Based on the interim financial statements for Horana Plantations PLC for the twelve months ended 31st March 2024, the following financial performance data can be extracted:

- Segmental Revenue for the main sectors was Rs. 2,556,632,000 in 2024, compared to Rs. 2,912,192,000 in 2023, indicating a decrease in revenue year-over-year.

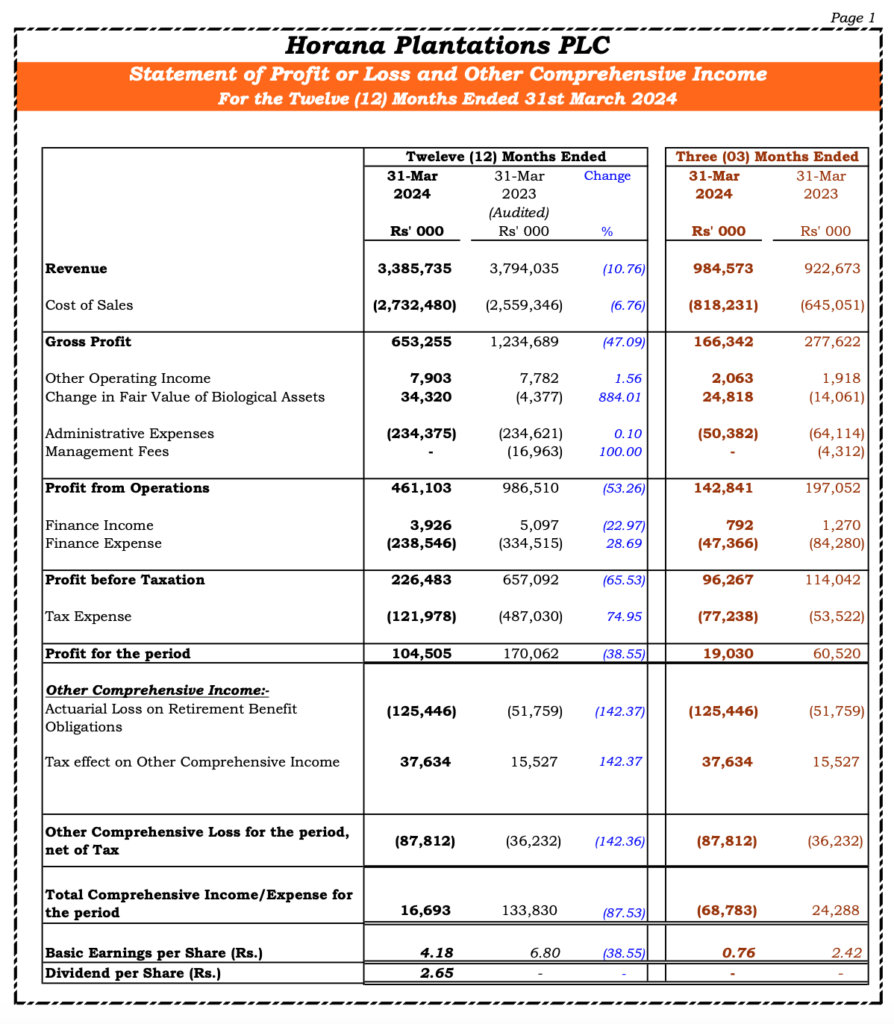

- The company reported a total comprehensive income of Rs. 16,693,000 for the period ended 31st March 2024, which is a significant decrease from the Rs. 133,830,000 reported for the same period in 2023.

- Basic Earnings per Share (EPS) for the twelve months ended 31st March 2024 was Rs. 4.18, down from Rs. 6.80 in the previous year.

- The company declared a dividend per share of Rs. 2.65 for the period, whereas there was no dividend declared in the previous year.

- The Statement of Changes in Equity shows that the balance as at 31st March 2024 was Rs. 880,396,000, with the stated capital comprising 25 million ordinary shares and 1 golden share.

The financial performance indicates a reduction in revenue and comprehensive income, along with a decrease in EPS. However, the company has declared a dividend, which could be a positive signal to shareholders. The decrease in performance metrics could be due to various factors, including market conditions, operational challenges, or strategic decisions made by the company. It is important to analyze these results in the context of the broader industry trends and the company’s long-term strategic goals.

