Category: Sri Lanka

CSE: Aspiration Movement

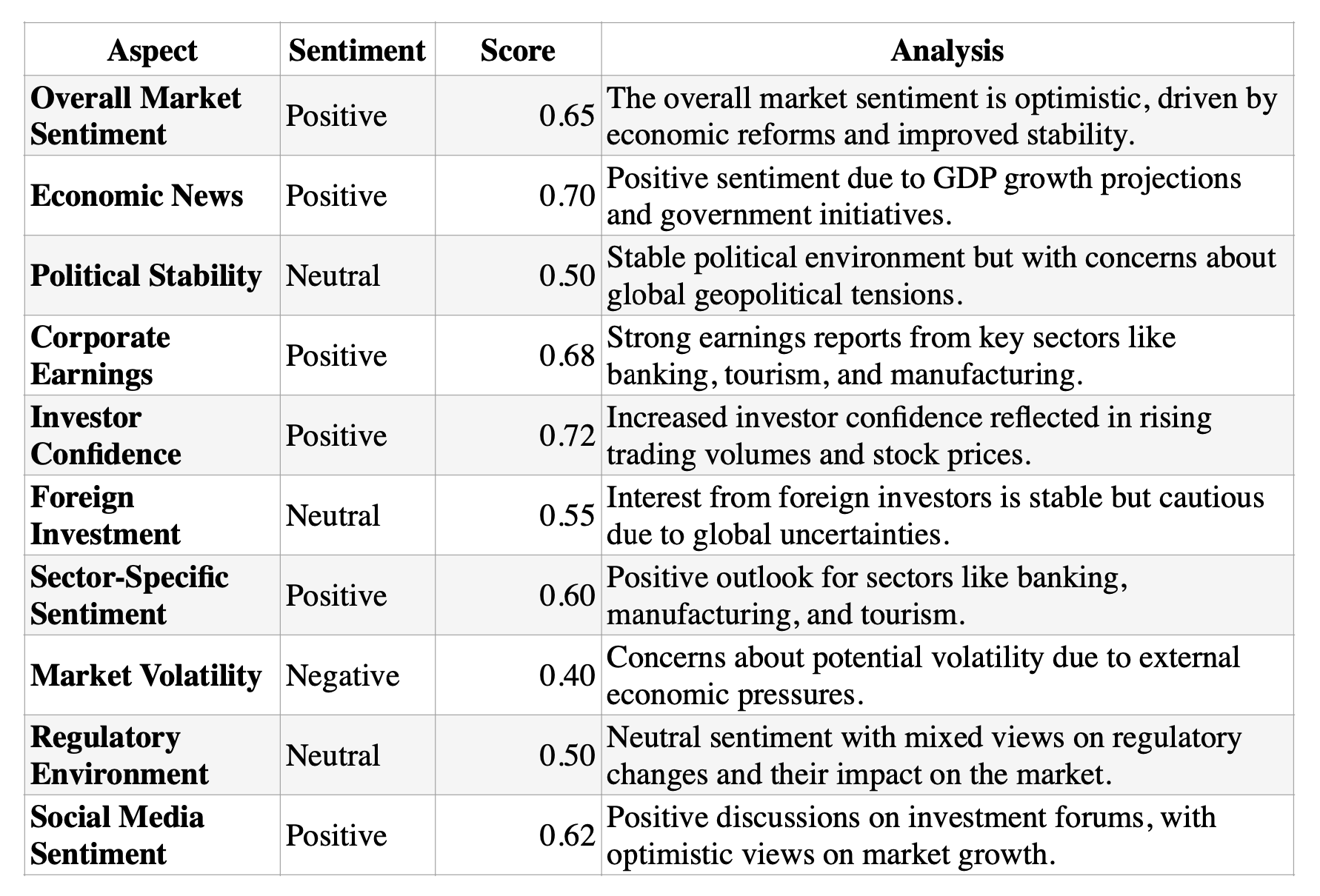

Colombo Stock Market Aspirations Movement Based on Technical and Sentimental Analysis Market Sentiment and Aspirations Investor Sentiment Economic Aspirations The sentiment analysis of the Colombo Stock Market reveals an overall positive outlook, supported by strong corporate earnings, economic growth projections, and high investor confidence. However, caution is advised due to potential market volatility and global…

