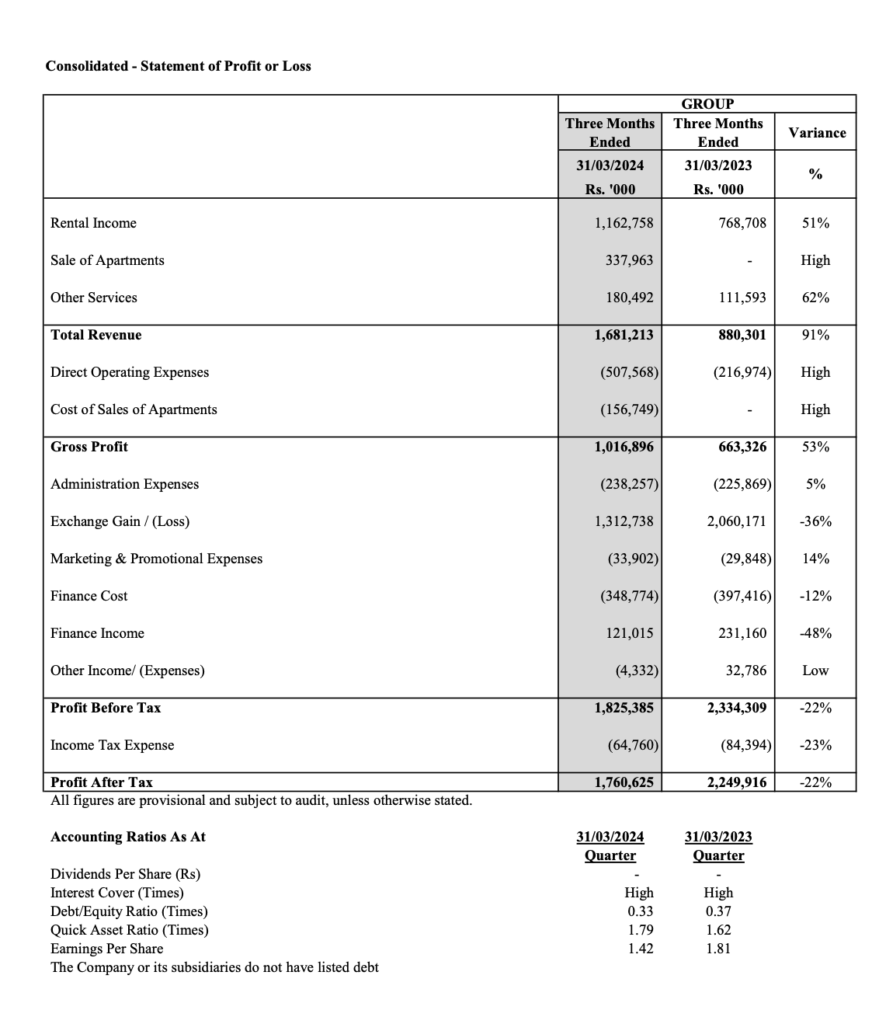

As of 31st March 2024, the latest financial data for Overseas Realty PLC indicates the following:

- Profit After Tax (PAT) for the period was Rs. 1,760,625,000, which is a 22% decrease compared to the same quarter in the previous year.

- The Gross Profit Margin for the quarter was 53%, which is an improvement from the previous year.

- The company’s Earnings Per Share (EPS) for the quarter was Rs. 1.42, down from Rs. 1.81 in the same quarter of the previous year.

- The Debt to Equity Ratio was 0.33 times, which is a decrease from 0.37 times, indicating a reduction in financial leverage.

- The Quick Asset Ratio was 1.79 times, which is higher than the previous year’s 1.62 times, suggesting better short-term liquidity.

The financial outlook for Overseas Realty PLC as of 31st March 2024 shows a mixed performance with a decrease in profitability but improvements in liquidity and a reduction in debt relative to equity. The decrease in PAT and EPS suggests that the company faced challenges in maintaining its profitability levels from the previous year. However, the improved liquidity ratios indicate that the company is in a better position to meet its short-term obligations.

For a more comprehensive understanding of the company’s financial health and future prospects, it would be important to consider the broader economic conditions, the real estate market trends, and any strategic initiatives the company may be undertaking to address the challenges and capitalize on opportunities.

Overseas Realty PLC – Annual_Dec 2023.pdf,” the company’s financial performance for the year ended 31st December 2023 can be summarized as follows:

- The Gross Profit Margin decreased from 65% in the previous year to 45% in 2023.

- The Profit After Tax (PAT) Margin, including Fair Value Gain (FVG), decreased from 76% to 40%.

- Earnings Per Share (EPS), including FVG, increased from 3.10 to 4.89.

- Return on Equity (ROE) improved from 7% to 12%.

- Return on Assets (ROA) increased from 5% to 8%.

- The Debt Equity Ratio went up from 36% to 43%.

- Net Assets Per Share (NAVPS) decreased from 43.54 to 41.66.

- The Dividend Payout Ratio was reduced from 40% to 26%.

- The Price to Earnings (PE) Ratio improved from 5 to 4.

The company recorded a consolidated net profit after tax of Rs. 3,853,112,805 for the year 2023, which is a decrease from the previous year’s profit of Rs. 6,079,337,485. Despite the decrease in net profit, the company’s ROE and ROA have improved, indicating more efficient use of equity and assets.

The Directors recommended a dividend of Rs 1.25 per share for the financial year ended 31st December 2022, which was approved by shareholders at the Annual General Meeting held on 26th April 2023.

In terms of financial outlook, the company’s profitability ratios indicate a mixed performance with some areas of improvement in asset and equity efficiency but a decrease in profit margins. The increase in the debt equity ratio suggests a higher level of financial risk due to increased borrowing. The decrease in NAVPS could be a concern for investors looking at the intrinsic value of the shares, while the improved PE ratio indicates the market may view the company’s earnings more favorably.

For a more comprehensive analysis and future outlook, it would be important to consider the company’s strategic initiatives, market conditions, and any recent developments post-2023 that could affect its financial health and performance.