Based on the provided interim condensed financial statements for Central Industries PLC for the year ended 31st March 2024, we can analyze the financial performance and profitability of the company.

Revenue:

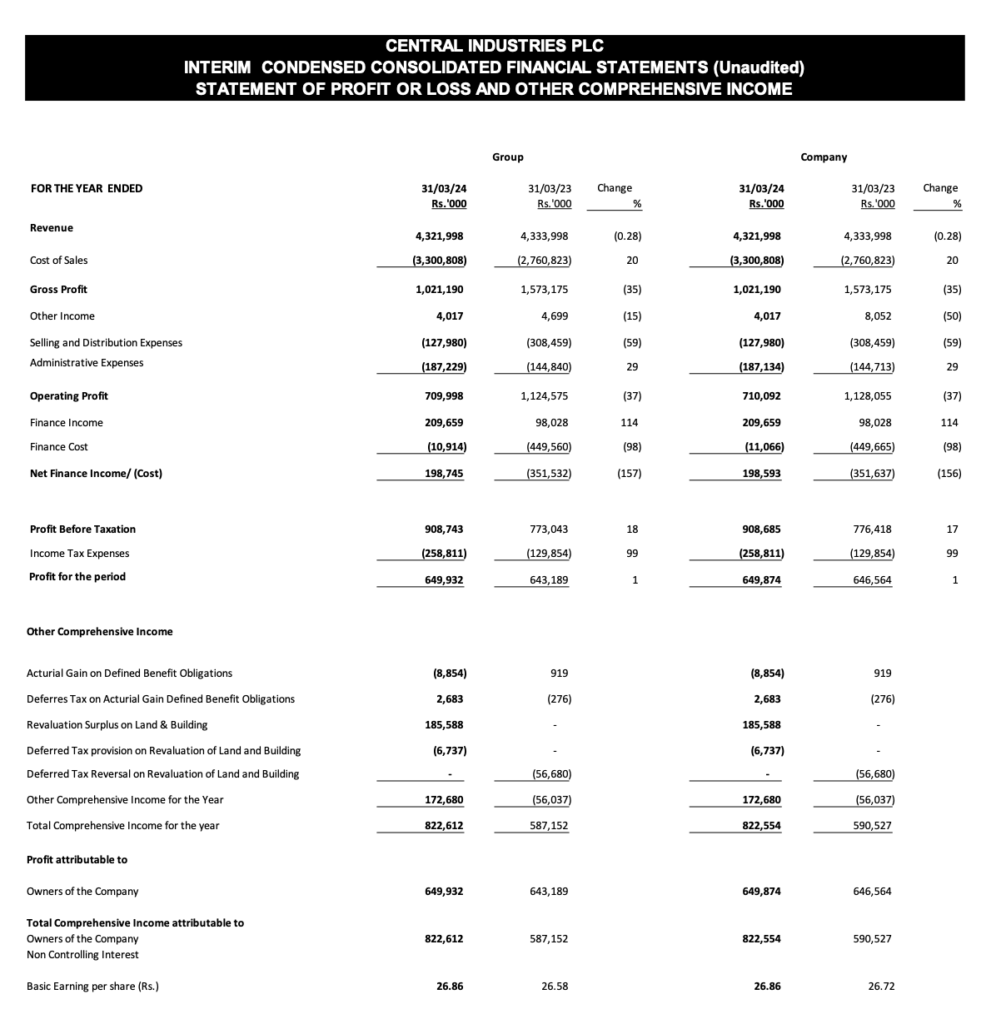

The revenue for the year ended 31st March 2024 was Rs. 4,321,998,000, which shows a slight decrease of 0.28% from the previous year’s revenue of Rs. 4,333,998,000.

Cost of Sales:

The cost of sales increased significantly by 20% to Rs. 3,300,808,000 in the year ended 31st March 2024 from Rs. 2,760,823,000 in the previous year. This increase in the cost of sales has impacted the gross profit margin.

Gross Profit:

The gross profit for the three months ended 31st March 2024 was Rs. 270,090,000, which is a 9% increase from the same period in the previous year. However, the annual gross profit margin may have been affected by the overall increase in the cost of sales.

Profit Before Taxation:

The profit before taxation for the year ended 31st March 2024 was Rs. 908,743,000, which is an increase from the previous year’s figure of Rs. 773,043,000.

Total Comprehensive Income:

The total comprehensive income for the year ended 31st March 2024 was Rs. 822,612,000 for the group, which is an increase from the previous year’s total comprehensive income of Rs. 587,152,000.

Basic Earnings Per Share (EPS):

The basic earnings per share for the year ended 31st March 2024 was Rs. 26.86, which is slightly higher than the previous year’s EPS of Rs. 26.58.

Equity:

The total equity as at 31st March 2024 was Rs. 3,979,717,000, which shows an increase from the balance as at 1st April 2022.

Analysis:

Central Industries PLC has shown resilience in maintaining its revenue, with a marginal decrease of 0.28%. However, the cost of sales has increased significantly, which could be due to various factors such as increased raw material costs, labor costs, or other operational expenses. Despite this, the company has managed to increase its profit before taxation and total comprehensive income, which indicates improved profitability and effective cost management in other areas of the business.

The increase in basic EPS suggests that the company has become more profitable on a per-share basis, which is a positive sign for shareholders. The growth in total equity indicates that the company is strengthening its financial position, which could be due to retained earnings and other comprehensive income.

Overall, Central Industries PLC’s financial performance for the year ended 31st March 2024 shows positive signs of profitability and growth in equity, despite the challenges in managing the cost of sales. Investors and stakeholders may view these results favorably, considering the company’s ability to improve its bottom line in a challenging economic environment.