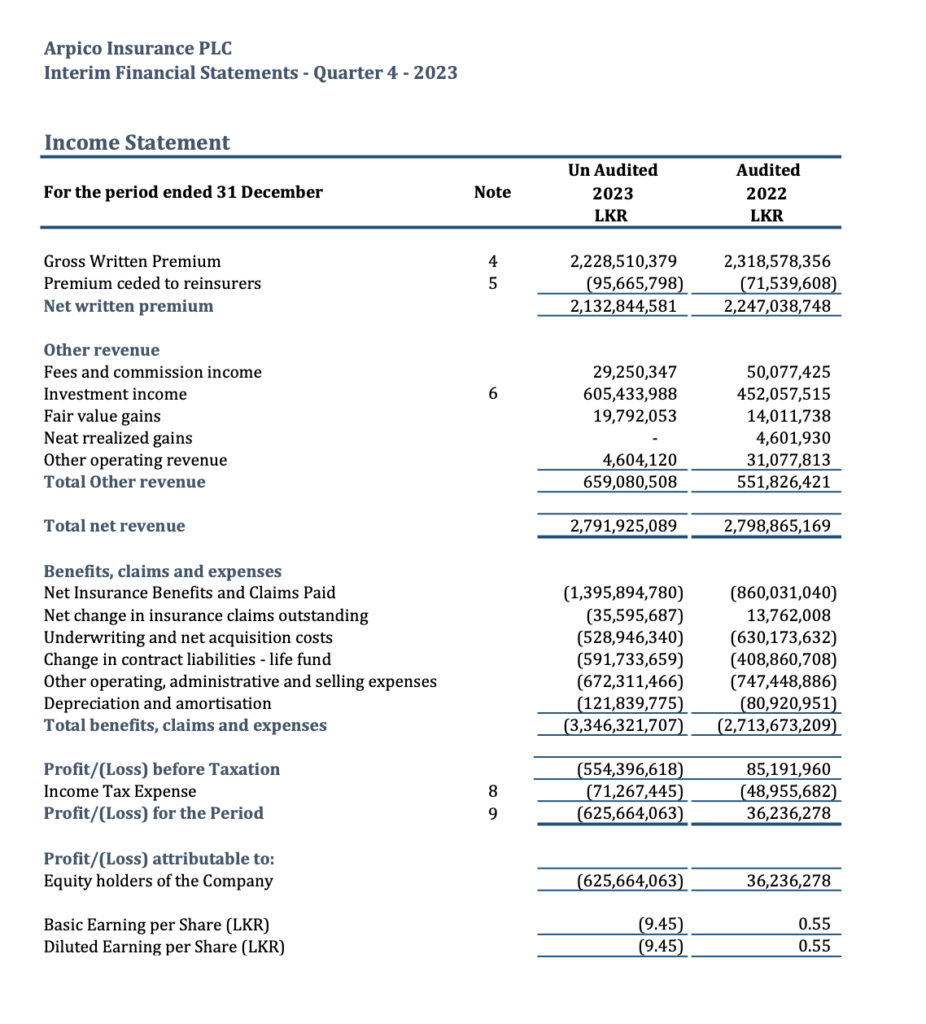

Arpico Insurance PLC has Reported as loss of LKR 625mn for the FY2023 (Unaudited). This Loss of LKR 9/= per share has eroded the shareholders equity by massive 23% to LKR 1,470mn. Poor performance mainly attributable to high Actuarial Provisions and Inefficient Management of Insurance Funds.

Latest Financial Status as of December 2023:

- Net Assets Per Share: The unaudited net assets per share as of December 2023 stood at LKR 22.21, which is a decrease from the audited figure of LKR 31.20 in 2022.

- Market Price Per Share: The market price per share saw a highest price of LKR 22.50 and a lowest price of LKR 22.50 in 2023, indicating a stable market price in that period.

- Total Comprehensive Income: The total comprehensive income for the period ending 30th September 2023 was LKR 325,451,298, which includes a profit for the period of LKR 132,928,435 and other comprehensive income, net of tax, of LKR 192,522,863.

- Gross Written Premium: There was a decrease in gross written premium from LKR 564,586,267 in 2022 to LKR 434,817,499 in 2023.

- Investment Income: Investment income increased from LKR 123,813,762 in 2022 to LKR 145,718,897 in 2023.

- Market Capitalization: The market capitalization as of 30th September 2023 was LKR 1,688,875,379.

- Public Shareholding: The public shareholding remained at 10%, with 6,630,404 shares.

