Keells Food Products PLC’s financial performance for the year ended 31st March 2024 indicates a challenging period for the company. Here is a summary of the key financial figures and ratios based on the provided context:

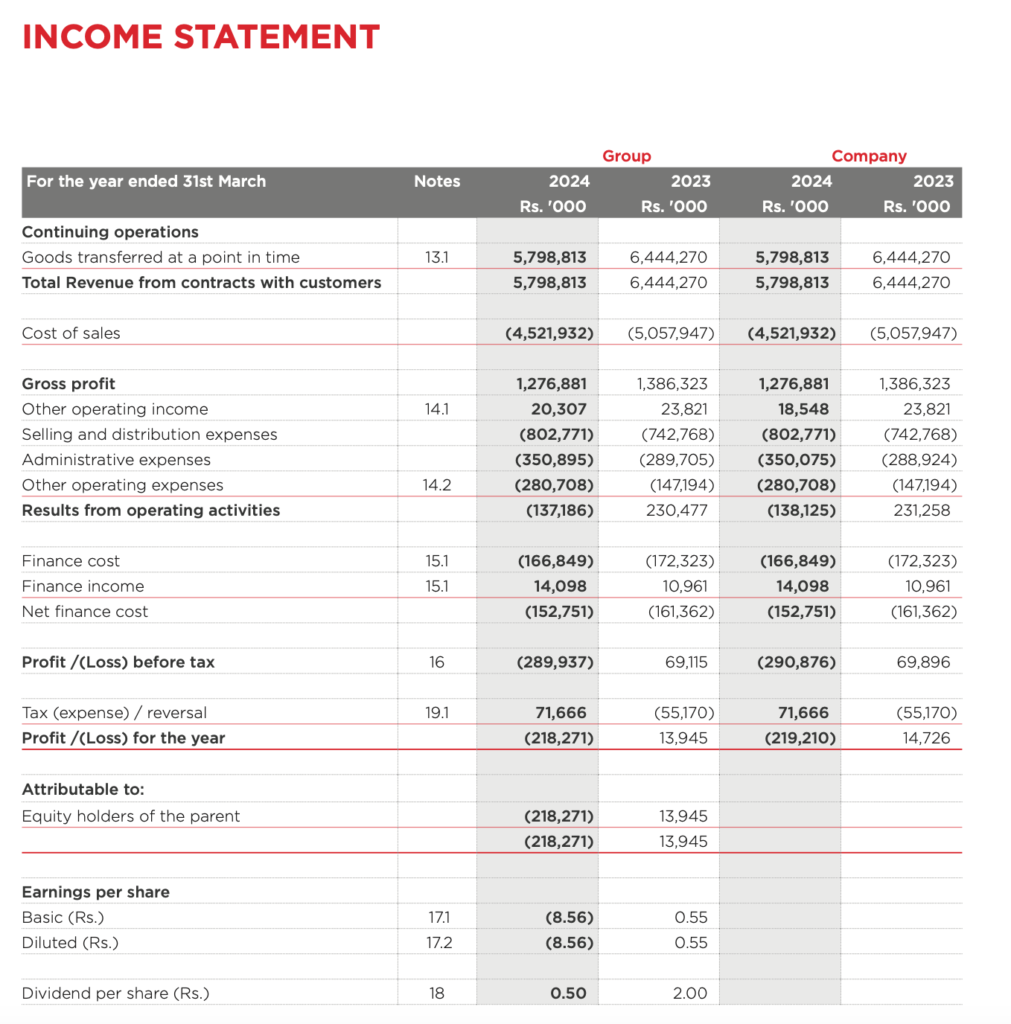

Profit After Tax (PAT):

- The company experienced a significant downturn, with a loss after tax of Rs. (218,271,000) for the year ended 31st March 2024, compared to a profit of Rs. 13,945,000 in the previous year. This represents a decrease of 1,665%.

Revenue:

- The company reported total revenue from contracts with customers at Rs. 5,798,813,000 for the year ended 31st March 2024, which is a decrease of 10% from the previous year’s revenue of Rs. 6,444,270,000.