Key Financial Ratios

Based on the provided context from Horana Plantations PLC’s interim financial statements for December 2023 and March 2024, the following key financial ratios can be calculated:

1. Current Ratio:

This ratio measures the company’s ability to pay short-term obligations with its short-term assets.

For December 2023:

Current Assets: Rs. 842,257,000

Current Liabilities: Rs. 1,236,634,000

Current Ratio = Current Assets / Current Liabilities = 842,257 / 1,236,634 = 0.68

For March 2024:

Current Assets: Rs. 760,984,000

Current Liabilities: Rs. 1,346,953,000

Current Ratio = Current Assets / Current Liabilities = 760,984 / 1,346,953 = 0.56

2. Net Profit Margin:

This ratio indicates the percentage of revenue that remains as profit after all expenses are paid.

For the year ended March 2024:

Revenue: Rs. 2,556,632,000

Profit for the period: Rs. 85,476,000

Net Profit Margin = (Profit for the period / Revenue) x 100 = (85,476 / 2,556,632) x 100 = 3.34%

3. Return on Equity (ROE):

This ratio measures the profitability of a business in relation to its equity.

For March 2024:

Net Income: Rs. 85,476,000

Average Shareholders’ Equity: (Rs. 959,180,000 + Rs. 880,396,000) / 2 = Rs. 919,788,000

ROE = (Net Income / Average Shareholders’ Equity) x 100 = (85,476 / 919,788) x 100 = 9.29%

4. Earnings Per Share (EPS):

This ratio measures the amount of profit that is allocated to each share of stock.

For the year ended March 2024:

Net Income: Rs. 85,476,000

Number of Shares: 25,000,000 (excluding the golden share as it typically does not have the same rights as ordinary shares)

EPS = Net Income / Number of Shares = 85,476 / 25,000 = Rs. 3.42

5. Debt-to-Equity Ratio:

This ratio measures the company’s financial leverage by comparing its total liabilities to its shareholders’ equity.

For March 2024:

Total Liabilities: Rs. 3,819,993,000

Total Equity: Rs. 880,396,000

Debt-to-Equity Ratio = Total Liabilities / Total Equity = 3,819,993 / 880,396 = 4.34

Please note that these calculations are based on the figures provided in the context and are meant to give a snapshot of the company’s financial health. For a more comprehensive analysis, additional information and context would be necessary.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net

Future Outlook

The future outlook for Horana Plantations PLC should be considered in the context of both company-specific factors and broader industry trends. As of the latest available interim financial statements for December 2023 and March 2024, the following points can be highlighted:

- Financial Performance: The financial ratios calculated from the interim statements indicate the company’s current financial health. For instance, the current ratio has decreased from December 2023 to March 2024, suggesting a tighter liquidity position. The net profit margin and return on equity provide insights into profitability, which are crucial for future growth prospects.

- Industry Trends: The tea industry, where Horana Plantations PLC operates, is subject to various external factors. According to the information from Kahawatte Plantation PLC’s annual report for December 2023, the revocation of the ban on importing chemical fertilizers in Sri Lanka has eased supply chain constraints, which could lead to better yields and improved tea production for plantations like Horana.

- Challenges: The same industry report also mentions potential challenges, such as reduced yields and quality issues that may continue to affect tea auction prices in the near term. These factors could impact Horana Plantations PLC’s revenue and profitability.

- Strategic Initiatives: The company’s future outlook will also depend on its strategic initiatives to address these challenges and capitalize on positive developments. This could include optimizing agricultural practices, improving cost management, and exploring new markets or product lines.

- Economic and Regulatory Factors: The broader economic environment, including currency fluctuations, inflation, and regulatory changes, will also play a significant role in shaping the company’s future. As Horana Plantations PLC operates within Sri Lanka, it is subject to the economic conditions of the country, which should be monitored closely.

- Sustainability and Social Responsibility: As consumers and investors increasingly value sustainability, Horana Plantations PLC’s commitment to socially responsible practices can enhance its reputation and long-term viability.

In conclusion, while Horana Plantations PLC’s past performance provides a foundation for assessing its future outlook, it is essential to consider the dynamic nature of the industry, economic factors, and the company’s strategic responses to these challenges and opportunities. Investors and stakeholders should keep abreast of the company’s ongoing performance and any significant changes in the industry or regulatory environment that could affect its future prospects.