Based on the provided context from the interim financial reports of Colombo Dockyard PLC, here is an analysis of the company’s financial performance, profitability, and key ratios for the quarter ended 31st March 2024:

Financial Performance:

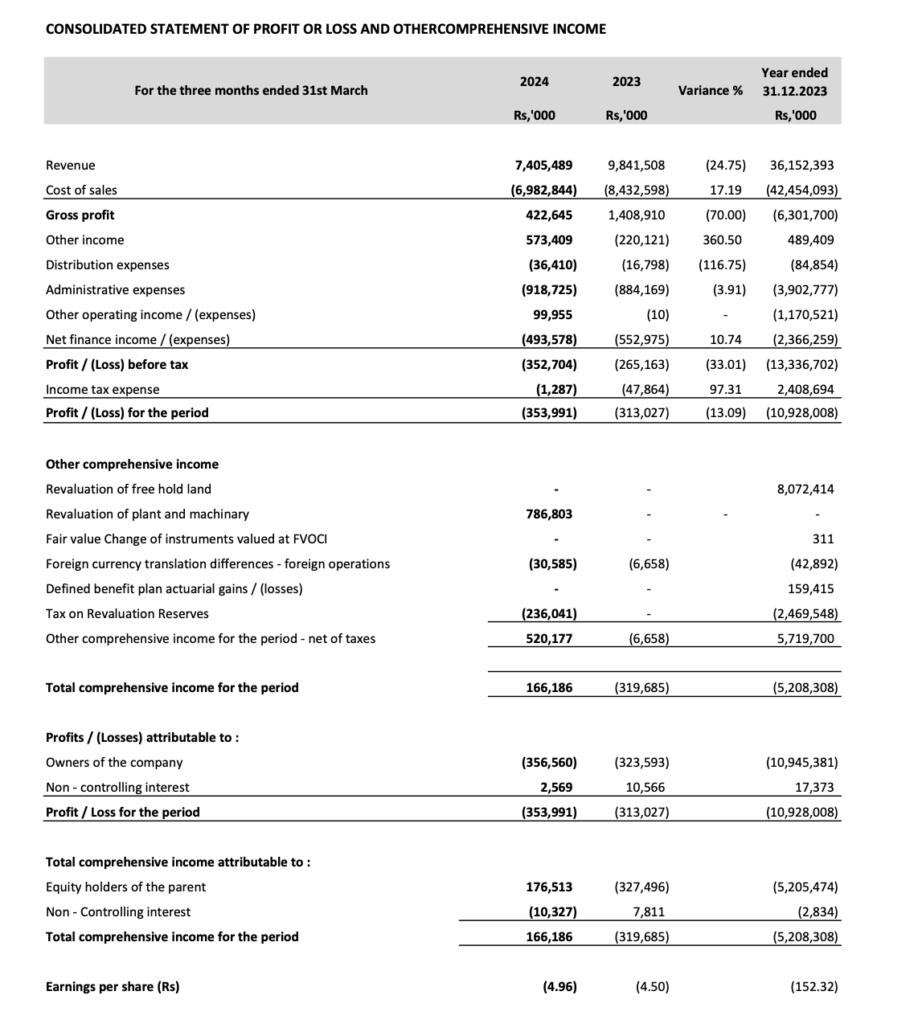

- Revenue: For the quarter ended 31st March 2024, the revenue was Rs. 7,405,489,000, which shows a decrease of 24.75% compared to the revenue of Rs. 9,841,508,000 for the same period in 2023.

- Cost of Sales: The cost of sales for the quarter was Rs. 6,982,844,000, which is an improvement of 17.19% compared to Rs. 8,432,598,000 for the same period in 2023.

- Gross Profit: The gross profit for the quarter was Rs. 422,645,000, a significant decrease of 70% from Rs. 1,408,910,000 in the same quarter of the previous year.

- Net Loss: The company reported a net loss of Rs. (389,729,000) for the quarter.

