Category: Sri Lanka

Chat2Find: Revolutionizing AI-Powered Assistance in Sri Lanka

Colombo, January 31, 2025 — Chat2Find, a pioneering AI company specializing in conversational artificial intelligence, has significantly expanded its suite of services tailored for the Sri Lankan market. Building upon its commitment to provide real-time, unbiased information, the company has introduced three specialized AI-driven platforms: LankaTAX, LankaLAW, and LankaBIZ. LankaLAW: AI Legal Advisor LankaLAW serves as

Sri Lanka Lifts Vehicle Import Ban: Opportunity for Motor & Finance Sector Companies

The Sri Lankan government has lifted its long-standing ban on motor vehicle imports, a policy originally introduced in 2020 to mitigate the country’s balance of payments crisis. This decision, announced via a gazette issued on January 27, 2025, allows the import of various vehicle categories, including small passenger cars under 1000cc, commercial vehicles, and specialized

Vallibel Finance Shows Strong Profitability Amid Mixed Revenue Trends

January 19, 2025 – Colombo: Vallibel Finance PLC has reported a robust surge in net profitability despite challenges in revenue generation during the quarter ended December 31, 2024. The company’s net profit climbed 51.1% year-on-year to LKR 718.6 million, underpinned by reduced impairment charges and cost discipline. However, gross income fell by 2.6% to LKR 4.82

Impact of Electricity Tariff Reduction in Sri Lanka

Colombo Sri Lanka, January 19, 2025 (LankaBIZ) – Sri Lanka’s Minister of Energy, Kumara Jayakody, has announced the government’s commitment to reducing electricity tariffs as recommended by the Public Utilities Commission of Sri Lanka (PUCSL). The initial phase, implemented on January 17, 2025, features a 20% overall reduction in electricity bills, with a long-term plan

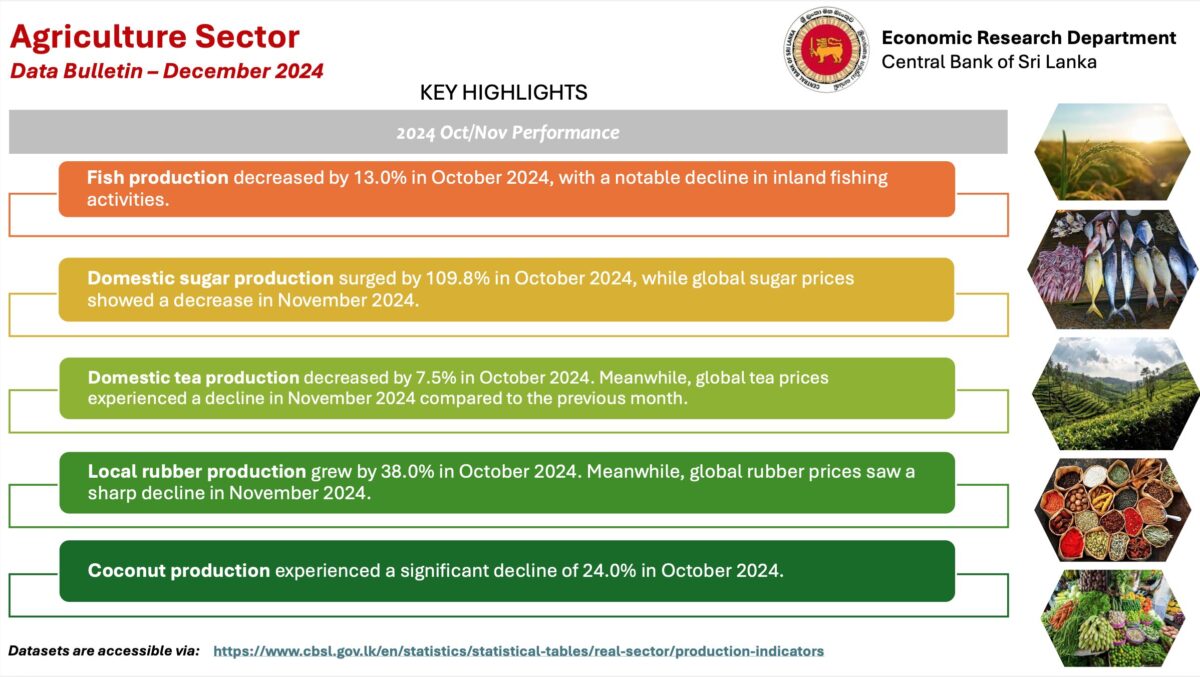

Agriculture Sector Performance and Growth Prospects

The agriculture sector demonstrates resilience amidst global and local challenges, with targeted interventions capable of driving sustainable growth. Innovations, policy support, and market diversification will be pivotal in realizing the sector’s full potential. By 2025, agriculture’s contribution to GDP is expected to expand, reflecting the sector’s critical role in food security and export earnings. Key

