Access Engineering PLC (AEL.N0000) has shown an improvement in revenue and profitability in the period ended 31st December 2023 compared to the previous year. The company has also managed to reduce its debt to equity ratio significantly, indicating a stronger balance sheet. The interest cover ratio has improved, suggesting better earnings relative to interest expenses. The future outlook appears stable with no significant events affecting the financial statements post-reporting period, and the share price performance indicates investor confidence. However, for a comprehensive analysis, one should also consider the broader market conditions, competitive landscape, and potential risks that could affect the company’s future performance

Financial Performance and Profitability:

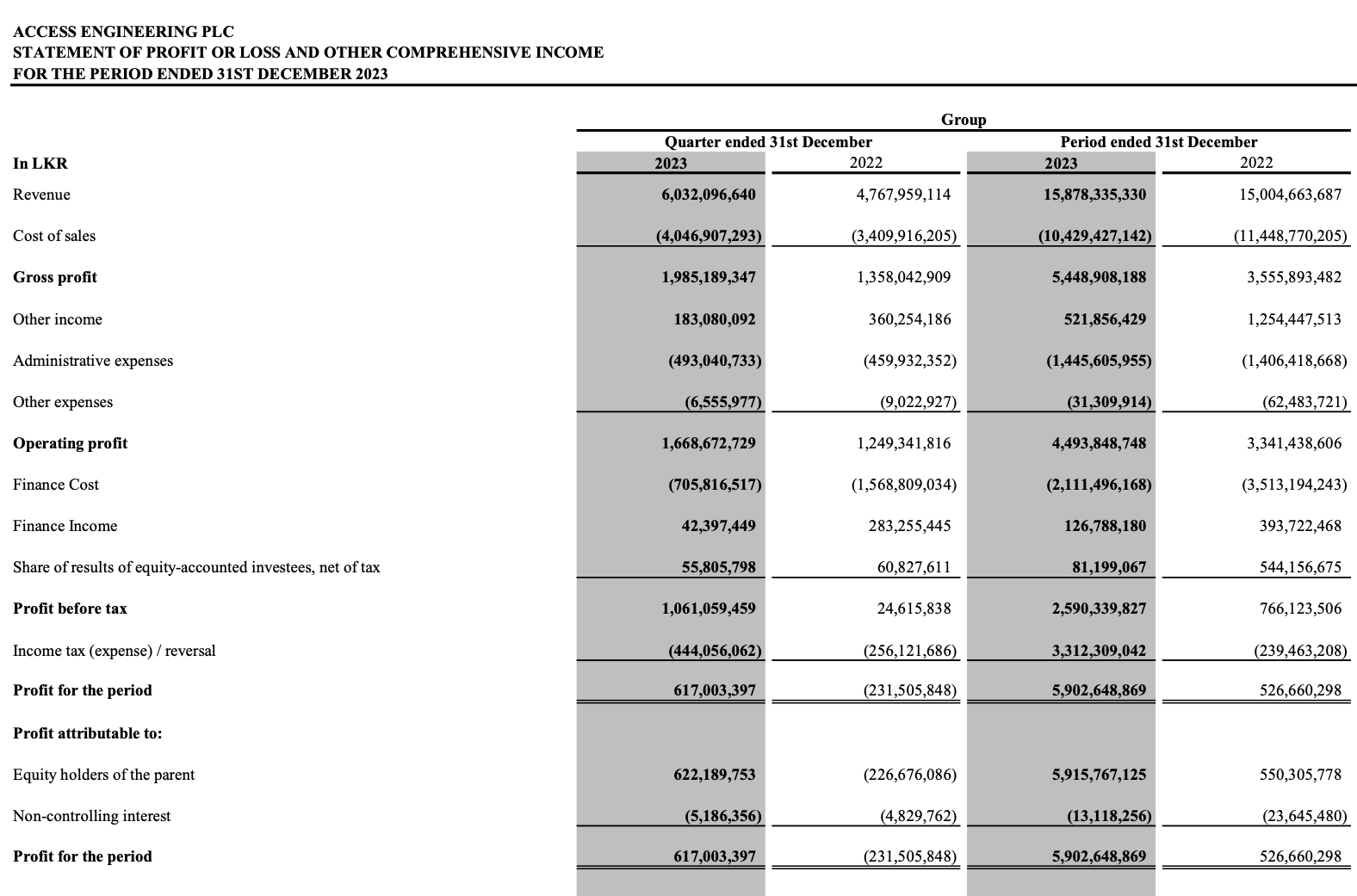

- Revenue for the period ended 31st December 2023 was LKR 6,032,096,640 compared to LKR 4,767,959,114 in the same period of 2022.

- Cost of sales for the same period was LKR 4,046,907,293, which is an increase from LKR 3,409,916,205 in 2022.

- Basic earnings per share (EPS) for the quarter ended 31st December 2023 were LKR 0.62, which is an improvement from a loss per share of LKR (0.23) in the same quarter of 2022.

- For the period ended 31st December 2023, the EPS was LKR 5.92, up from LKR 0.55 in 2022.

Financial Ratios:

- Debt to equity ratio (%) as at 31st December 2023 was 54, which is a significant decrease from 90 in 2022.

- Quick assets ratio (times) was 1.09 in 2023, down from 1.38 in 2022.

- Interest cover (times) was 2.19 in 2023, up from 1.39 in 2022.

Financial Statement:

Download Latest Financial Statements: https://cdn.cse.lk/cmt/upload_report_file/1141_1707905586965.pdf

Future Outlook:

The future outlook of the construction industry in Sri Lanka is cautiously optimistic, with several factors expected to contribute to its growth from 2024 to 2027. Here are the key points based on the provided context:

- Growth Rate: The construction industry is expected to record an average annual growth rate of 6% from 2024 to 2027.

- Supporting Factors:

- Easing of foreign exchange liquidity pressures.

- Strong remittances from abroad.

- Improved tourism earnings, which have seen a robust revival in 2023.

- Rising private investment within the construction sector.

- Challenges:

- The industry has faced headwinds such as high inflation, falling exports, depreciation of the local currency, and a rise in construction material prices.

- Government Initiatives:

- The government is pursuing the development of the National Policy for Industrial Development to improve policy focus and strategic direction.

- Collaborative measures with private and international agencies to overcome industry sector issues, including regulatory limitations and import restrictions.

- Tourism and Construction Link:

- The tourism industry’s revival is expected to positively impact the construction industry, as infrastructure development is often correlated with tourism growth.

- Private Sector Involvement:

- There is an anticipation of increased private investment in the construction industry, which could further stimulate growth.

In summary, while the construction industry in Sri Lanka has faced challenges, the outlook for 2024 to 2027 is positive, with expected growth supported by various economic factors and government initiatives aimed at fostering a conducive environment for the industry’s expansion.

Above analysis and information is compiled by LankaBIZ (GPT) – Sri Lanka’s First ever AI Assistant for Stock Market and Research. Click below link to ask questions about any listed company in Sri Lanka.

www.lankabizz.net