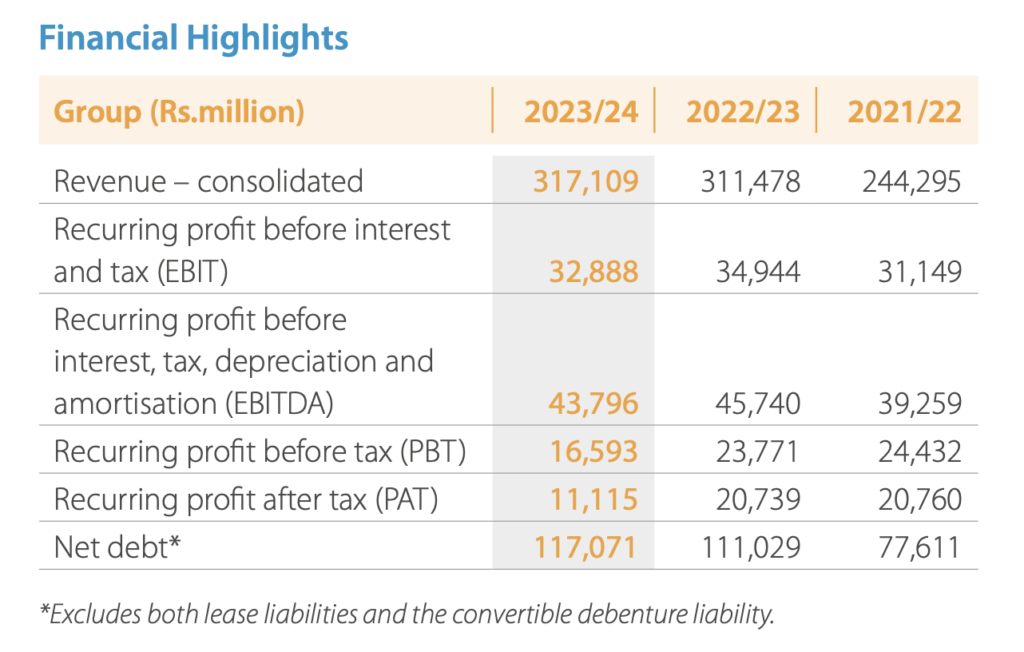

For the financial year 2023/24, Group revenue (excluding equity accounted investees) recorded a marginal growth of 1% to Rs.280.77 billion. The muted growth in revenue is mainly as a result of the decline in revenue of the Transportation industry group on account of the Bunkering business, Lanka Marine Services (LMS). LMS recorded a decline in revenue in the current year primarily due to the sharp reduction in global fuel oil prices as compared to the previous year.

The Group recorded a recurring earnings before interest expense, tax, depreciation and amortisation (EBITDA) of Rs.43.80 billion in the financial year 2023/24, in comparison to the recurring Group EBITDA of Rs.45.74 billion in the previous year, mainly as a result of the lower EBITDA recorded at LMS, the lower interest income recorded at the Holding Company and the decline in EBITDA in the Information Technology and Plantation Services businesses. Interest income recorded a decline driven by lower domestic interest rates, the translation impact on the foreign currency denominated interest income due to the appreciation of the Rupee, as well as a decline in cash and cash equivalents at the Holding Company on account of the planned utilisation for equity infusions in investments. Excluding the Holding Company and LMS, Group revenue and recurring Group EBITDA recorded a growth of 12% and 3%, respectively.

The recurring Group profit before tax (PBT) decreased by 30% to Rs.16.59 billion from the Rs.23.77 billion recorded in the previous year. The previous year included net exchange gains of Rs.6.63 billion, primarily on account of the net US Dollar denominated cash holdings and liabilities at the Holding Company which benefited due to the steep depreciation of the Rupee, whilst the PBT for the year under review comprises of net exchange gains of Rs.3.37 billion, including the net exchange gain on the USD 219 million term loan facility at Waterfront Properties (Private) Limited on account of the transition of its functional currency from US Dollars to Rupees. PBT was also impacted on account of the interest charged on the convertible debentures issued to HWIC Asia Fund (HWIC), including a notional non-cash interest of approximately Rs.3.02 billion, whereas the previous year included notional interest of approximately Rs.1.83 billion on the debenture. Interest expense also increased on account of higher Rupee borrowing costs due to an increase in Rupee debt in line with the planned funding strategy of

the Group. Excluding the impacts of the exchange gain and notional interest, the recurring PBT declined by 14% to Rs.16.24 billion as against Rs.18.97 billion recorded in the previous year.

The recurring profit attributable to equity holders of the parent decreased by 49% to Rs.10.21 billion for the financial year ended 31 March 2024.