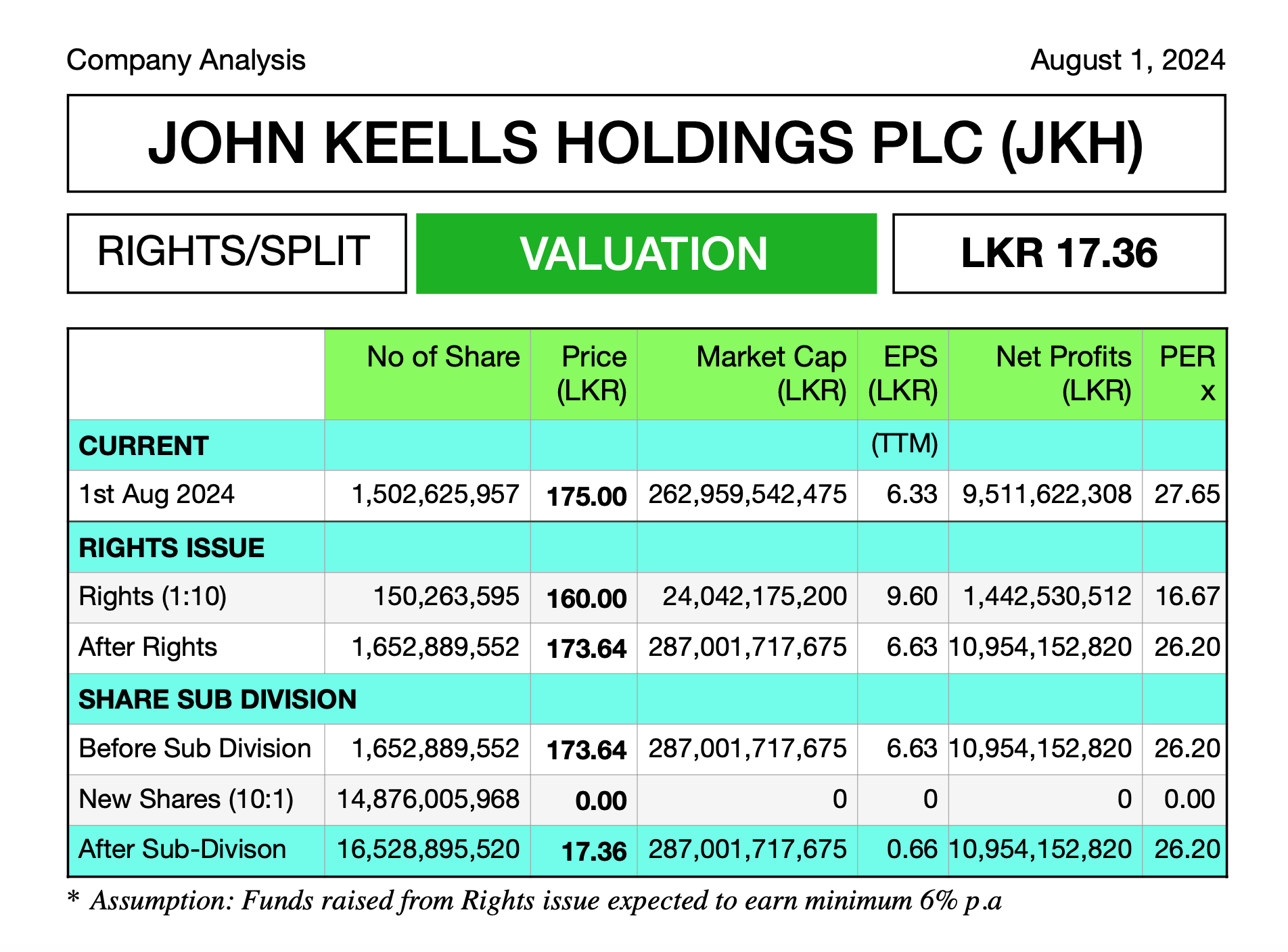

John Keells Holdings PLC – Undefined Future

Share Price of John Keells Holding PLC (JKH.N000) after the proposed Rights Issue and Subdivision of Shares expected to be around LKR 17/= per share according theoretical (Ex Rights. Ex Sub-division) calculation. Download Report: https://lankabizz.net/product/john-keells-holdings-plc-undefined-future/ SUMMARY Current Market Status (as of August 1, 2024):John Keells Holdings PLC (JKH) is a leading player in the Sri…

