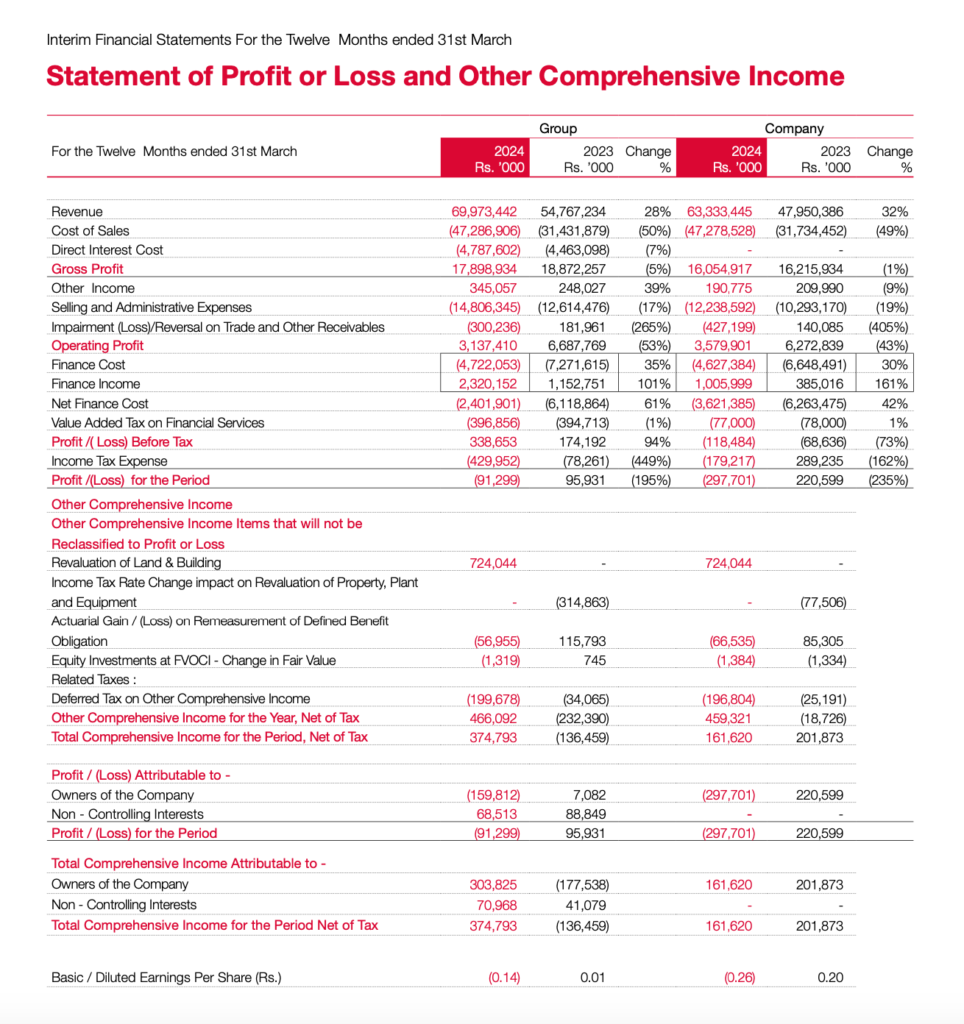

Based on the interim financial statements for the twelve months ended 31st March 2024, Singer (Sri Lanka) PLC has shown a significant improvement in its financial performance compared to the previous year. Here are some key highlights and their future outlook:

Revenue Growth:

- The Group’s revenue increased by 28% to Rs. 69,973,442,000 in FY2024 from Rs. 54,767,234,000 in FY2023.

- The Company’s revenue saw a more substantial increase of 32% to Rs. 63,333,445,000 in FY2024 from Rs. 47,950,386,000 in FY2023.

Profitability:

- The Group’s operating profit rose dramatically to Rs. 1,152,415,000 in 4Q2024 from Rs. 404,963,000 in 4Q2023.

- Net finance costs for the Group were significantly reduced, indicating better management of financial expenses or increased finance income.

- The Group’s profit before tax turned around from a loss of Rs. (925,023,000) in 4Q2023 to a profit of Rs. 668,946,000 in 4Q2024.

Earnings Per Share (EPS):

- Basic/Diluted EPS for the Group for the quarter ended 31st March 2024 improved from a negative Rs. (0.69) during the same quarter in 2023 to a positive Rs. 0.32 in 2024.

- Basic/Diluted EPS for the Group for the year ended 31st March 2024 declined from a positive of Rs. 0.01 in 2023 to a negative Rs. (0.14) in 2024.

Share Price Movement:

- The highest share price for the last three months ended 31st March 2024 was Rs. 16.40, up from Rs. 15.70 in the same period in 2023.

- The lowest share price improved from Rs. 8.20 in 2023 to Rs. 11.90 in 2024, indicating increased investor confidence.

Segment Performance:

- Key segments such as Consumer Electronics, Financial Services, Furniture, Home Appliances, IT products, and Sewing Machines have shown varying degrees of performance, with IT products and Home Appliances being notable contributors to the revenue.

Future Outlook:

Given the positive trend in revenue and profitability, Singer (Sri Lanka) PLC appears to be on a growth trajectory. The company’s ability to manage costs and finance expenses effectively has also contributed to the improved bottom line. However, it is essential to consider external factors such as market conditions, consumer spending power, and competition, which can influence future performance.

Investors and stakeholders should also look at the company’s strategic initiatives, investment in technology, and market expansion plans to assess the long-term prospects. It is advisable to monitor the company’s quarterly reports and any announcements for a more comprehensive understanding of its future outlook.