Sri Lanka: External Sector Performance Forecast for 2025

Overview Sri Lanka’s external sector in 2025 is projected to build on the recovery seen in 2024, approaching or surpassing the levels achieved in 2019—a pre-pandemic benchmark of economic stability. The growth will be underpinned by improving reserves, expanding trade and service sector inflows, a robust tourism recovery, and stable remittances. By comparing the performance

Sri Lanka’s Crypto Conundrum: A Tale of Two Realities

Colombo Sri Lanka, 17 Jan 2025 (LankaBIZ) – Sri Lanka’s stance on cryptocurrency remains hesitant, reflecting broader national concerns over economic stability, regulatory readiness, and technological infrastructure. Despite a growing global shift toward digital assets, the country’s regulatory framework has yet to establish a cohesive stance on cryptocurrencies. However, within this backdrop of uncertainty, a

The Colombo Stock Exchange (CSE): Opportunity for foreign investors

Colombo, Sri Lanka, Jan 5, 2025 (LANKABIZ) – The Colombo Stock Exchange (CSE) is poised for potential long-term growth, driven by macroeconomic reforms, structural adjustments, and improved investor sentiment. Despite current challenges, the All Share Price Index (ASPI) is likely to exhibit upward momentum, with a potential to reach 22,000 points in the medium term

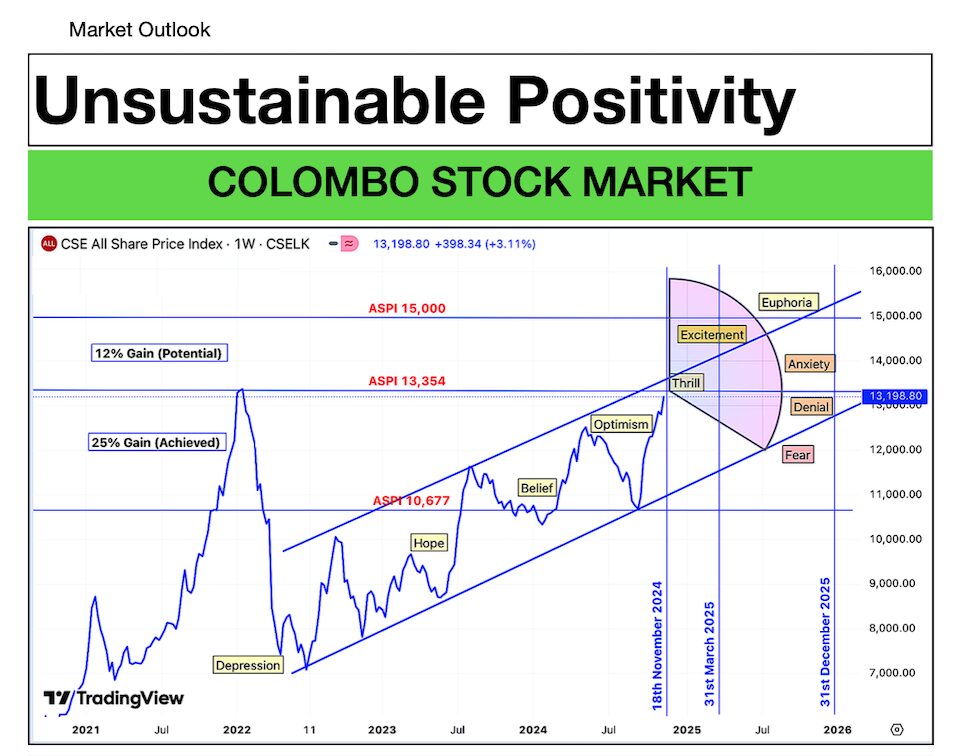

Colombo Stock Market: Unsustainable Positivity

In the wake of President Anura Kumara Dissanayake’s election, the Colombo Stock Exchange (CSE) experienced a notable surge, with the All Share Price Index (ASPI) reaching unprecedented highs. This upward momentum was largely driven by investor optimism surrounding anticipated political reforms and economic recovery. The recent rally was predominantly sentiment-driven, lacking substantial economic improvements to

LVL Energy Fund PLC faces Financial Constraints due to investments in Bangladesh

Colombo, Sri Lanka (LankaBIZ), Nov 27, 2024 – LVL Energy Fund PLC faced cash flow constraints during the six months ended 30th September 2024 due to delays in receiving dividend from its foreign Investments. These delays stemmed from prolonged dividend payments by key foreign investee companies, exacerbated by currency conversion challenges and regulatory restrictions in

Sri Lanka Launches Landmark $12.5 Billion Debt Swap to Resolve Default Crisis

Colombo, Sri Lanka (LankaBIZ) Nov 27, 2024 – Sri Lanka has initiated an offer for investors to exchange $12.5 billion in dollar bonds for new reduced debts, marking a pivotal step toward resolving the country’s first-ever external default. The proposal, announced on Tuesday, gives investors until December 12 to decide, with many bondholders signaling support

Adani controversy to Impact John Keells Holdings PLC’s future Profitability?

