Analyzing the profitability and financial performance of Tea Smallholder Factories PLC for the year ended 31st March 2024 involves examining various financial metrics and comparing them with previous years’ data to understand the company’s trajectory. Here’s a detailed analysis based on the provided excerpts from the interim reports:

Revenue:

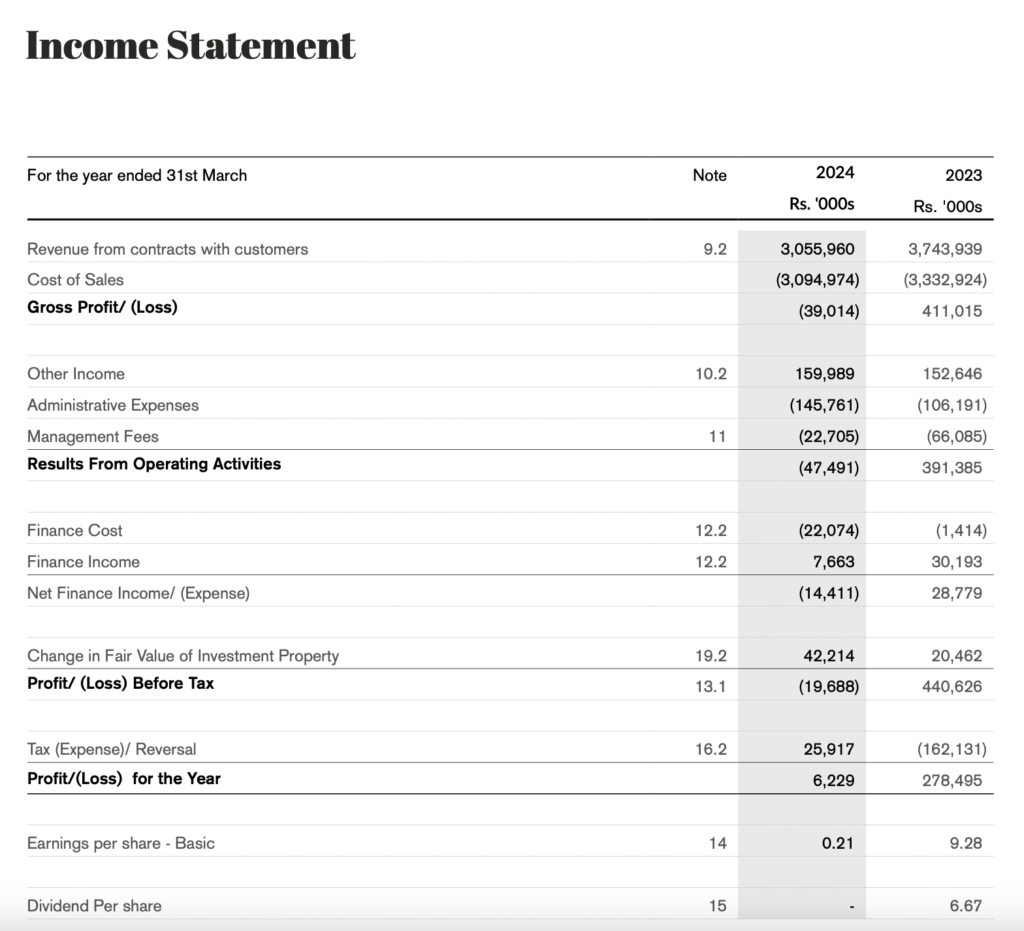

- The company’s total revenue for the year ended 31st March 2024 was Rs. 3,055,960,000, a significant decline of 18% from the previous year’s revenue of Rs. 3,743,939,000. This decrease in revenue is a primary concern as it indicates a reduction in the company’s sales performance.

Cost of Sales:

- The cost of sales was Rs. 3,094,974,000, which is slightly lower than the previous year’s Rs. 3,332,924,000. Despite the reduction in cost of sales, the company still reported a gross operating loss, suggesting that the decrease in revenue was not proportionately matched by a decrease in costs.

Gross Operating Profit/(Loss):

- The company experienced a gross operating loss of Rs. 39,014,000, compared to a profit of Rs. 411,015,000 in the previous year. This shift from profit to loss is a critical indicator of reduced profitability and may reflect issues such as declining market prices for tea, increased production costs, or both.

Other Income:

- Other income amounted to Rs. 159,989,000, which would have helped mitigate the gross operating loss. However, the nature of this income is not specified, and it may not be sustainable or related to the core operations of the company.

Profit for the Year:

- The profit for the year was Rs. 6,229,000, which is a positive outcome considering the gross operating loss. This suggests that the company managed to control other expenses or had other sources of income that contributed to the net profit.

Earnings Per Share (EPS):

- The EPS was Rs. 0.21, which provides an indication of the company’s profitability on a per-share basis. While positive, this figure should be compared with previous years to assess the trend in profitability from the shareholders’ perspective.

Cost Increases:

- The cost of labor and electricity per kg of made tea increased, with electricity costs surging by 29%. These increases in production costs have likely contributed to the gross operating loss and are a concern for future profitability if not managed effectively.

Market Factors:

- The decrease in revenue was primarily due to reduced tea prices at the Colombo Tea Auction, with an 18% reduction in low grown elevation prices compared to the previous financial year. This external market factor has had a direct impact on the company’s revenue.

Sales Volume:

- The total quantity of tea sold during the year increased by 3% to 2.49 million kilograms. This indicates that while the company was able to sell more tea, the lower prices led to reduced revenue, affecting overall profitability.

Strategic Focus:

- The company has focused on strategies for financial capital value creation, including targeted investments and operational streamlining. These strategies are aimed at sustainable growth and may contribute to improved financial performance in the future.

In summary, Tea Smallholder Factories PLC faced a challenging year with a significant decline in revenue and a gross operating loss. The company’s profitability was affected by lower market prices for tea and increased costs. However, the net profit and positive EPS indicate some resilience. The company’s strategic investments and focus on operational efficiency are critical for future performance, and it will be important to monitor how these initiatives impact the financial results in the coming years.