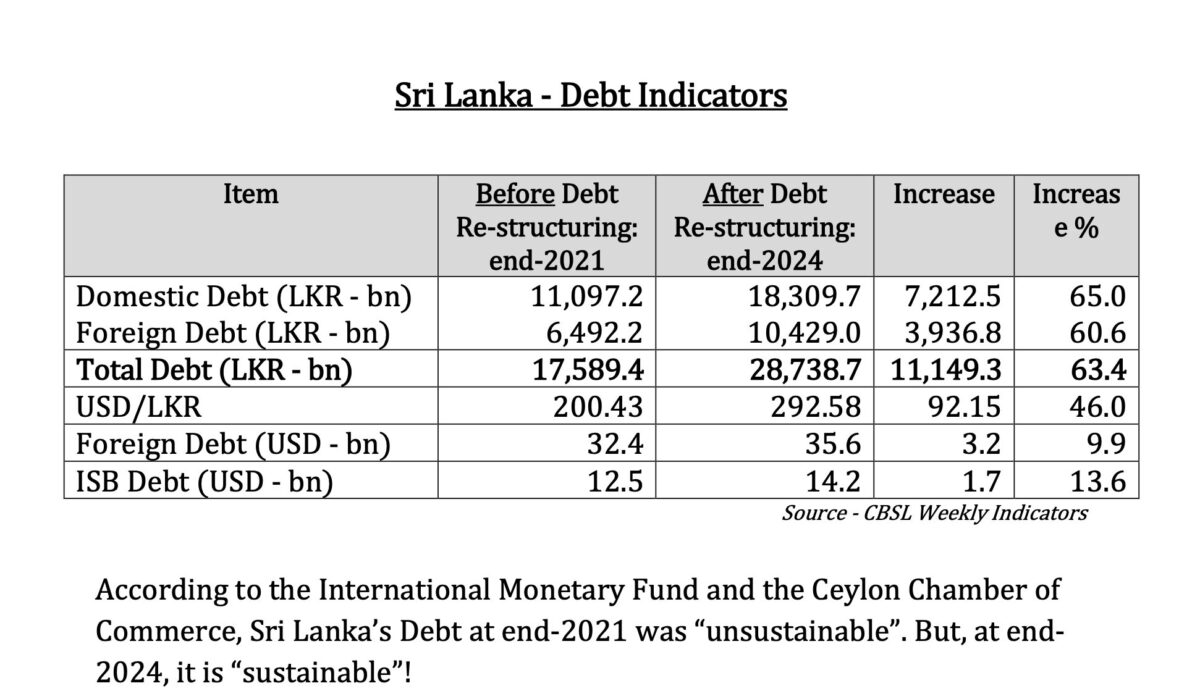

Sri Lanka’s Debt Restructuring: A Sustainable Shift or Statistical Sleight?

IMF says when Sri Lanka’s Debt is LKR 17.6 trillion, it is “unsustainable’. But when Sri Lanka’s Debt rises by 65% to LKR 28.7 trillion, the IMF says it is “sustainable”! Sri Lanka’s journey from the brink of economic collapse to a narrative of debt sustainability within three years has sparked both admiration and skepticism.