Based on the provided context from the interim reports of CW Mackie PLC, the financial performance and profitability for the year ended 31st March 2024 can be analyzed as follows:

Revenue:

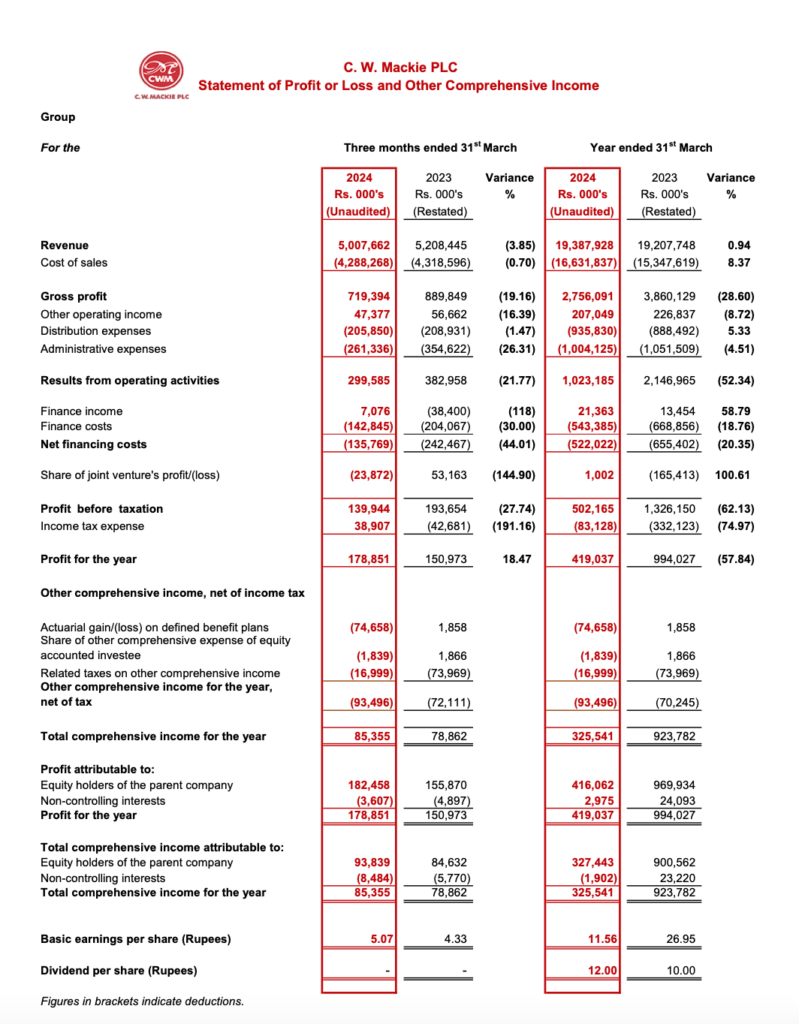

- For the year ended 31st March 2024, the company reported revenue of Rs. 19,387,928,000.

- This represents a slight increase of 0.94% compared to the previous year’s revenue of Rs. 19,207,748,000.

Cost of Sales and Gross Profit:

- The cost of sales for the year was Rs. 16,631,837,000, which is an 8.37% increase from the previous year’s Rs. 15,347,619,000.

- This resulted in a gross profit of Rs. 2,756,091,000 for the year ended 31st March 2024, which is lower when compared to the previous year due to the higher increase in the cost of sales relative to revenue.

Profit for the Year:

- The profit for the year ended 31st March 2024 was Rs.419,047,000 a significant decrease from the previous year’s profit of Rs. 994,027,000.

- The profit for the quarter ended 31st March 2024 was Rs.178,851,000 a increase from the previous year’s profit of Rs. 150,973,000.

Total Comprehensive Income:

- The total comprehensive income for the year was Rs. 325,451,000 which is significantly lower than the previous year’s total comprehensive income of Rs. 923,782,000.

- The total comprehensive income for the quarter ended 31st March 2024 was Rs. 85,355,000, which is higher than the previous year’s total comprehensive income of Rs. 78,862,000.

Earnings Per Share (EPS):

- Basic earnings per share for the Year ended 31st March 2024 was Rs. 11.56, which is a decrease from the previous year’s EPS of Rs. 26.95.

- Basic earnings per share for the Quarter ended 31st March 2024 was Rs. 5.07, which is an increase from the previous year’s EPS of Rs. 4.33.

Net Asset Value (NAV) per Share:

- The net asset value per share as of 31st March 2024 is Rs. 106.13.

In summary, CW Mackie PLC experienced a marginal increase in revenue but faced a significant decrease in profit for the year ended 31st March 2024. The cost of sales increased at a higher rate than revenue, which negatively impacted the gross profit. However, the company managed to increase its total comprehensive income and maintain its dividend per share. The basic earnings per share also saw an increase. When evaluating the financial performance of CW Mackie PLC, it is important to consider these factors along with the broader economic conditions and industry trends that may have influenced the company’s performance during this period.

CW Mackie PLC is a conglomerate company based in Colombo, Sri Lanka, with a diverse portfolio of business segments. The key business segments of CW Mackie PLC include:

- Commodity Trading: This segment is involved in the export and local sale of various commodities. It deals with all grades of natural rubber, including thick pale crepe rubber (TPC) and ribbed smoked sheet rubber (RSS). Additionally, the segment trades in desiccated coconut, non-traditional spices, and sugar. This segment is significant as it taps into the global demand for natural rubber and other commodities, contributing to the company’s revenue through international and local sales.

- Rubber-Based Products Manufacturing: This segment manufactures technically specified rubber (TSR), plantation sole crepe rubber, industrial sole crepe rubber, and molded rubber products. The production of these rubber-based products is likely a key contributor to the company’s profitability, given the wide range of applications for rubber in various industries.

- Industrial Products: This segment imports and sells welding equipment and consumables, light engineering products, refrigeration and air-conditioning components, and marine paints and protective coatings. By offering a range of industrial products, CW Mackie PLC serves a broad customer base, including industrial and commercial clients.

- Fast Moving Consumer Goods (FMCG): Engaged in manufacturing and trading consumer goods, this segment caters to the everyday needs of consumers. The FMCG sector is typically characterized by high turnover and consistent demand, which can provide stable revenue streams for the company.

- Other: This segment includes rent income from investment properties. It represents a more passive income stream compared to the active trading and manufacturing operations of the other segments.

CW Mackie PLC’s diversified business model allows it to mitigate risks associated with market fluctuations in any single industry. The company’s involvement in both manufacturing and trading, as well as its presence in various sectors from commodities to consumer goods, positions it to capitalize on different market opportunities.