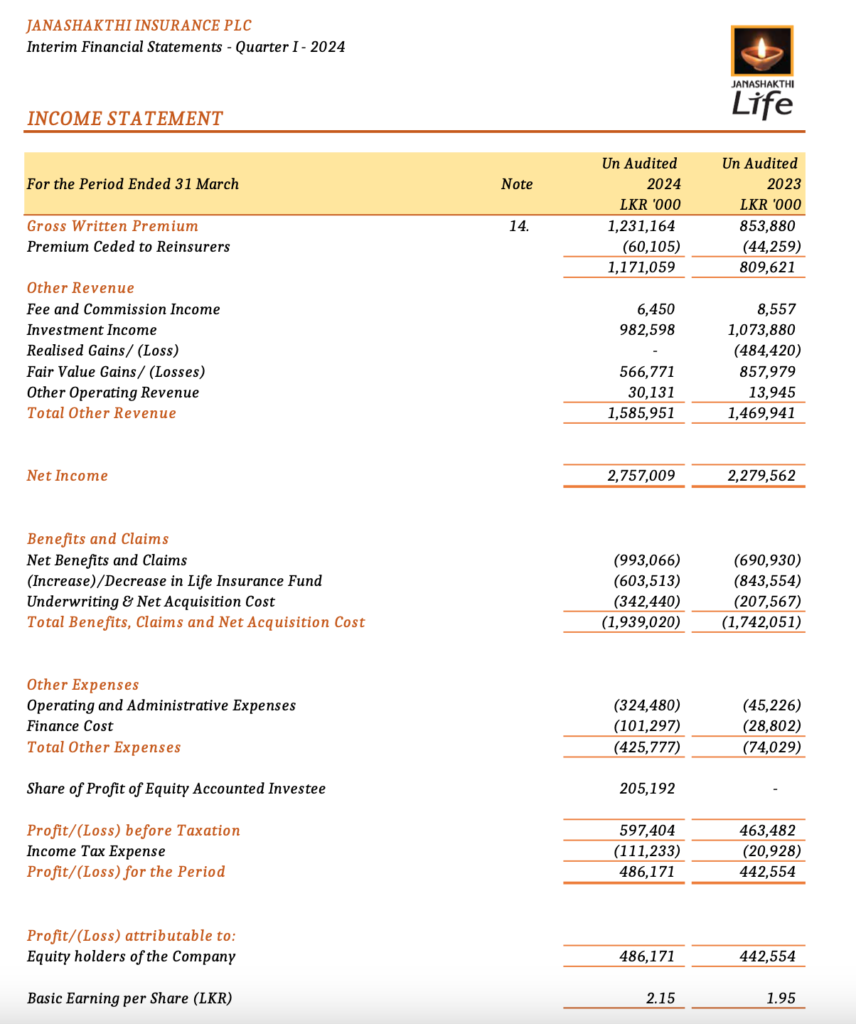

The financial performance and profitability of Janashakthi Insurance PLC for the quarter ended 31st March 2024 can be assessed by examining key figures from the interim financial statements:

- Gross Written Premium: The company reported a Gross Written Premium of LKR 1,231,164,000 for the quarter, which shows an increase compared to LKR 853,880,000 for the same period in the previous year. This growth in premiums suggests that the company has been successful in expanding its insurance business.

- Profit for the Period: Janashakthi Insurance PLC recorded a profit of LKR 486,171,000 for the quarter, compared to a profit of LKR 442,554,000 for the same quarter in the previous year. This indicates an improvement in profitability.

- Other Comprehensive Income: The company also reported other comprehensive income of LKR 168,027,000 for the quarter, which is lower compared to LKR 925,520,000 for the same period in the previous year.

- Total Comprehensive Income: The total comprehensive income for the period was LKR 654,198,000, which is significantly lower than the LKR 1,368,074,000 reported for the same period in 2023.

- Earnings per Share: The Earnings per Share (EPS) for the quarter was LKR 2.15, which is an increase from the LKR 1.95 reported for the same period in the previous year.

- Assets: The total assets of the company as of 31st March 2024 stood at LKR 36,192,210,000. This is an increase from the LKR 25,145,747,000 reported at the end of the previous year, indicating significant growth in the company’s asset base.

- Investment in Associate: There was a notable increase in the investment in associate, from LKR 3,754,587,000 at the end of 2023 to LKR 3,949,720,000 as of 31st March 2024.

- Property, Plant, and Equipment: There was a decrease in property, plant, and equipment from LKR 220,078,000 at the end of 2023 to LKR 161,620,000 as of 31st March 2024.

- Financial Investments: The company’s financial investments also saw an increase, suggesting a strategic allocation of funds into investment vehicles that could potentially yield higher returns.

- The Net Asset Value (NAV) per share for Janashakthi Insurance PLC as of 31st March 2024 is LKR 71.51. This represents an increase from the NAV per share of LKR 68.83 as of 31st December 2023.

The increase in Gross Written Premium and Profit for the Period suggests that Janashakthi Insurance PLC has experienced positive growth in its core operations. The rise in EPS also indicates that the company has become more profitable on a per-share basis, which is a positive sign for shareholders.

However, the decrease in total comprehensive income suggests that there may have been some elements of income or expenses that were not present in the previous year, or that certain investments or assets have performed differently.

When considering the future outlook, it is important to take into account the broader economic environment, competitive landscape, regulatory changes, and the company’s strategic initiatives. Given the growth in premiums and profitability, if the company continues to manage its operations effectively, it may continue to see positive financial performance. However, stakeholders should also consider the decrease in total comprehensive income and investigate the underlying factors that contributed to this change.

Future Outlook:

The increase in Gross Written Premium and the growth in total assets reflect a positive outlook for Janashakthi Insurance PLC. The company’s strategic investments and asset growth suggest that it is well-positioned to capitalize on market opportunities.

However, to provide a more comprehensive future outlook, one would need to consider external factors such as market conditions, regulatory changes, economic factors, and competitive dynamics within the insurance industry in Sri Lanka. Additionally, the company’s ability to maintain its growth in premiums, manage claims effectively, and continue to make prudent investment decisions will be critical for its future success.

Given the positive growth in premiums and assets, if Janashakthi Insurance PLC continues to execute its strategies effectively, it is likely to maintain a strong position in the market. However, it is important for investors and stakeholders to monitor the company’s performance regularly and stay informed about any significant changes in the industry or the broader economy that could impact the company’s operations and financial results.

Future Outlook:

The increase in Gross Written Premium and the growth in total assets reflect a positive outlook for Janashakthi Insurance PLC. The company’s strategic investments and asset growth suggest that it is well-positioned to capitalize on market opportunities.

However, to provide a more comprehensive future outlook, one would need to consider external factors such as market conditions, regulatory changes, economic factors, and competitive dynamics within the insurance industry in Sri Lanka. Additionally, the company’s ability to maintain its growth in premiums, manage claims effectively, and continue to make prudent investment decisions will be critical for its future success.

Given the positive growth in premiums and assets, if Janashakthi Insurance PLC continues to execute its strategies effectively, it is likely to maintain a strong position in the market. However, it is important for investors and stakeholders to monitor the company’s performance regularly and stay informed about any significant changes in the industry or the broader economy that could impact the company’s operations and financial results.