Category: Stock market

LOLC Finance PLC reports 40% increase in PAT for FY 2023/24

LOLC Finance PLC is a premier non-bank financial institution (NBFI) in Sri Lanka, renowned for its comprehensive range of financial products and services. Established in 2001, LOLC Finance PLC has grown to become a significant player in the financial sector, offering services that cater to diverse customer needs, including personal and business loans, leasing, and

TAL Lanka PLC Reports Loss per Share of LKR (1.81) for 2Q2024

Financial Performance of TAL Lanka PLC for the Period Ended 30 June 2024 Statement of Financial Position Equity and Liabilities Analysis TAL Lanka PLC experienced a challenging period with a significant decline in net profit and increased finance costs. The company’s revenue decreased slightly, while the cost of sales saw a modest reduction. Administrative expenses

LB Finance PLC: 2Q2024 Income Decreased by 11%

The interim financial performance of LB Finance PLC for the period ended 30 June 2024 highlights key financial metrics compared to the same period in 2023. Below is a summary of the financial performance based on the provided interim financial statements: Statement of Comprehensive Income (Company) Key Figures: Statement of Comprehensive Income (Group) Key Figures:

Lion Brewery PLC revenue increased by 16%

Research Report of Lion Brewery (Ceylon) PLC for year ended 31st March 2024 1. Company Profile History and Overview: Lion Brewery (Ceylon) PLC, a subsidiary of Carson Cumberbatch & Co. Ltd., has a rich heritage spanning over a century in the brewing industry. Established in 1849 in the picturesque region of Nuwara Eliya, the company has

WindForce PLC reported a 18% increase in revenue

Research Report of WindForce PLC for year ended 31st March 2024 Overview WindForce PLC, established in July 2010, is Sri Lanka’s largest renewable energy producer with a significant global presence. The company specializes in the development, construction, and management of state-of-the-art renewable energy plants, focusing on wind, solar, and hydroelectric power. This report provides a