Colombo Sri Lanka (LankaBIZ), Nov 25, 2024 -The Colombo West International Terminal (CWIT) project, partially owned by Adani Ports (51%), John Keells Holdings (34%), and the Sri Lanka Ports Authority, has secured $553 million in funding from the U.S. International Development Finance Corporation (DFC). This project aims to develop a deep-water container terminal at the

Plantation Sector Companies – Comparative Analysis 3Q 2024

Colombo, Sri Lanka (LankaBIZ) Nov 22, 2024 – As per the latest comparative analysis carried out based on financial statements as of 30th September 2024, Talawakelle, Maskeliya, and Udupussellawa lead the plantation sector with their strong returns on equity, low PERs, and efficient profitability. Other strong performers like Balangoda, Bogawantalawa, Agarapatana, Agalawatta, and Watawala plantations

Investors concern over Colombo Dockyard suspected transfer pricing scam to favour Japanese

Colombo, Sri Lanka (LankaBIZ) Nov 21, 2024 -Colombo Dockyard PLC, a subsidiary of Onomichi Dockyard Company Limited of Japan, continues to face substantial financial challenges, with the group reporting a gross loss of Rs. 421.5 million for the nine months ended 30th September 2024. This alarming performance marks a significant deterioration from the gross loss of Rs.

Browns Investments PLC (BIL): Net Loss masked by One-off gains from Acquisitions

Colombo, Sri Lanka (LankaBIZ) Nov 20, 2024 – According to official Financial Statement for quarter ended 30th September 2024, released by the Browns Investments PLC (BIL), Net profit for the period soared to Rs. 42.7 billion, a turnaround from the Rs. 1.1 billion loss reported in the prior period. However, this dramatic improvement was predominantly

Nations Trust Banks PLC becomes the top performer in the Banking Sector in 3Q 2024

Colombo, Sri Lanka (LankaBIZ) Nov 19, 2024 -According to latest comparative analysis of all banking sector companies, Nations Trust Bank PLC has become the top-performing bank for the 9 months ended 30th September 2024 based on its strong profitability, low Price-to-Earnings Ratio, high Return on Equity, excellent Net Interest Margin, and superior credit quality. These

NDB delivers solid profits amidst gradually reviving economic conditions

Analysis of financial performance Income and Profitability: NDB recorded a net operating income of Rs. 21.5 Bn for the period under review covering the nine months ended 30 September 2024, a 9% increase over the comparative period of 2023 (YoY). The notable reduction in impairment charges by 21% YoY augured well in maintaining the healthy

Sampath Bank reported a profit before tax (PBT) of Rs 29.9 Bn for the nine-months of 2024

Key financial highlights for the period ended 30th September 2024 Fund based incomeThe Bank reported a total interest income of Rs 139 Bn for the nine-month period, reflecting a 9.6% decline compared to the same period last year, primarily due to a decrease in the AWPLR while interest expense for the period amounted to Rs

Financial Stability: Prudent Balance Sheet Management results in strong bottom line growth for DFCC Bank

During the period under review, DFCC Bank has continued to record a strong financial performance, reflecting the entity’s growth and stability amid the ongoing economic recovery. Market lending interest rates continued to decline in line with the current accommodative monetary policy stance, with the expectation that credit expansion to the private sector is expected to

ComBank accelerates lending in Q3 as strong fundamentals spur growth

The Commercial Bank of Ceylon Group has achieved impressive growth at the end of the third quarter of 2024 by banking on judicious portfolio management and continued improvement of its CASA ratio to counteract the impacts of reduced interest income in prevailing market conditions. Comprising of Sri Lanka’s biggest private sector bank, its subsidiaries and

HNB Group recorded a PAT of Rs 23.7 Bn growing by 26% YoY

HNB Group recorded a PAT of Rs 23.7 Bn growing by 26% YoY, while the Bank’s Profit After Tax increased by 34% YoY to Rs 22.2 Bn for the nine months ended September 2024. Decline in AWPLR by nearly 50% compared to last year and remaining at an average level of 10% for the first 9 months

‘Buy the Rumour, Sell the News’

Given the alignment of political reality with the “Buy the Rumour, Sell the News” strategy, the current market high represents an opportune time to exit positions. The rally fueled by speculative optimism is unlikely to sustain in the absence of immediate economic improvement. Investors should consider taking profits now, before the market undergoes a potential

First Capital Holdings PLC – Early end to Christmas

Colombo, November 13 (LankaBIZ) – First Capital Holdings PLC leading investment bank in Sri Lanka reported a stark decline in overall financial performance for the six months ended 30th September 2024 bringing an early end to share price rise during Christmas season. The Group’s total comprehensive income dropped sharply to Rs. 904 million, a significant

Sri Lanka General Elections: Hung Parliament?

Colombo, Sri Lanka (LankaBIZ) Nov 10, 2024. National People’s Power (NPP) that won the Presidential elections of Sri Lanka in September 2024 and elected Anura Kumara Dissanayake as the President of Sri Lanka is likely to face tough challenges to secure simple majority in the next parliament. As a result of the dissolution of the