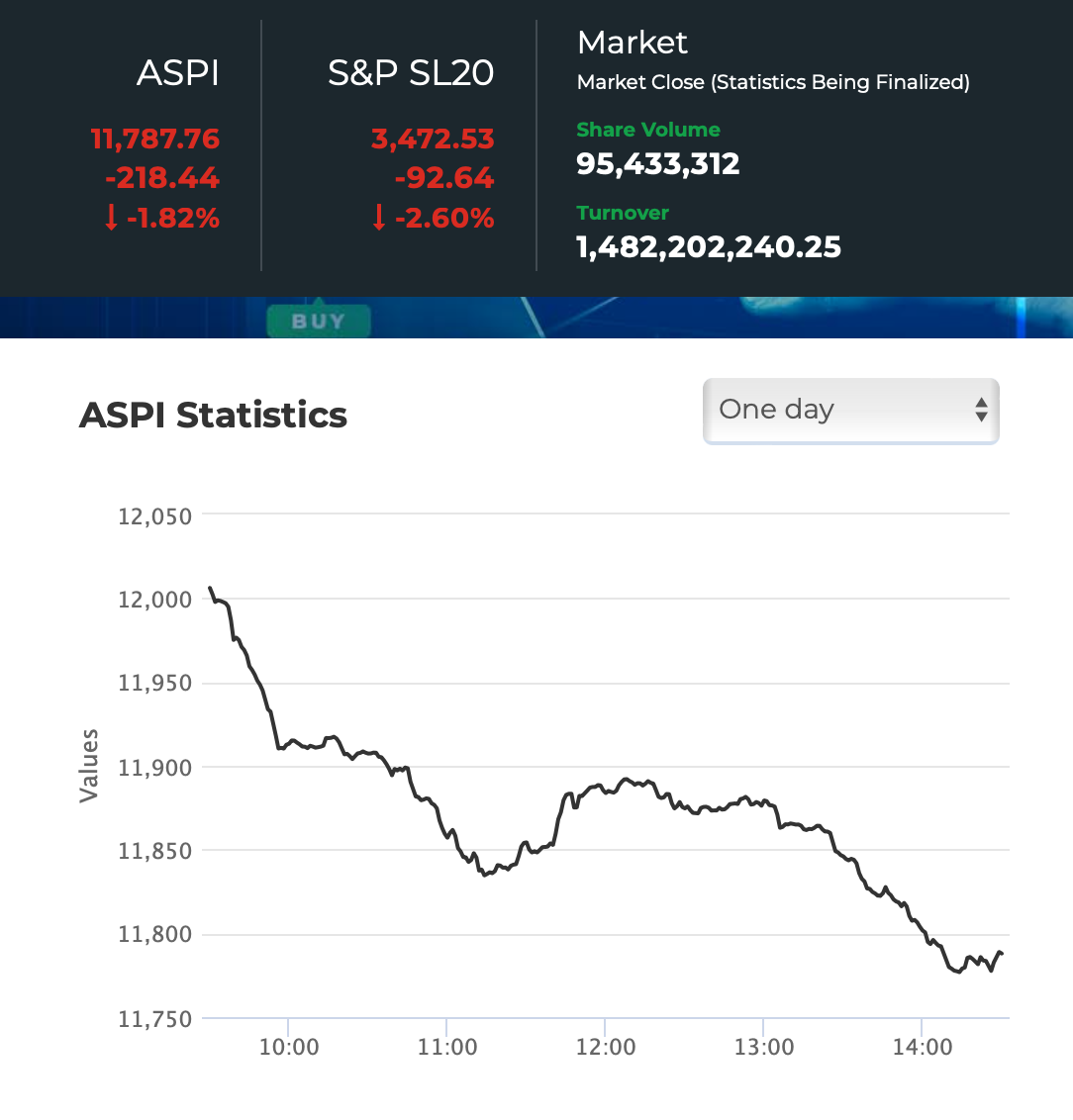

Colombo Stock Market reported sharp decline on April 16, 2024 signalling Early Warning Signal (EWS) of a possible economic downturn due to following factors reported by Sri Lanka Press.

- Sri Lanka fails to reach deal on restructure terms with bondholders.

- Sri Lanka: China EXIM Bank Debt become due in April 2024.

- Uncertainty over impending elections could risk Lanka’s economic recovery: ADB

- Sri Lanka could get hit from a disorderly US tumble: Bellwether.

Sri Lanka fails to reach deal on restructure terms with bondholders

Reuters Images

Sri Lanka has failed to strike an agreement on restructuring about $12 billion of debt with its bondholders, the government said on Tuesday, complicating the nation’s plans to meet the requirements of an IMF programme.

“The steering committee did not agree to extension of restricted discussions,” it said in a regulatory filing to the London Stock Exchange.

Following talks with bondholders on the sidelines of the International Monetary Fund (IMF) and World Bank Spring meetings in Washington, Sri Lanka said it failed to reach consensus on the bondholders’ proposal submitted earlier in the month.

Sri Lanka disagreed with the bondholders’ proposals for debt repayment since they differed from an analysis of the country’s debt worked out by the IMF and how to include the bondholders’ plan to link repayments to the country’s future macroeconomic growth, through macro-linked bonds, in the restructuring plan, the filing showed.

After the announcement, Sri Lanka’s bonds were down between 2.3 and 2.8 cents , leaving them at just over half their original face value at between 53 and 55 cents on the dollar.

The much-anticipated agreement in principle was needed for the island to finalise the second review of a $2.9 billion programme with the IMF and get executive board approval for the release of about $337 million.

