Overview

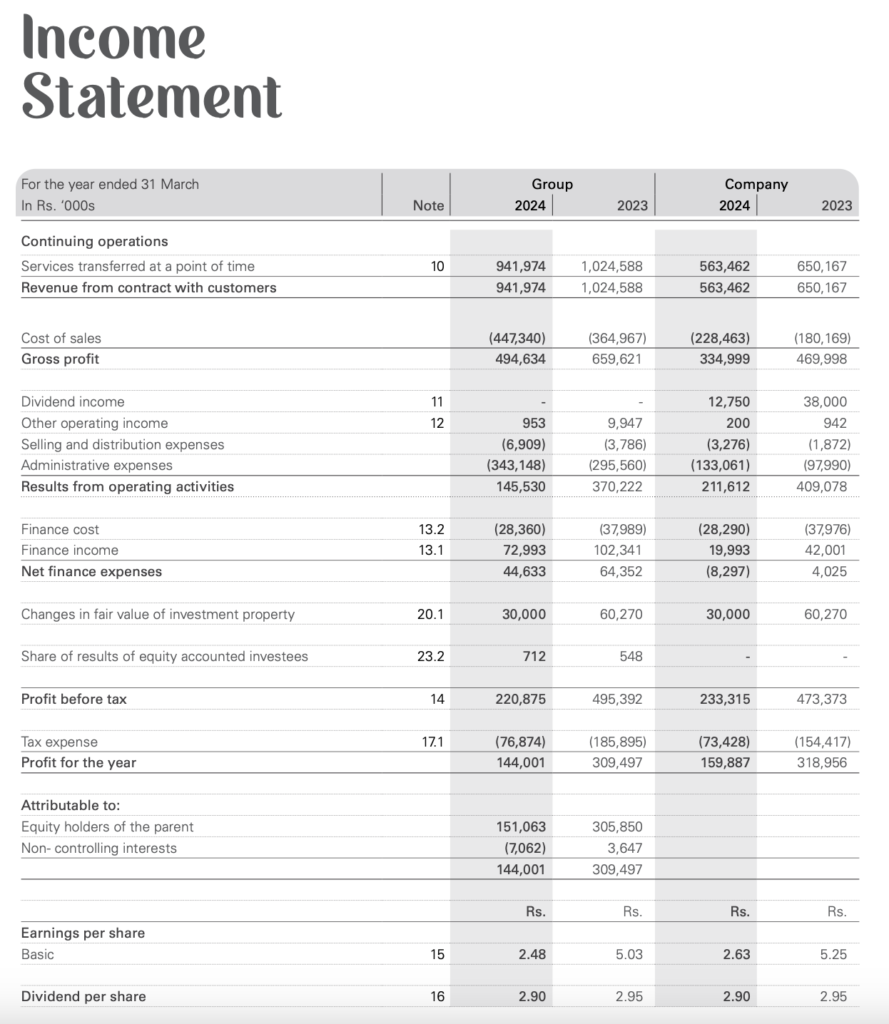

The financial year ended 31st March 2024 was challenging for John Keells PLC as the company navigated through volatile market conditions and economic headwinds. Despite the efforts to mitigate risks and maintain operational efficiency, the financial performance reflected a decline compared to the previous year.

Revenue and Profitability

The consolidated revenue of the John Keells PLC Group decreased by 8% to Rs. 941.97 million from Rs. 1,024.59 million in the previous year. This decline was mainly driven by reduced revenue from key segments such as Tea Broking and Share Broking, while Warehousing operations showed a positive growth trajectory.

- Revenue Breakdown:

- Company: Rs. 563 million (2023: Rs. 650 million)

- Group: Rs. 942 million (2023: Rs. 1,025 million)

The Tea Broking segment, a significant contributor to the company’s revenue, experienced a 13% decline to Rs. 555.97 million from Rs. 641.17 million. This was due to lower average prices per kilogram despite an increase in volume sold. The Share Broking segment also saw a revenue drop, reflecting broader market challenges.

- Profit Before Tax (PBT):

- Company: Rs. 233.32 million (2023: Rs. 473.37 million)

- Group: Rs. 220.88 million (2023: Rs. 495.39 million)

- Profit After Tax:

- Company: Rs. 160 million (2023: Rs. 319 million)

- Group: Rs. 151 million (2023: Rs. 306 million)

Key Ratios and Financial Metrics

The key financial ratios highlighted the impact of the challenging environment on the company’s performance:

- Net Profit Margin: 15.29% (2023: 30.21%)

- Return on Equity (ROE): 3.48% (2023: 7.29%)

- Return on Capital Employed (ROCE): 5.78% (2023: 12.55%)

- Debt to Equity Ratio: 4.90% (2023: 2.02%)

- Current Ratio: 1.19 (2023: 1.26)

- Interest Coverage Ratio: 8.79 times (2023: 14.04 times)

These ratios indicate a significant drop in profitability and a slight increase in financial leverage. The decline in interest coverage ratio reflects the reduced earnings before interest and taxes, posing potential risks to debt servicing capabilities.

Segmental Performance

- Tea Broking: The segment faced a 13% revenue decline due to a decrease in average prices despite higher sales volumes. The average price per kilogram fell to Rs. 1,092.53 from Rs. 1,349.50, driven by increased production and a stronger Sri Lankan Rupee.

- Share Broking: The brokerage income dropped by 14% to Rs. 337.37 million from Rs. 439.18 million. This segment’s performance was impacted by market volatility and reduced trading volumes.

- Warehousing: This segment provided a positive note with a 19% revenue increase, showcasing resilience and growth potential in storage and logistics services.

Strategic Outlook

Looking ahead, John Keells PLC is poised to focus on enhancing operational efficiencies, managing costs, and exploring growth opportunities in resilient segments like Warehousing. The company aims to leverage its strengths and mitigate risks posed by global market uncertainties, geopolitical tensions, and domestic economic conditions.

The strategic initiatives will include:

- Strengthening collaborations with key stakeholders such as the Sri Lankan Tea Board to support the tea industry.

- Adapting to market demands and innovating product offerings to meet consumer expectations.

- Enhancing sustainability practices and expanding global market reach for Ceylon Tea.

Conclusion

The financial year 2023/24 underscored the resilience of John Keells PLC amidst challenging conditions. While profitability metrics and revenue figures declined, the company maintained a stable financial base with a focus on long-term sustainability and strategic growth. The continued emphasis on risk management, operational efficiency, and stakeholder collaboration will be crucial as JKPLC navigates the upcoming financial year