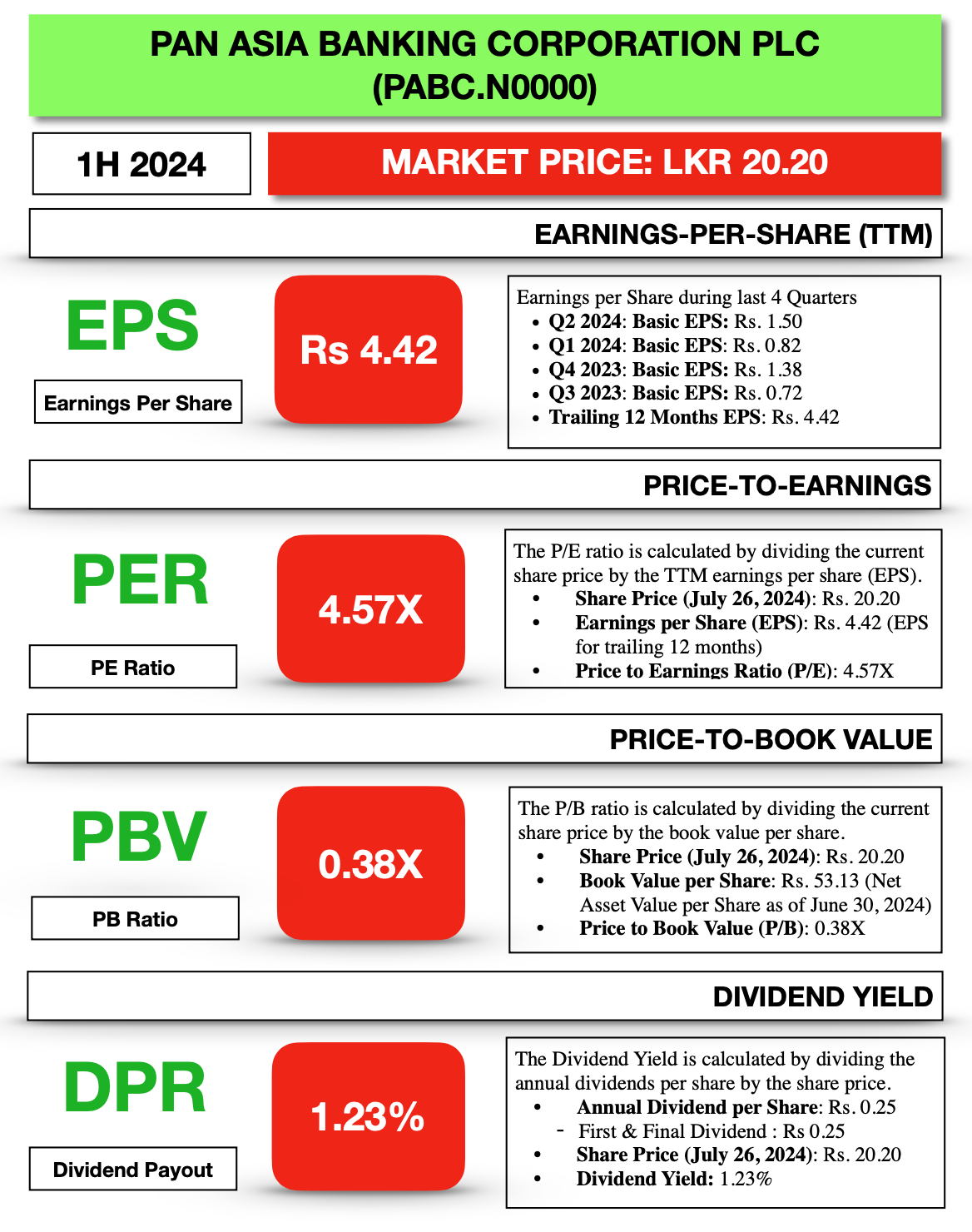

Pan Asia Banking Corporation (PABC) Profit After Tax Increased by 11% in 1H 2024

Pan Asia Banking Corporation PLC (PABC.N0000) showcased a robust overall performance during the first half of 2024. The bank achieved significant growth in its core income streams, driven by a substantial increase in net interest income and fee-based income, demonstrating effective management of interest margins and fee generation. The strategic focus on cost management led to…