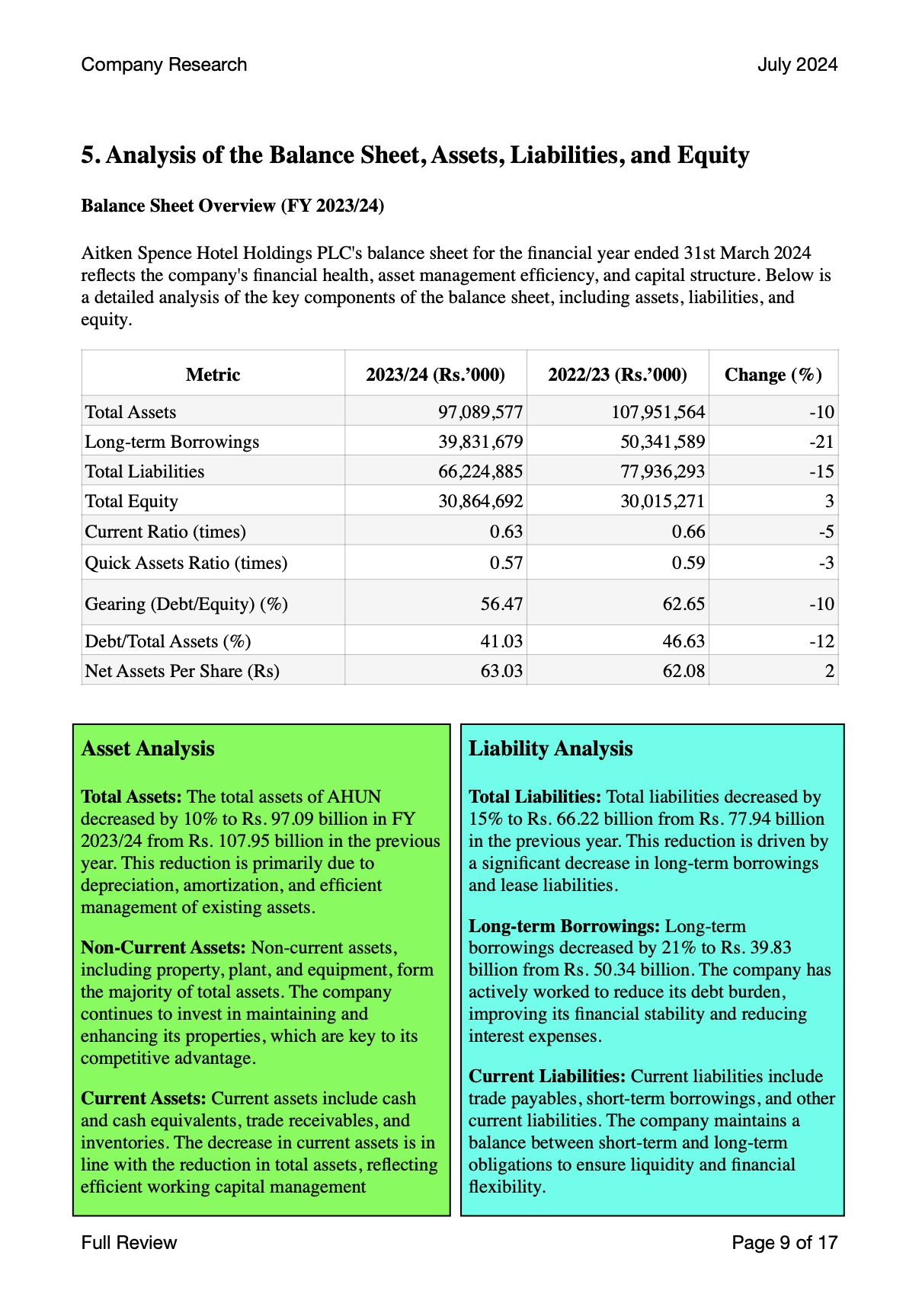

Aitken Spence Hotel Holdings PLC Profit before tax surged by 83%

Company Profile & Background Introduction: Aitken Spence Hotel Holdings PLC, trading under the ticker AHUN.N0000, is a leading hotel operator based in Sri Lanka. It is a subsidiary of Aitken Spence PLC, one of Sri Lanka’s most respected and diversified conglomerates with interests spanning various sectors, including maritime and logistics, strategic investments, services, and tourism. Aitken

