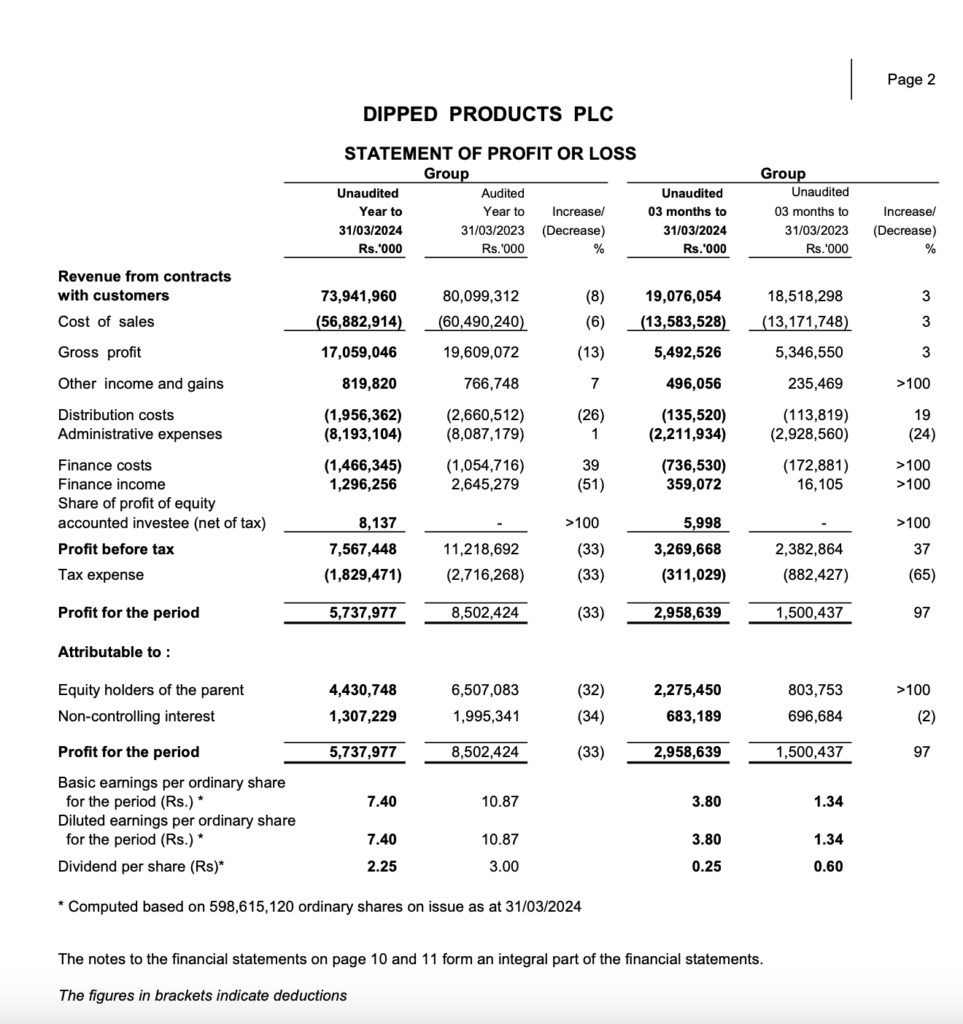

Based on the provided context from the interim report for Dipped Products PLC for the year ended 31st March 2024, the company’s profitability can be summarized as follows:

- Profit for the Year:

Dipped Products PLC reported a profit of Rs. 5,737,977,000 for the year ended 31st March 2024. This figure represents a significant decrease of 32% compared to the previous year’s profit of Rs. 8,502,424,000. - Quarterly Profit Comparison:

For the three months to 31st March 2024, the company reported a profit of Rs. 2,958,639,000, which is a substantial increase of 97% compared to the profit of Rs. 1,500,437,000 for the corresponding three months in the previous year. - Profit for the Previous Quarter:

The profit for the quarter ending 31st December 2023 was Rs. 4,346,034,000, which indicates that the profit for the last quarter of the financial year (January to March 2024) was lower than the third quarter (October to December 2023). - Goodwill Adjustment:

There was a retrospective adjustment in Goodwill of Rs. 165 million in the Statement of Financial Position for the year ended 31st March 2023. This adjustment would have impacted the previous year’s financials but does not directly affect the profitability for the year ended 31st March 2024. - Net Assets per Share as at the period end (31st March 2024): Rs. 48.17

- Share Price of Dipped Products PLC as at 15th May 2024 was Rs 30.60

Future Outlook

The future outlook for Dipped Products PLC should be considered in light of its recent performance, industry trends, and the broader economic environment. As of the last available interim report for the year ended 31st March 2024, the following factors could be relevant to the company’s future outlook:

- Recent Performance: The company’s profitability has seen a decrease in the year ended 31st March 2024 compared to the previous year. However, there was a significant increase in profit for the last quarter of the financial year, which may indicate a positive trend.

- Market Position: Dipped Products PLC is listed on the Colombo Stock Exchange and has a diverse range of products in the hand protection and plantation segments. Its market capitalization as of 31st March 2024 was Rs. 18,258 million, reflecting its size and presence in the market.

- Industry Trends: The demand for industrial and medical gloves, which are part of the company’s main product lines, may be influenced by global health concerns, industrial growth, and safety regulations. The company’s ability to adapt to changing market demands and maintain competitive pricing will be crucial.

- Global Economic Factors: Economic conditions, including inflation rates, currency exchange fluctuations, and trade policies, can impact the company’s costs and export competitiveness. The company’s future performance will be partly dependent on these external factors.

- Investment in Technology and Innovation: The company’s commitment to investing in new technologies and innovation can lead to improved efficiency and product development, which may enhance its competitive edge and market share.

- Sustainability Practices: As environmental concerns become more prominent, the company’s sustainability practices and eco-friendly initiatives could influence consumer preferences and regulatory requirements, potentially opening new markets or creating competitive advantages.

- Strategic Expansion: Any plans for expansion, whether through mergers, acquisitions, or entering new markets, could significantly impact the company’s growth trajectory and market share.

- Regulatory Environment: Changes in the regulatory environment, particularly in key markets, could affect the company’s operations and compliance costs.

Given these factors, stakeholders should monitor the company’s strategic initiatives, quarterly reports, and any announcements regarding new contracts, partnerships, or product lines. It is also advisable to stay informed about global economic trends and industry-specific developments that could influence the company’s performance.