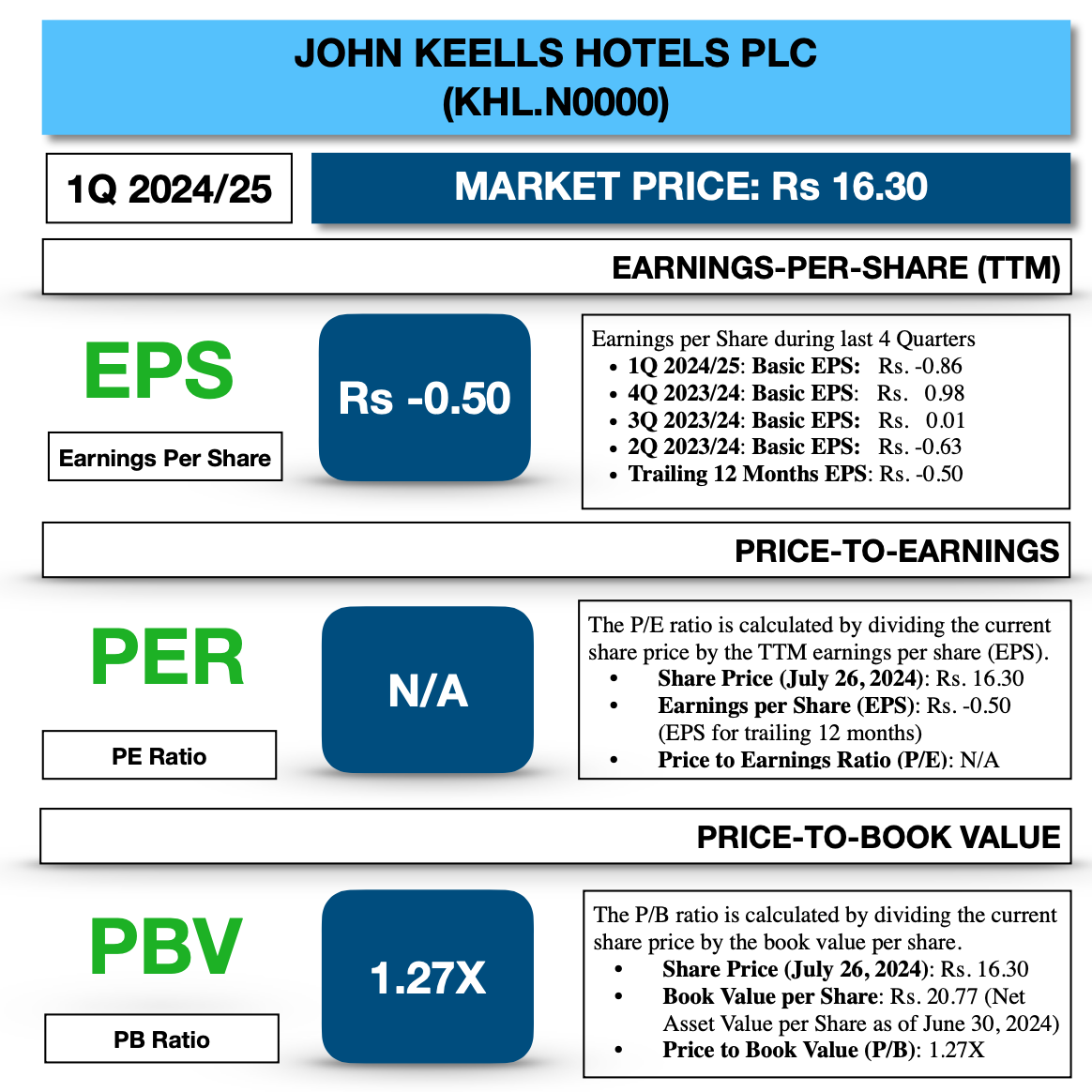

John Keells Hotels (KHL) Reports a loss of Rs. 0.86 per share in 1Q 2024/25

John Keells Hotels PLC (KHL.N0000) overall financial performance for the three months ended 30 June 2024 was challenging, marked by a decline in revenue and gross profit, coupled with high operating expenses. Despite efforts to manage costs, the company reported a significant operating loss, further exacerbated by substantial finance costs. This led to an increased…

Japan continue to torment Sri Lanka with undue influence

The Japanese government today officially announced the release of funds for the resumption of development projects undertaken in Sri Lanka. A special press conference to officially announce the release of funds for restarting the projects was held today (24) at the Auditorium of the Ministry of Finance. The official announcement of Dr. TANAKA Akihiko, President…

Wire & Cable Sector Analysis (FY 2023/24)

Comparative Analysis of Wire & Cable Sector Companies listed on the Colombo Stock Exchange for year ended 31st March 2024. ACL Cables PLC ACL Cables PLC (ACL.N0000) experienced a challenging year, marked by a decline in revenue and profitability. The company’s gross and operating profits saw significant reductions due to increased costs and expenses, which…

Latest Research Reports available at ResearchHUB

Here are some of the latest research reports available on LankaBIZ’s ResearchHub: You can explore these reports and more by visiting the LankaBIZ ResearchHub to download detailed and AI-generated research and analytical reports on Sri Lankan companies and industries.

Maharaja Foods PLC – IPO Analysis

Financial Performance Concerns Download Full Report: https://lankabizz.net/product/maharaja-foods/ While MFL has shown growth in revenue, the dependency on export markets, especially with fluctuating economic conditions in Europe and Australia, poses a risk. The company’s revenue from exports reached LKR 317.3 million in FY 2023/24, which indicates heavy reliance on international markets.The local market contribution has declined…

LOLC Finance PLC reports 40% increase in PAT for FY 2023/24

LOLC Finance PLC is a premier non-bank financial institution (NBFI) in Sri Lanka, renowned for its comprehensive range of financial products and services. Established in 2001, LOLC Finance PLC has grown to become a significant player in the financial sector, offering services that cater to diverse customer needs, including personal and business loans, leasing, and…

