As of the latest available information, Capital Alliance PLC (CALT) has demonstrated a strong financial performance during the FY 2023/24 and announced a phenomenal interim dividend of LR 15 per share, whilst all key indicators reflecting a solid financial position and future growth prospects. Here are the details based on the provided context:

Dividend:

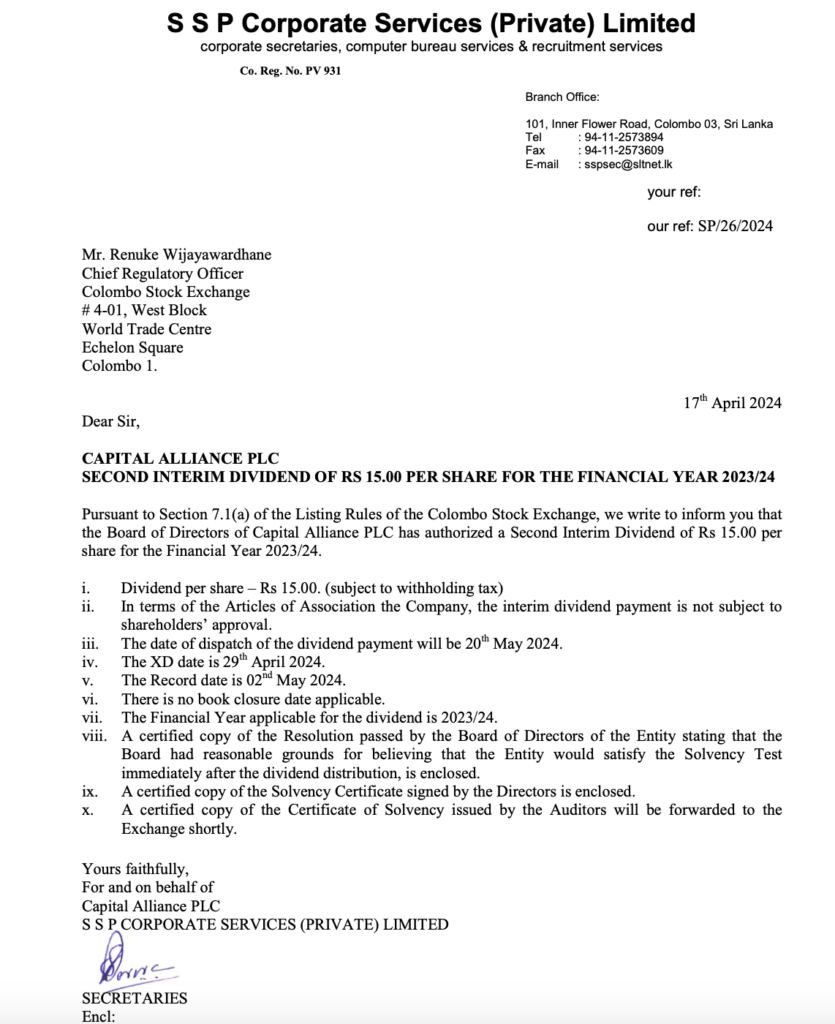

- New Dividend Announcement: 17th April 2024

- Dividend per share – Rs 15.00. (subject to withholding tax)

- In terms of the Articles of Association the Company, the interim dividend payment is not subject to shareholders’ approval.

- The date of dispatch of the dividend payment will be 20th May 2024.

- The XD date is 29th April 2024.

- The Record date is 02nd May 2024.

- There is no book closure date applicable.

- The Financial Year applicable for the dividend is 2023/24.

Capital Alliance PLC (CALT) demonstrated a robust financial performance for the year ended 31st March 2023. The company achieved a significant post-tax profit of LKR 2,827 million, which is a substantial improvement from the post-tax loss of LKR 171 million recorded in the previous year. This turnaround can be attributed to a variety of factors, including a substantial increase in net interest income, net gains from trading, and net gains from the remeasurement of financial assets at fair value through profit or loss (FVTPL).

Key financial highlights include:

- Interest Income: LKR 4,720,189,909, an increase of 829% from the previous year.

- Interest Expenses: LKR 3,127,944,659, an increase of 1001% from the previous year.

- Net Interest Income: LKR 1,592,245,250, up 610% from the previous year.

- Net Gain from Trading: LKR 609,575,468, compared to a loss of LKR 202,893,988 in the previous year.

- Net Gain from Remeasurement of Financial Assets at FVTPL: LKR 2,660,964,068, a significant increase from a loss of LKR 16,022,056 in the previous year.

The company’s total assets increased to LKR 38,041 million, which reflects strategic management of interest rate exposure amid challenging shifts in the interest rate environment for government securities.

Key Ratios:

While specific key ratios such as Return on Equity (ROE), Return on Assets (ROA), and Debt-to-Equity ratio are not provided in the context, the substantial profit after tax suggests a strong ROE and ROA for the year. The increase in total assets and profitability indicates a solid financial position.

Dividend:

The company declared a dividend of LKR 3.04 per share with an ex-dividend date of September 21, 2023. This dividend payout is a positive sign for investors, reflecting the company’s profitability and its commitment to returning value to shareholders.

Future Prospects:

Capital Alliance PLC has shown resilience and adaptability in navigating the financial markets. The launch of the CAL Online platform, which democratizes retail access to government securities, positions the company as a leader in digital innovation within the Sri Lankan financial sector. This strategic move is likely to enhance customer engagement and could contribute to future revenue streams.

The company’s commitment to prudent risk management, as evidenced by its financial performance, suggests that it is well-positioned to handle future challenges. However, the economic environment remains uncertain, and the company acknowledges that the road ahead is arduous, requiring difficult choices and minimal margin for errors.

Investors should consider these factors and the company’s strategic initiatives when evaluating its future prospects. It is also advisable to review the latest market conditions, regulatory changes, and economic indicators that could impact the company’s performance going forward.

This Report is compiled by LankaBIZ (AI Assistant) based on available source documents. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net