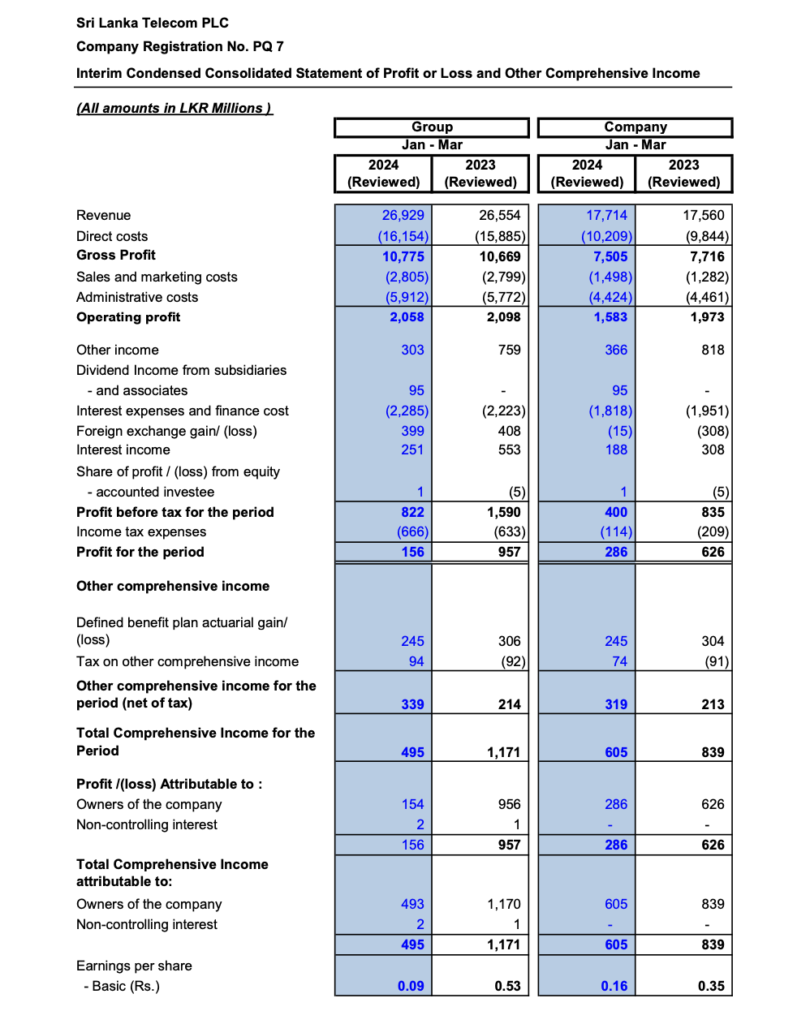

Based on the interim condensed consolidated financial statements for the quarter ended 31 March 2024, Sri Lanka Telecom PLC reported the following financial performance:

- Revenue for the quarter was LKR 26,929 million, a slight increase from LKR 26,554 million in the same quarter of the previous year.

- Direct costs were LKR 16,154 million, compared to LKR 15,885 million in the previous year, indicating a rise in costs.

- This resulted in a gross profit of LKR 10,775 million, marginally higher than the LKR 10,669 million reported in the same period last year.

- Sales and marketing costs were LKR 2,805 million, almost unchanged from LKR 2,799 million in the previous year.

- Administrative costs increased to LKR 5,912 million from LKR 5,772 million.

- The operating profit was LKR 2,058 million, compared to LKR 2,098 million in the previous year.

- Other income was LKR 303 million, a decrease from LKR 759 million in the same quarter of the previous year.

- Interest expenses and finance costs were LKR 2,285 million, up from LKR 2,223 million.

- The company reported a foreign exchange gain of LKR 399 million, compared to a gain of LKR 408 million in the previous year.

- Interest income was LKR 251 million, down from LKR 553 million.

- The profit before tax for the period was LKR 822 million, a decrease from LKR 1,590 million in the same quarter of the previous year.

- After accounting for income tax expenses of LKR 666 million, the profit for the period was LKR 156 million, significantly lower than the LKR 957 million reported in the previous year’s same quarter.

In summary, Sri Lanka Telecom PLC’s profitability has decreased in the quarter ended 31 March 2024 compared to the same quarter in the previous year, with lower operating profit and profit before tax. The company has managed to slightly increase its revenue, but this has been offset by higher direct and administrative costs, as well as lower other income and interest income. The increase in finance costs also impacted the net profitability.

Key Ratios

Based on the information provided, the key financial ratios for Sri Lanka Telecom PLC for the quarter ended 31 March 2024 are as follows:

- Net asset value per share: Rs. 49.31

- Debt/equity ratio: 1.06 times

- Quick asset ratio: 0.54 times

These ratios provide insights into the company’s financial health and performance. The net asset value per share indicates the value of the company’s equity on a per-share basis, which has slightly increased from Rs. 49.03 at the end of December 2023.

The debt/equity ratio measures the company’s financial leverage by comparing its total liabilities to its shareholders’ equity. A ratio of 1.06 suggests that the company has Rs. 1.06 of debt for every Rs. 1 of equity, which is a slight increase from the 1.02 ratio at the end of the previous year, indicating a higher reliance on debt financing relative to equity.

The quick asset ratio, also known as the acid-test ratio, measures the company’s ability to meet its short-term obligations with its most liquid assets. A ratio of 0.54 means that for every Rs. 1 of current liabilities, the company has Rs. 0.54 of quick assets, which include cash, marketable securities, and receivables. This ratio has decreased from 0.57 at the end of December 2023, indicating a slight reduction in liquidity.