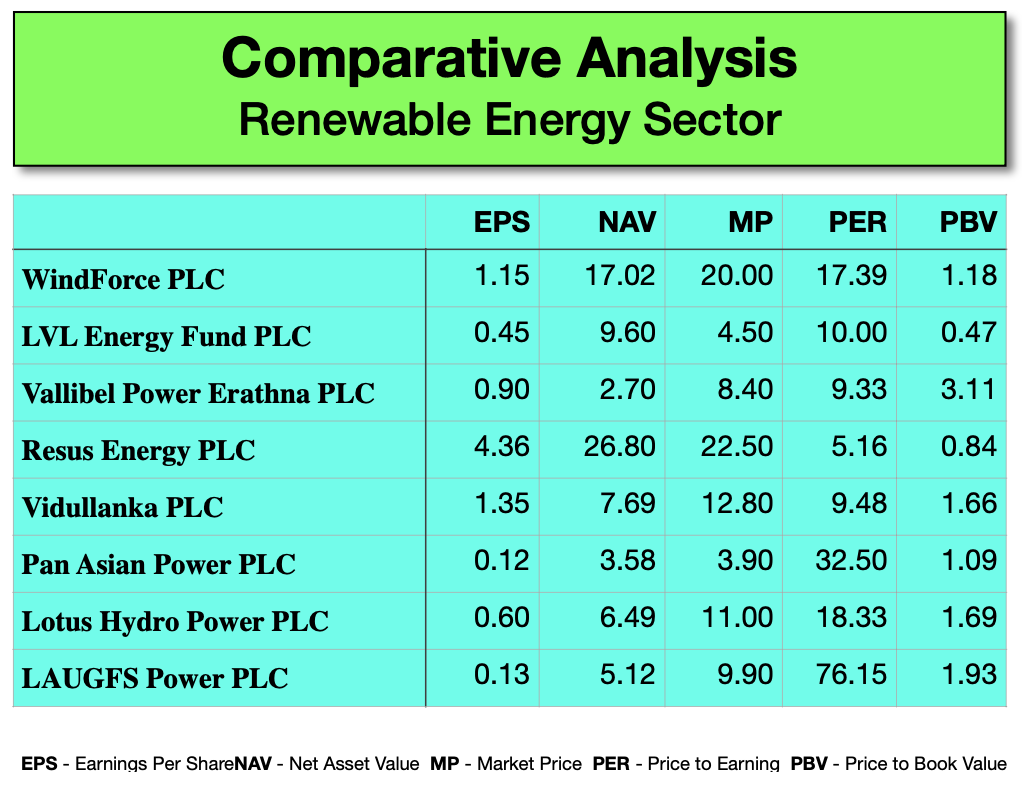

Sri Lanka: Energy Sector

Highlights and Observations Download Full Report: https://lankabizz.net/product/energy-sector/

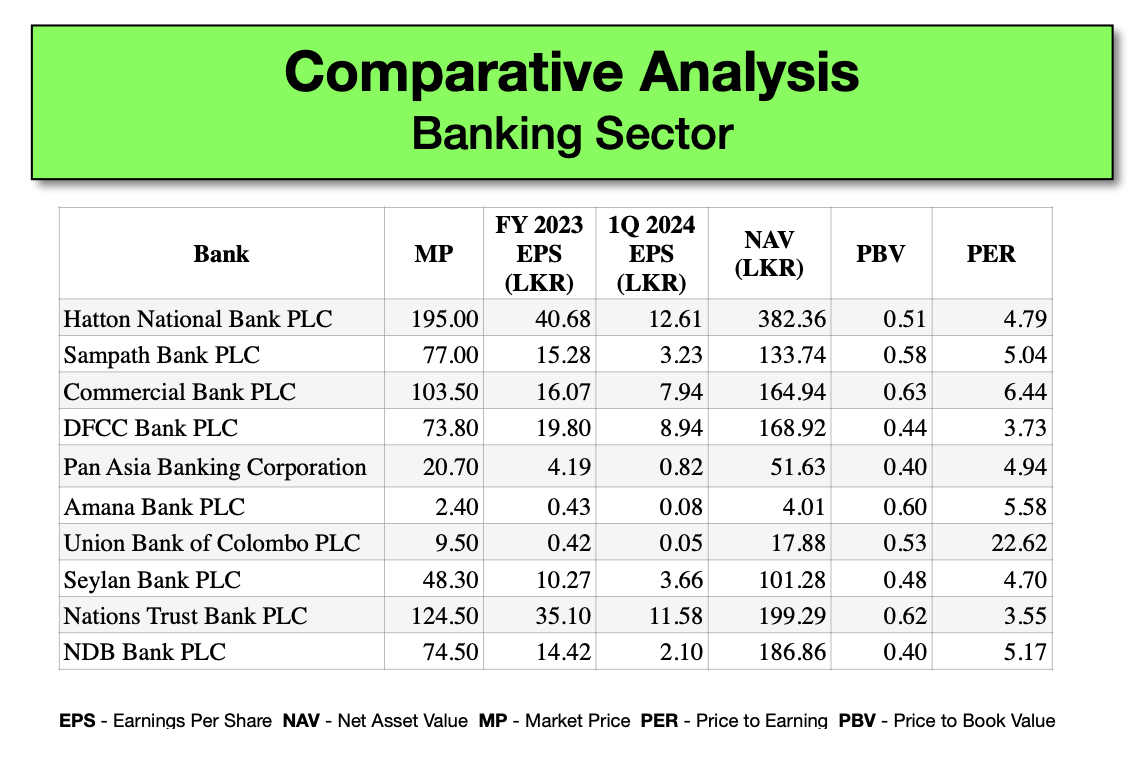

Comparative Analysis of Banks

Highlights and Observations• Hatton National Bank: Strong performance with the highest EPS and NAV, indicating robust profitability and a solid equity base.• Commercial Bank: Exceptional growth in NII and net profit, showcasing effective interest rate management and operational efficiency.• Nations Trust Bank: Leading in ROE and ROA, reflecting high profitability and efficient asset utilization. Trading

Impact of Elections on Colombo Stock Market Sentiment

Elections play a crucial role in shaping investor sentiment in stock markets, including the Colombo Stock Exchange (CSE). Here are some ways elections are expected to affect market sentiment: Download Full Report on Stock Market Outlook for 2024, which highlights the key factors that determines the direction of the market in 2024. Key Content: Analysis

