Analysis of the financial status and performance of Access Engineering PLC for the fiscal year ended 31st March 2024. The analysis is based on the interim financial statements provided and includes a review of key financial ratios.

Financial Performance Summary:

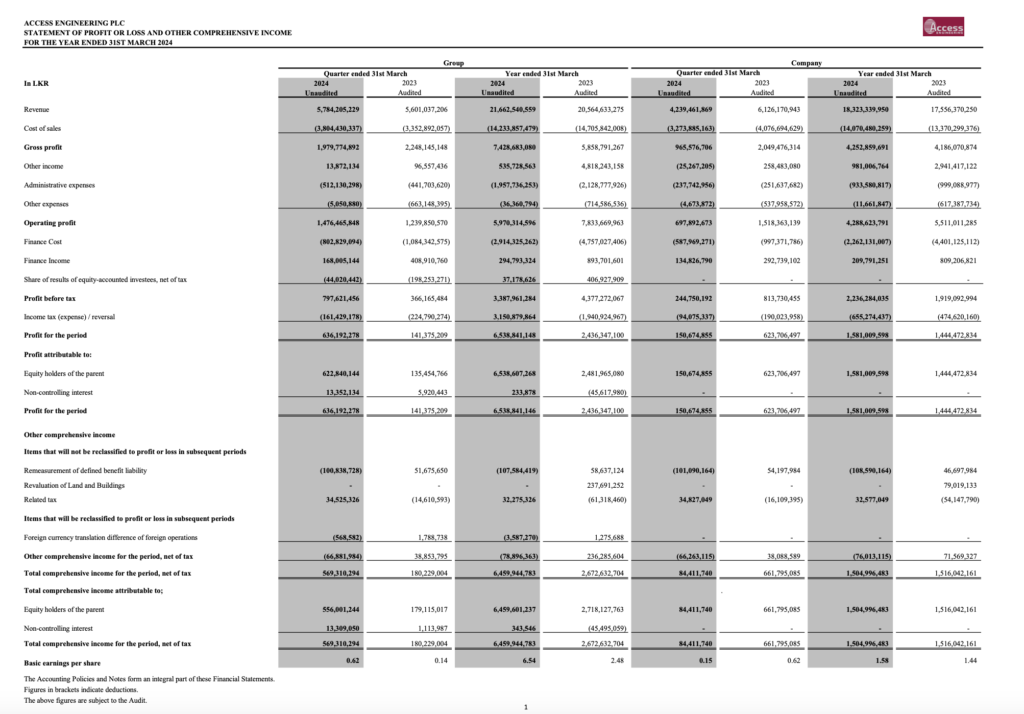

- Revenue: Access Engineering PLC reported a revenue of LKR 21,662,540,559 for the year ended 31st March 2024, compared to LKR 20,564,633,275 in the previous year. This represents a growth of approximately 5.34%, indicating an increase in the company’s sales and operational activities.

- Profitability: The company’s basic earnings per share (EPS) increased to LKR 6.54 in 2024 from LKR 2.48 in 2023. This substantial increase in EPS reflects a strong improvement in profitability over the year.

- Cash Flow: The cash and cash equivalents at the end of the year were LKR 3,169,958,077, a significant recovery from the negative balance of LKR (1,064,998,173) at the end of the previous year. This improvement in liquidity suggests that the company has effectively managed its cash flows during the year.

Key Financial Ratios:

- Debt to Equity Ratio: The debt to equity ratio decreased to 55% in 2024 from 62% in 2023. This reduction indicates that the company has lowered its debt levels relative to its equity, which may be seen as a positive sign of financial health.

- Quick Ratio: The quick ratio improved to 1.06 times in 2024 from 0.98 times in 2023. This indicates that the company has a better capacity to meet its short-term obligations without needing to sell inventory.

- Interest Cover Ratio: The interest cover ratio increased to 2.09 times in 2024 from 1.50 times in 2023. This improvement suggests that the company is generating more earnings relative to the interest expenses on its debt, which is a positive indicator of financial stability.

The financial performance of Access Engineering PLC for the year ended 31st March 2024 shows positive trends in revenue growth, profitability, and liquidity. The company has demonstrated an ability to manage its debt and improve its financial ratios, which is indicative of a strong financial position. The improved cash flow situation and the increased earnings per share are particularly noteworthy, reflecting the company’s operational efficiency and profitability.

Investors and stakeholders may view these results favorably, as they suggest that Access Engineering PLC is on a solid financial path. However, it is important to note that these figures are subject to audit, and stakeholders should review the audited financial statements for final confirmation of the company’s financial status.