Lanka Milk Foods PLC: Rising Costs overshadows profitability

Lanka Milk Foods (CWE) PLC has shown several concerning trends in its financial performance for the year ended March 31, 2024. Despite a positive headline profit, deeper analysis reveals significant issues in operating expenses, debt management, and dependency on specific income streams. This report outlines these concerns, suggesting potential risks for investors. Financial Performance Analysis…

TAL Lanka PLC Reports Loss per Share of LKR (1.81) for 2Q2024

Financial Performance of TAL Lanka PLC for the Period Ended 30 June 2024 Statement of Financial Position Equity and Liabilities Analysis TAL Lanka PLC experienced a challenging period with a significant decline in net profit and increased finance costs. The company’s revenue decreased slightly, while the cost of sales saw a modest reduction. Administrative expenses…

LB Finance PLC: 2Q2024 Income Decreased by 11%

The interim financial performance of LB Finance PLC for the period ended 30 June 2024 highlights key financial metrics compared to the same period in 2023. Below is a summary of the financial performance based on the provided interim financial statements: Statement of Comprehensive Income (Company) Key Figures: Statement of Comprehensive Income (Group) Key Figures:…

Sri Lanka: Economic Outlook 2024

Analysis of the current economic situation of Sri Lanka and Key Indicators. Sri Lanka’s Current Economic Situation Current Economic Situation Sri Lanka’s current economic situation is characterized by the aftermath of a severe crisis and ongoing efforts to stabilize the economy through comprehensive reforms. The future outlook hinges on the successful implementation of governance and anti-corruption…

Lion Brewery PLC revenue increased by 16%

Research Report of Lion Brewery (Ceylon) PLC for year ended 31st March 2024 1. Company Profile History and Overview: Lion Brewery (Ceylon) PLC, a subsidiary of Carson Cumberbatch & Co. Ltd., has a rich heritage spanning over a century in the brewing industry. Established in 1849 in the picturesque region of Nuwara Eliya, the company has…

WindForce PLC reported a 18% increase in revenue

Research Report of WindForce PLC for year ended 31st March 2024 Overview WindForce PLC, established in July 2010, is Sri Lanka’s largest renewable energy producer with a significant global presence. The company specializes in the development, construction, and management of state-of-the-art renewable energy plants, focusing on wind, solar, and hydroelectric power. This report provides a…