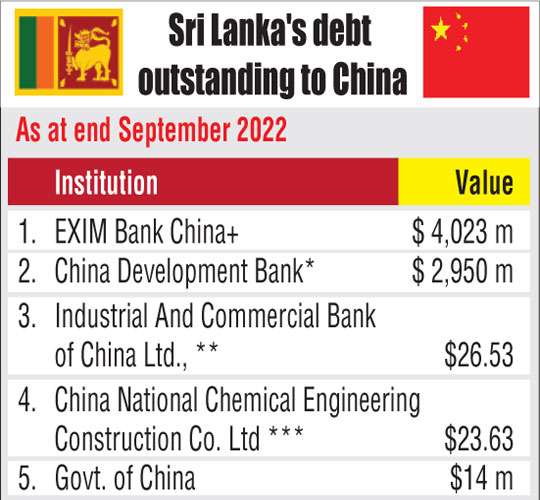

Sri Lanka: China EXIM Bank Debt Moratorium to End in April 2024

As per the agreement reached in January 2023, China Exim Bank agreed to give a 2 year extension for debt service due in 2022 and 2023 as an immediate contingency measure “based on Sri Lanka’s request”. As per this agreement, the Government would be required start repaying the debt due in 2022 and 2023, from April 2024 onwards, or to seek further extension from China EXIM Bank.

This is likely to widen the external financing gap as per the IMF Programme Financing Plan for Sri Lanka and cause further set back to the IMF Programme in Sri Lanka.

According to a letter reviewed by Reuters, China EximBank said it was going to provide “an extension on the debt service due in 2022 and 2023 as an immediate contingency measure” based on Sri Lanka’s request. It had also stated, “You will not have to repay the principal and interest due of the bank’s loans during the above-mentioned period”, adding that China EximBank wanted to expedite the negotiation process with the Sri Lanka side regarding medium and long-term debt treatment in this period.

Uncertainty over impending elections could risk Lanka’s economic recovery: ADB

The “uncertainty” over the impending elections in Sri Lanka will cause a possible downward trend in the country’s economic outlook, the Asian Development Bank (ADB) has said, according to a PTI dispatch.

Sri Lanka is set to face a presidential election in the last quarter of this year, while the parliamentary election is due mid-next year. However, political uncertainty prevails in the country as opposition parties have pledged to reverse the current IMF-linked reforms, which have proved to be unpopular with the masses, the PTI repor says.

President Ranil Wickremesinghe, who has steered the recovery programme by going into a bailout deal with the International Monetary Fund (IMF) for a USD 2.9 billion facility, maintains that the island could once again face economic collapse if the IMF programme reforms are not adhered to.

Outlining the economic risks Sri Lanka is facing, the ADB in its South Asian chapter’s economic trends report released yesterday said, Among them the most important is uncertainty associated with the upcoming elections, including any possible impact on fiscal policy and reform implementation.

The ADB noted that there are signs of economic recovery in Lanka and emerging growth had revived in the second half of 2023 and is expected to continue in 2024 and 2025.

Sri Lanka could get hit from a disorderly US tumble: Bellwether

By BELLWETHER

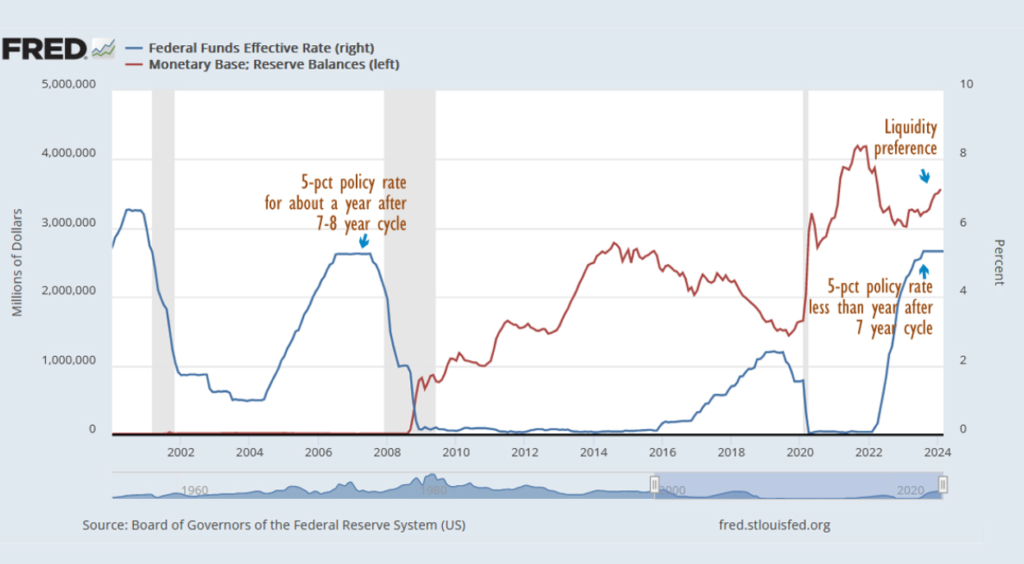

Sri Lanka is recovering fast but the country could get hit from an unravelling of advanced economies, particularly the United States, which is skating on very thin ice, after exceptionally bad monetary policy, which has destroyed fiscal metrics as well.

The US was running bad to atrocious monetary policy since 2001, when Ben Bernanke misled Alan Greenspan into printing money to run an 8-year cycle, firing a commodity and housing bubble which collapsed after rates were kept at around 5 percent for about a year.

That was the end of the Great Moderation started by Paul Volcker and continued with some skill under Greenspan, until the Fed was infected by Bernanke, the depression scholar. Keynes was also a ‘depression scholar’, in essence.

Gold prices fell from 800 to 284 dollars an ounce under Volcker-Bernanke, until Bernanke cooked up a false deflation scare with a healthy banking system and started to reverse it, firing the housing bubble and the Great Recession in its wake.