LAUGFS Power PLC turned around to a profit of Rs. 51.98 million in 2023/24

The financial performance of LAUGFS Power PLC for the year ended March 31, 2024, shows both stability and growth, with notable highlights in hydro and solar energy segments. Performance Highlights Financial Ratios Asset and Liability Overview Segment Performance Strategic Initiatives and Future Outlook LAUGFS Power is focusing on expanding its renewable energy portfolio, including solar

Financial Performance of LOLC Holdings PLC for the Year Ended 31st March 2024

1. Statement of Financial Position Assets: Liabilities and Equity: 2. Statement of Profit or Loss Continuing Operations: Discontinued Operations: 3. Statement of Comprehensive Income 4. Statement of Changes in Equity 5. Statement of Cash Flows 6. Notes to the Financial Statements LOLC Holdings PLC demonstrated substantial asset growth and an improvement in total equity for

Vallibel One PLC reported a PAT of LKR 17,444 mn for FY 2023/24

Vallibel One PLC is a leading diversified conglomerate in Sri Lanka, engaged in multiple sectors including lifestyle, finance, aluminum, leisure, consumer, and investments. The company has demonstrated resilience and a commitment to sustainable growth amidst challenging economic conditions. Financial Performance Revenue and Profitability: Margins and Ratios: Key Indicators Asset Base: Equity and Debt: Cash Flows

HNB Finance PLC reports PAT of LKR 621 mn for FY2023/24

HNB Finance PLC has undergone significant transformation and achieved remarkable financial turnaround during the fiscal year ending 31st March 2024. The company has strategically navigated economic challenges and leveraged its robust operational capabilities to deliver substantial growth and improved financial performance. Financial Performance Highlights Strategic Initiatives and Operational Achievements Future Outlook HNB Finance PLC is

Abans Finance PLC reports Net Profit of LKR 355mn for FY 2023/24

Abans Finance PLC, a key non-banking financial institution in Sri Lanka, has demonstrated resilience and strategic foresight amidst a challenging economic environment. The company’s financial performance for the year ended 31st March 2024 reflects significant achievements and strategic growth despite adverse economic conditions. Financial Highlights Management Discussion and Analysis Financial Review Conclusion Abans Finance PLC

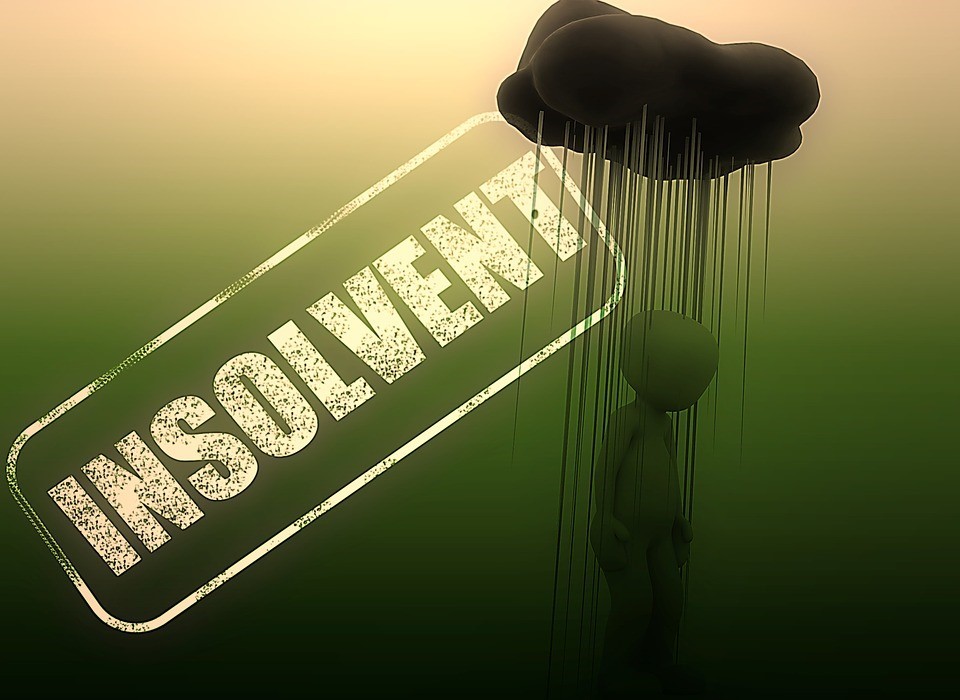

Richard Pieris Finance Ltd continue to endanger the Depositors with negative performance