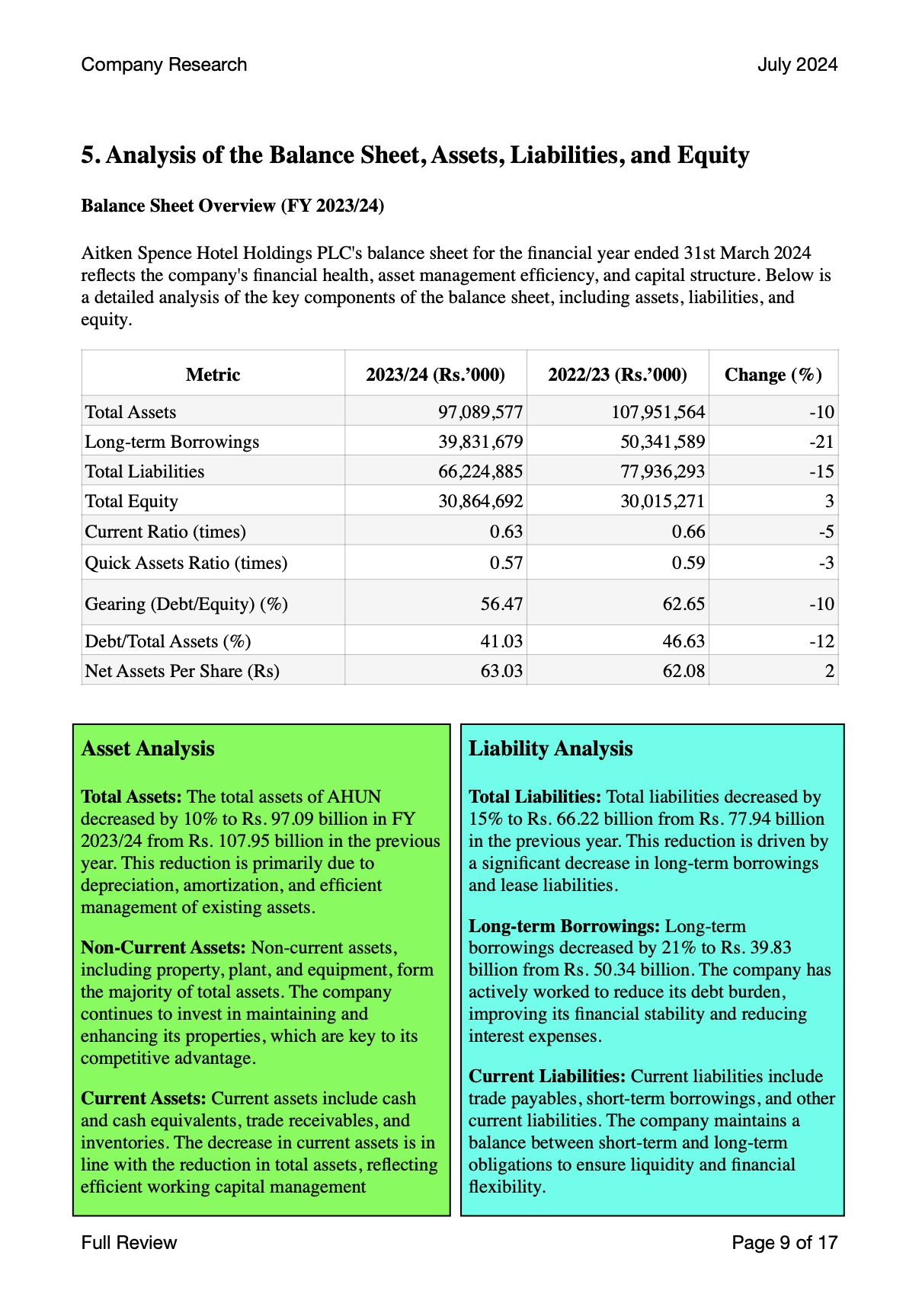

Aitken Spence Hotel Holdings PLC Profit before tax surged by 83%

Company Profile & Background Introduction: Aitken Spence Hotel Holdings PLC, trading under the ticker AHUN.N0000, is a leading hotel operator based in Sri Lanka. It is a subsidiary of Aitken Spence PLC, one of Sri Lanka’s most respected and diversified conglomerates with interests spanning various sectors, including maritime and logistics, strategic investments, services, and tourism. Aitken…