Latest Accounts (FY2023)

Unaudited Annual Report FY 2023: https://cdn.cse.lk/cmt/upload_report_file/1405_1712227194027.pdf

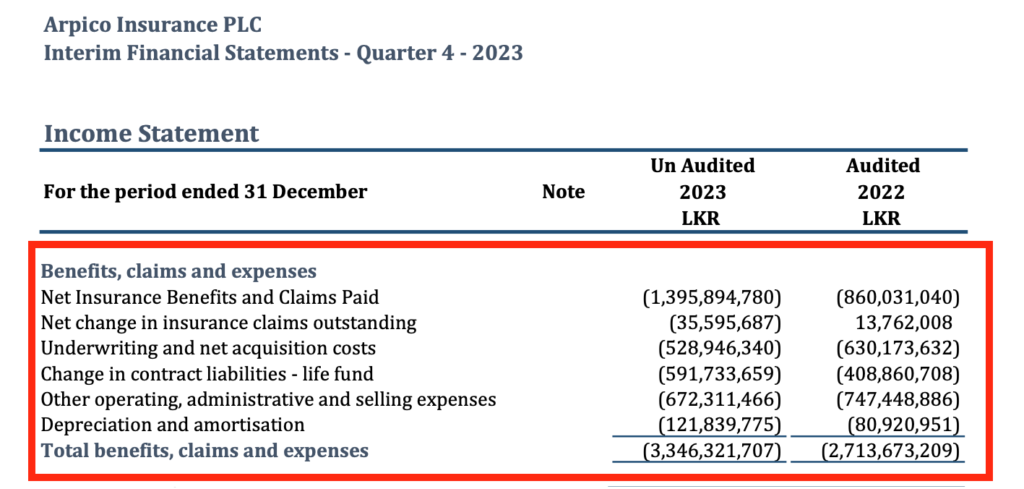

Actuarial Provisions

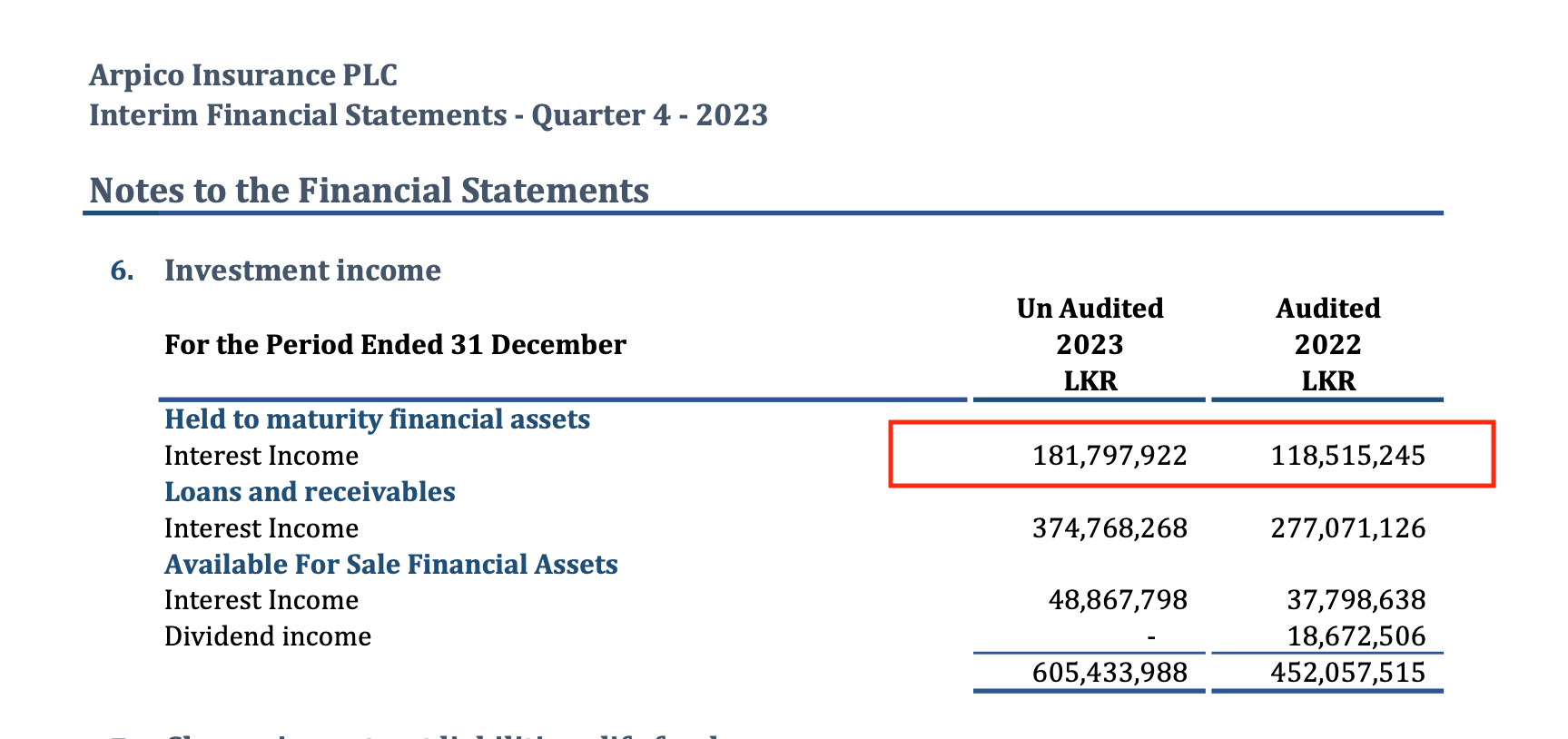

Investment Income

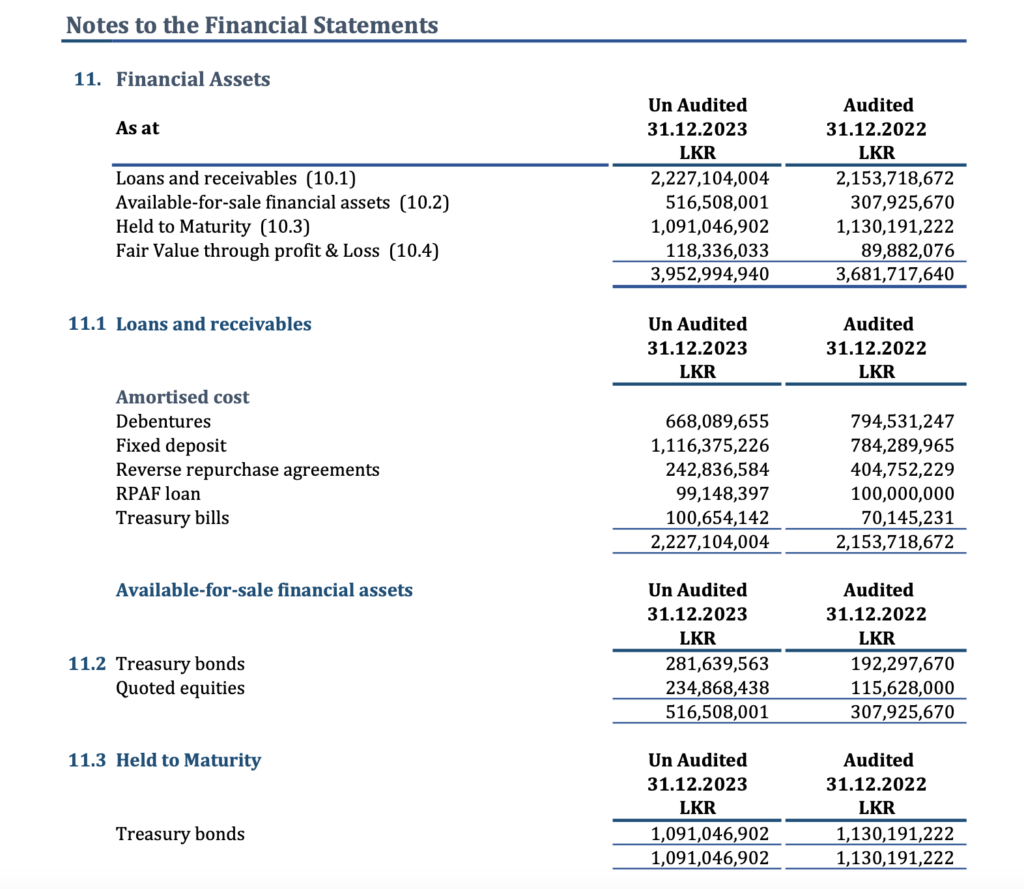

Investment Portfolio

Arpico Insurance has earned only LKR 605mn or 15.3% return on investment during the FY 2023 from their debt portfolio of LKR 3,852mn, whilst industry peers reported much higherl investment incomes for the same period. The investment income of Softlogic Life Insurance PLC for the year ended 31st December 2023 was Rs. 2,149mn

Who owns Arpico Insurance PLC

The major shareholders of Arpico Insurance PLC as of 30 September 2023 are:

- Kegalle Plantations Limited – holding 26,685,001 shares, which is 40.29% of the company.

- Richard Pieris Distributors Limited – holding 17,790,001 shares, which is 26.86% of the company.

- Richard Pieris and Co Ltd – Account No. 01 – holding 15,125,001 shares, which is 22.84% of the company.

These three shareholders combined hold a significant majority of the shares, amounting to 90.99% of the total shares. The remaining shareholders each hold less than 3% of the shares individually.

Future Outlook:

While the context does not provide explicit future projections, we can infer some aspects of the future outlook based on the data:

- Market Stability: The stable market price per share at the end of 2023 suggests a level of market confidence in the company’s stability.

- Investment Income Growth: The increase in investment income could indicate effective investment strategies that may continue to benefit the company if sustained.

- Challenges in Premium Growth: The decrease in gross written premium may suggest challenges in premium growth, which could be an area of focus for the company moving forward.

- Comprehensive Income: The significant other comprehensive income suggests that the company has profitable investments or assets that may continue to contribute positively to its financial health.

- Regulatory Compliance: The company’s compliance with Sri Lanka Accounting Standard “LKAS 34 – Interim Financial Reporting” and the Companies Act No. 07 of 2007 indicates a strong regulatory adherence, which is crucial for maintaining investor trust.

It is important to note that for a complete and accurate future outlook, one would typically look for management discussion and analysis, market trends, competitive analysis, and forward-looking statements from the company, which are not provided in the context information.