- Other Income: Other income for the quarter was Rs. 573,000.

Profitability:

- Earnings Per Share (EPS): The EPS for the quarter was Rs. (4.96), which indicates a loss per share and is a decrease from the EPS of Rs. (4.50) for the same period in 2023.

- Total Comprehensive Income: The total comprehensive income for the quarter is not provided in the context, but for the year ended 31st December 2023, it was Rs. (5,208,308,000).

Key Ratios:

- Net Assets Per Share: As at 31st March 2024, the net assets per share were Rs. 40.17, which is an increase from Rs. 37.72 as at 31st December 2023.

- Gross Profit Margin: For the quarter, the gross profit margin can be calculated as (Gross Profit / Revenue) * 100 = (422,645 / 7,405,489) * 100 ≈ 5.71%, which is a decrease from the previous year’s comparable quarter.

- Net Profit Margin: For the quarter, the net profit margin is negative due to the net loss reported, calculated as (Net Loss / Revenue) * 100 = (-389,729 / 7,405,489) * 100 ≈ -5.26%.

- Return on Equity (ROE): The ROE cannot be directly calculated from the provided context as the total equity at the beginning and end of the quarter is not given. However, with a net loss, the ROE would be negative.

In conclusion, Colombo Dockyard PLC’s financial performance for the quarter ended 31st March 2024 shows a decrease in revenue and a significant reduction in gross profit compared to the same period in the previous year. The company also reported a net loss, which has negatively impacted the EPS and profitability ratios. The net assets per share have increased slightly compared to the end of the previous year. These figures suggest that the company faced challenges during this period, which affected its profitability. Stakeholders should consider these results in the context of the company’s overall strategy and market conditions when making investment decisions.

SWOT Analysis

Based on the provided context and the latest available data, here is a SWOT analysis for Colombo Dockyard PLC:

Strengths:

- Strategic Location: Colombo Dockyard is strategically located in proximity to major shipping routes, which is beneficial for attracting international business in ship repairs and building.

- Diversified Services: The company offers a range of services including ship repairs, shipbuilding, and heavy engineering, which allows it to tap into different revenue streams.

- Established Reputation: With a history dating back to 1974, Colombo Dockyard has built a reputation for quality and reliability in the maritime industry.

- Subsidiaries and Partnerships: The company has subsidiaries and partnerships that can provide additional capabilities and market penetration, such as Dockyard General Engineering Services (Pvt) Ltd and Ceylon Shipping Agency (Pte) Ltd.

Weaknesses:

- Financial Performance: Recent financial statements indicate a decrease in cash and cash equivalents, which could signal liquidity issues or a need for better cash management.

- Market Performance: The stock performance has shown a decline over the past year, which may reflect investor concerns or market conditions affecting the company.

- Dependence on Global Shipping Industry: The company’s performance is closely tied to the health of the global shipping industry, which can be volatile.

Opportunities:

- Maritime Industry Growth: Any growth in global trade and shipping could lead to increased demand for shipbuilding and repair services.

- Technological Advancements: Investing in new technologies could improve operational efficiency and open up new business opportunities, such as retrofitting ships with environmental compliance equipment.

- Expansion of Services: There may be opportunities to expand services into new areas, such as offshore engineering or specialized vessel construction.

Threats:

- Economic Uncertainty: Global economic uncertainty can lead to reduced shipping activity and investment, negatively impacting demand for Colombo Dockyard’s services.

- Competition: The company faces competition from other shipyards in the region, which could pressure prices and market share.

- Regulatory Changes: New environmental and safety regulations could increase operational costs or require significant capital expenditure to comply.

- Technological Disruption: The emergence of new technologies, such as autonomous ships, could disrupt traditional business models in the shipping industry.

This SWOT analysis provides a snapshot of Colombo Dockyard PLC’s internal and external factors that could affect its future performance. It is important for the company to leverage its strengths and opportunities while addressing its weaknesses and preparing for potential threats.