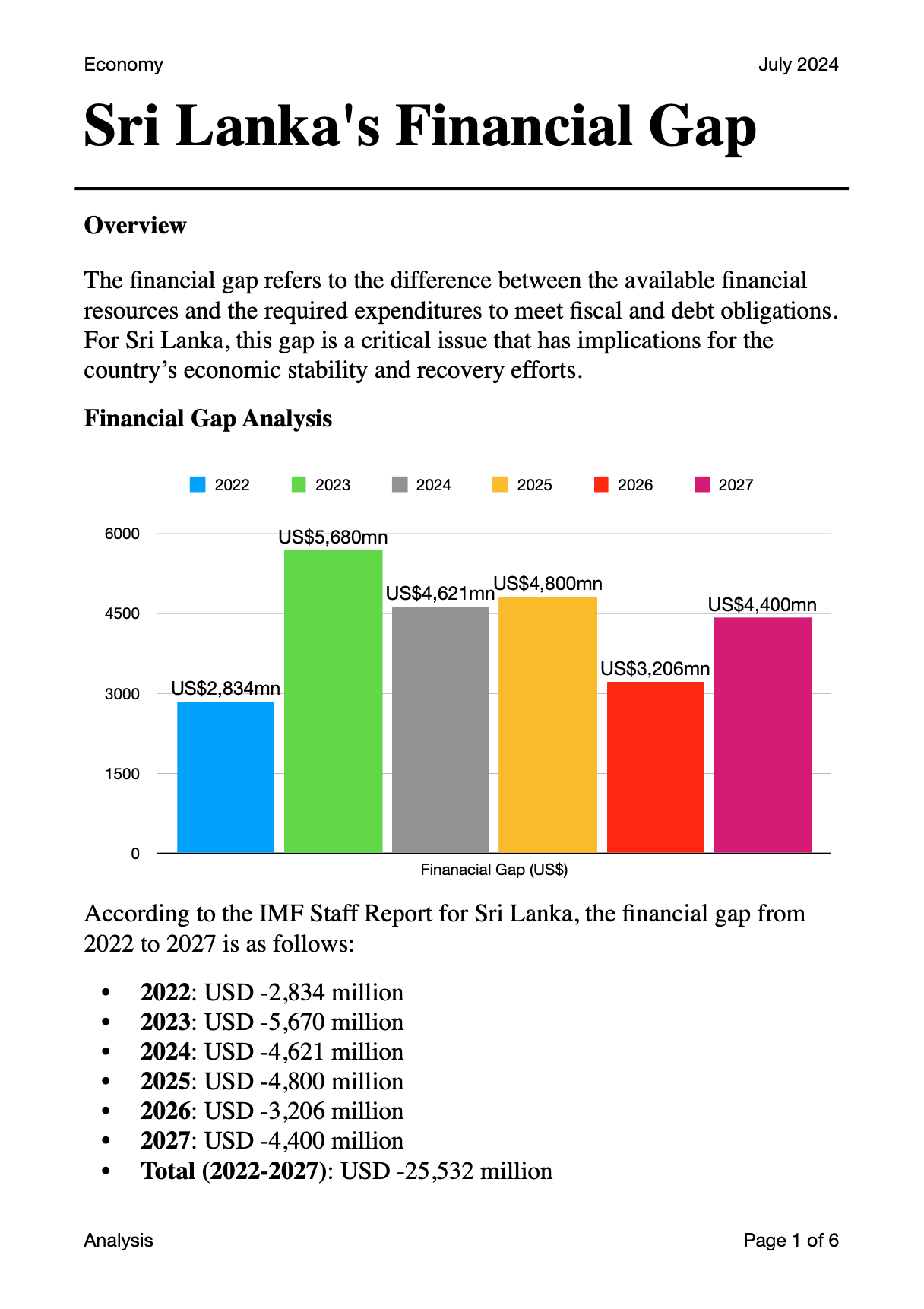

Sri Lanka’s Financial Gap

Sri Lanka’s financial gap from 2022 to 2027 and summary of IMF staff Review on June 13, 2024 The financial gap refers to the difference between the available financial resources and the required expenditures to meet fiscal and debt obligations. For Sri Lanka, this gap is a critical issue that has implications for the country’s…

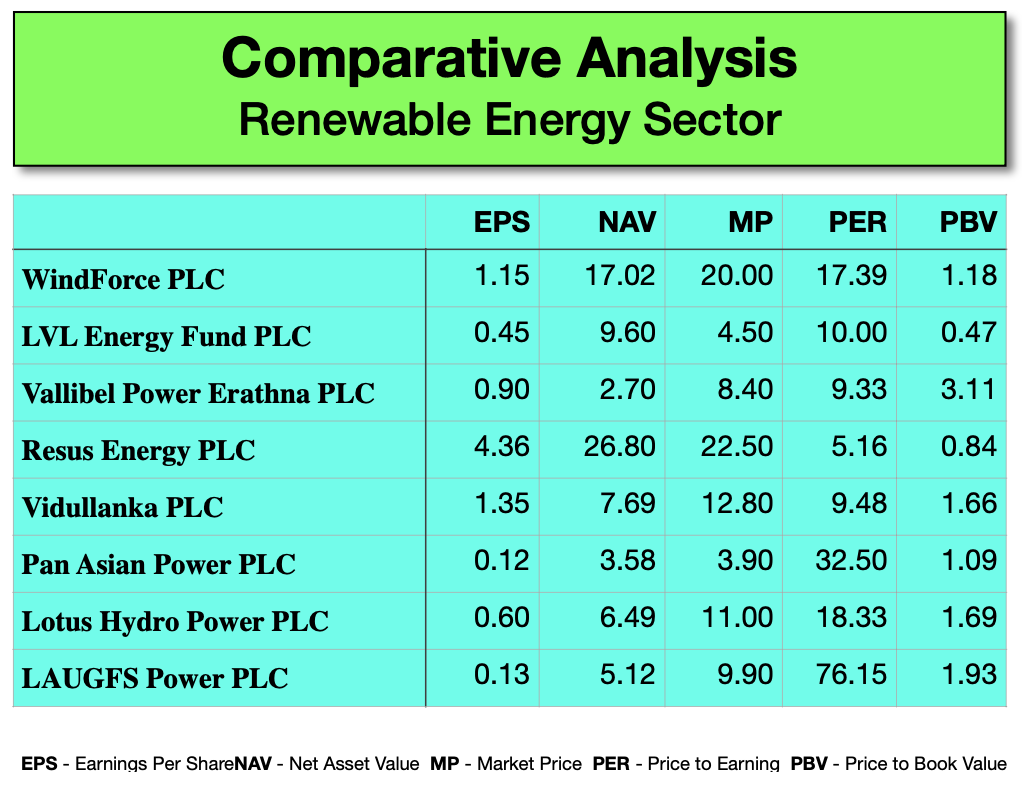

Sri Lanka: Energy Sector

Highlights and Observations Download Full Report: https://lankabizz.net/product/energy-sector/