Richard Pieris Finance Ltd Reports a Net Loss. The net loss for the 6 months period ending 30th September 2023 stood at Rs. 274mn which indicates a serious loss of capital endangering the deposit holders. Gross stage 3 loan ratio exceeded 43% whilst Tier-1 capital adequacy ratio was only 7.8% below the statutory requirement of 8.5%.

Do your own Stock Market Research using AI

Why depend on Third party Research Reports? Now you can do your own research and analysis of the financial performance of listed companies in Sri Lanka by using AI Tools available with LankaBIZ. Simply upload Annual reports or any other PDF document to ChatPDF and get instant answers to your research queries. Chat with PDF

United Motors PLC : Reports 7.83% increase in revenue during FY 2023/24

The fiscal year ending 31st March 2024 was a period of significant challenges for United Motors PLC. The company’s financial performance reflects a mix of strategic successes and difficulties, particularly influenced by the prolonged import restrictions and the overall economic environment in Sri Lanka. Revenue and Profitability United Motors PLC reported the following financial outcomes:

Kapruka Holdings PLC reports 8% decline in revenue for FY 2023/24

The fiscal year ending 31st March 2024 was a challenging period for Kapruka Holdings PLC. The company’s financial performance was marked by significant setbacks, including declining revenues, increased expenses, and substantial losses, indicating underlying issues in strategic planning and operational efficiency. Decline in Revenue and Profitability Kapruka Holdings PLC reported alarming financial outcomes: The decline

Elpitiya Plantations PLC demonstrates resilience and strategic agility in FY 2023/23

For the fiscal year ending 31st March 2024, Elpitiya Plantations PLC reported a total revenue of Rs. 7,204 million, a decrease from the previous year’s Rs. 8,348 million. This decline was attributed to adverse exchange rate fluctuations affecting commodity prices for tea, rubber, and oil palm. The gross profit also saw a reduction from Rs.

Lanka IOC PLC: Net profit margins for FY2023/24 declined to 5% from 13%

Lanka IOC PLC, a leading player in Sri Lanka’s petroleum industry, has faced a tumultuous fiscal year ending March 31, 2024. This report delves into the financial performance, key ratios, and profitability of the company, highlighting significant trends and providing a comprehensive analysis of its financial health. Financial Performance Overview Revenue and Profitability Lanka IOC

Asiri Hospital Holdings PLC reports outstanding financial performance for FY 2023/24

Asiri Hospital Holdings PLC demonstrated strong financial performance for the year ended 31st March 2024, with notable improvements in revenue, gross profit, and net profit. The company’s strategic initiatives and operational efficiencies contributed to its financial success. However, rising administrative expenses and reduced finance income highlight areas requiring strategic focus. Financial Performance Highlights Key Financial

First Capital Holdings PLC reports a significant surge in net profit, reaching LKR 10,156 million for FY 2023/24

Introduction This analytical report delves into the profitability, financial performance, and key financial ratios of First Capital Holdings PLC for the year ended 31st March 2024. The insights are derived from the interim financial statements provided by the company. Profitability Analysis Net Profit First Capital Holdings PLC recorded a significant surge in net profit, reaching

Asia Capital PLC continue to remain Insolvent during FY 2023/24

Asia Capital PLC’s financial performance for the year ended 31st March 2024 has been markedly poor, indicating significant challenges in profitability and overall financial health. The company’s income statements, balance sheets, and cash flow statements reflect substantial declines and unfavorable key financial ratios. Net assets continue to remain negative indicating that the company’s liabilities exceed

Richard Pieris and Company PLC reports 84% decline in earnings for FY 2023/24

Overview of Financial Performance The financial performance of Richard Pieris and Company PLC for the twelve months ended 31 March 2024 indicates several critical issues. The company has experienced significant declines in profitability, efficiency, and overall financial health compared to the previous year, with key metrics highlighting ongoing financial difficulties. Revenue and Profitability Cost and