Cost of Sales:

- The cost of sales for the year was Rs. 4,521,932,000, which is lower compared to the previous year’s cost of sales of Rs. 5,057,947,000.

Gross Profit:

- The reduction in cost of sales was not enough to offset the decrease in revenue, leading to a decrease in gross profit.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA):

- EBITDA also saw a sharp decline, with the company reporting Rs. 102,257,000 for the year, which is a 78% decrease from the previous year’s EBITDA of Rs. 457,020,000.

Financial Position:

- Current Assets: There was a year-over-year (YOY) decrease of 14% in current assets, from Rs. 2,275,413,000 in 2023 to Rs. 1,947,065,000 in 2024.

- Total Assets: Total assets decreased by 8% YOY, from Rs. 4,302,695,000 to Rs. 3,961,880,000.

- Total Debt: The company reduced its total debt by 13% YOY, from Rs. 1,230,059,000 to Rs. 1,074,431,000.

- Shareholders’ Funds: There was a decrease of 12% in shareholders’ funds, from Rs. 2,108,276,000 to Rs. 1,863,261,000.

- Debt to Equity Ratio: The debt to equity ratio slightly improved from 58.34% to 57.66%.

Other Comprehensive Income:

- The company reported other comprehensive income related to currency translation of foreign operations, which was positive at Rs. 4,122,000 for the year ended 31st March 2024, compared to a negative Rs. 4,223,000 in the previous year.

The financial performance of Keells Food Products PLC for the year ended 31st March 2024 reflects a downturn in profitability, with significant losses after tax and a decrease in EBITDA. The company managed to reduce its total debt and slightly improve its debt to equity ratio, but the overall financial position weakened with reductions in total assets and shareholders’ funds. The positive other comprehensive income suggests some gains in foreign operations, but this was not enough to offset the overall negative performance.

Future Prospects and Potential Risks

The future prospects and potential risks of Keells Food Products PLC can be assessed by analyzing the information provided in the context of the company’s annual report for the year ended 31st March 2024, as well as considering broader industry trends and economic factors.

Future Prospects:

- Product Innovation and Diversification:

- Keells Food Products PLC has shown a commitment to introducing new flavors and convenient, ready-to-cook options that cater to busy lifestyles. This indicates a focus on product innovation which is crucial for growth in the food industry.

- The company plans to expand its product range, particularly in the pasta category, to diversify its dry product offerings.

- Operational Excellence:

- The company has prioritized operational excellence and continuous improvement, which could lead to better efficiency and cost savings.

- Market Leadership and Experience:

- With over 42 years of experience and a strong market presence, Keells Food Products PLC has established itself as a leader in the processed meat industry in Sri Lanka.

- Quality and Safety Standards:

- The company’s Pannala manufacturing facility is 100% SLS certified, which could enhance consumer trust and open up opportunities for export markets.

- Subsidiary Growth:

- The subsidiary, John Keells Foods India Private Limited, provides an opportunity for regional expansion and access to a larger market.

Potential Risks:

- Economic Instability:

- The company has faced challenges due to economic uncertainties, which could continue to impact consumer spending and credit availability.

- Cost Pressures:

- Inflationary pressures, high electricity costs, and increased taxes could affect the company’s cost structure and profitability.

- Distributor Network Stability:

- Instability in the distributor network due to cost escalations and volume drops could disrupt the supply chain and sales.

- Credit Risk:

- The company has taken measures to evaluate creditworthiness and set credit limits, but the risk of payment delays and financial constraints among retailers remains.

- Market Competition:

- Keells Food Products PLC operates in a competitive market, and there is a continuous need to monitor customer preferences and develop products to retain a competitive edge.

- Regulatory Changes:

- Changes in food safety regulations and other industry-related laws could impact operations and compliance costs.

- Foreign Exchange Risk:

- As the company has operations in India, it is exposed to currency translation risks which could affect financial performance.

In conclusion, Keells Food Products PLC has several strategies in place to drive growth and create value for stakeholders. However, the company must also navigate potential risks that could impact its financial performance and market position. It is important for the company to continue monitoring these risks and adapt its strategies accordingly to maintain its competitive edge and ensure long-term sustainability.