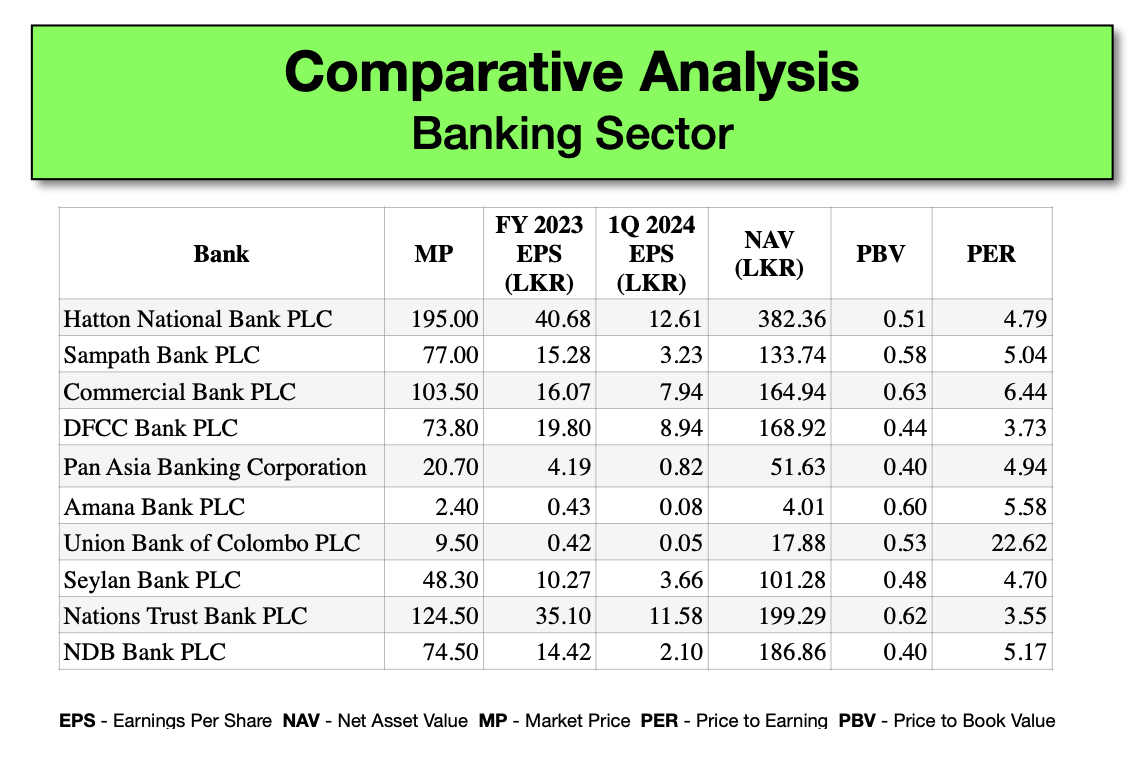

Comparative Analysis of Banks

Highlights and Observations• Hatton National Bank: Strong performance with the highest EPS and NAV, indicating robust profitability and a solid equity base.• Commercial Bank: Exceptional growth in NII and net profit, showcasing effective interest rate management and operational efficiency.• Nations Trust Bank: Leading in ROE and ROA, reflecting high profitability and efficient asset utilization. Trading…

Impact of Elections on Colombo Stock Market Sentiment

Elections play a crucial role in shaping investor sentiment in stock markets, including the Colombo Stock Exchange (CSE). Here are some ways elections are expected to affect market sentiment: Download Full Report on Stock Market Outlook for 2024, which highlights the key factors that determines the direction of the market in 2024. Key Content: Analysis…

LankaBIZ Unveils AI-Driven On-Demand Financial Research and Analysis Service

LankaBIZ, a subsidiary of Chat2Find, has launched a groundbreaking AI-powered On-Demand Financial Research and Analysis service. This innovative platform offers investors exclusive insights into Sri Lankan companies, sectors, and the broader economy, ensuring timely and accurate financial information. Comprehensive Research Offerings: LankaBIZ provides a wide range of services, including:- Equity Research- Industry/Sector Analysis- Stock Market Performance-…

LAUGFS Power PLC turned around to a profit of Rs. 51.98 million in 2023/24

The financial performance of LAUGFS Power PLC for the year ended March 31, 2024, shows both stability and growth, with notable highlights in hydro and solar energy segments. Performance Highlights Financial Ratios Asset and Liability Overview Segment Performance Strategic Initiatives and Future Outlook LAUGFS Power is focusing on expanding its renewable energy portfolio, including solar…

Financial Performance of LOLC Holdings PLC for the Year Ended 31st March 2024

1. Statement of Financial Position Assets: Liabilities and Equity: 2. Statement of Profit or Loss Continuing Operations: Discontinued Operations: 3. Statement of Comprehensive Income 4. Statement of Changes in Equity 5. Statement of Cash Flows 6. Notes to the Financial Statements LOLC Holdings PLC demonstrated substantial asset growth and an improvement in total equity for…

Vallibel One PLC reported a PAT of LKR 17,444 mn for FY 2023/24

Vallibel One PLC is a leading diversified conglomerate in Sri Lanka, engaged in multiple sectors including lifestyle, finance, aluminum, leisure, consumer, and investments. The company has demonstrated resilience and a commitment to sustainable growth amidst challenging economic conditions. Financial Performance Revenue and Profitability: Margins and Ratios: Key Indicators Asset Base: Equity and Debt: Cash Flows…