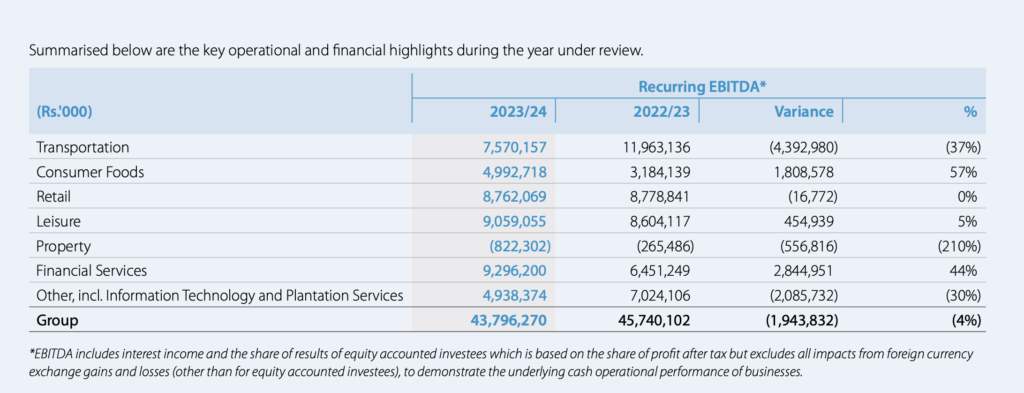

The recurring EBITDA analysis in the industry group discussion below

is post the elimination of one-off impacts in order to demonstrate the performance of the core operations of the businesses. The recurring adjustments are detailed in the ensuing section of this Message and the Financial and Manufactured Capital Review section of the Report. As the Annual Report contains discussions on the macroeconomic factors and its impact on our businesses, as well as a detailed discussion and analysis of each of the industry groups, I will focus on a high-level summation of the performance of each industry group during the financial year 2023/24.

Summarised below are the key operational and financial highlights during the year under review.

- The Group recorded a satisfactory financial performance during the year, in line with our expectations that it was a year of consolidation considering the priority of reaching stability and gradual recovery, thereon, post the economic crisis, coupled with the strong focus of the Group on operationalising the two large investments in the ensuing financial year.

- The momentum gathered pace towards the latter half of the year, with the Group recording a strong performance in the third and fourth quarters of 2023/24, which has continued into the new financial year.

- Group revenue (excluding equity accounted investees) recorded a marginal growth of 1% to Rs.280.77 billion, mainly on account of the decline in revenue in the Group’s Bunkering business, Lanka Marine Services (LMS). LMS recorded a decline in revenue in the current year primarily due to the sharp reduction in global fuel oil prices as compared to the previous year.

- Group recurring EBITDA was recorded at Rs.43.80 billion in 2023/24, in comparison to the recurring Group EBITDA of Rs.45.74 billion in 2022/23, mainly as a result of the lower EBITDA recorded at LMS and the lower interest income recorded at the Holding Company.

- Excluding LMS and the Holding Company, Group revenue and recurring Group EBITDA recorded a growth of 12% and 3%, respectively.

- As announced, Melco Resorts & Entertainment (Melco) will be the operator of the gaming facility at the ‘City of Dreams Sri Lanka’. Melco will also invest ~USD 125 million in the fit-out and equipping of the gaming space. As part of the collaboration between JKH and Melco, the integrated resort, which had previously been branded as ‘Cinnamon Life Integrated Resort’, will be rebranded as ‘City of Dreams Sri Lanka’.

- The Group’s Ports and Shipping business, South Asia Gateway Terminals (SAGT) recorded an increase in throughput of 7% in line with the overall Port of Colombo volumes, although profitability was impacted by a change in the throughput mix while ancillary revenues declined from the peak levels witnessed last year.

- The construction work on the West Container Terminal (WCT-1) at the Port of Colombo is progressing well. The first batch of quay and yard cranes is expected to arrive in August 2024.

- The Consumer Foods industry group recorded a significant increase in EBITDA, attributable to both the Beverages and the Frozen Confectionery businesses driven by both volume growth and improved margins.

- The Supermarket business recorded a strong performance in revenue during the year, with same store sales recording encouraging growth, driven by growth in customer footfall.

- Profitability of the Leisure industry group was driven by a strong recovery in the Sri Lankan Leisure businesses, on the back of a sustained recovery in tourist arrivals to the country.

- The ‘TRI-ZEN’ project, an 891-unit residential development, received the required clearances, including the Certificate of Conformity. Handing over of units has commenced from April 2024.

- The strong growth in profitability at Union Assurance PLC (UA) was driven by an increase in gross written premium (GWP), supported by an increase in regular new business premiums and renewal premiums while Nations Trust Bank (NTB) recorded growth in profitability aided by loan growth.

- In February 2024, HWIC Asia Fund (HWIC) exercised its option to convert 110,000,000 debentures, with a face value of Rs.14.30 billion. Accordingly, JKH issued and listed 110,000,000 new ordinary shares of the Company. The remaining outstanding debentures post this conversion amount to 98,125,000 debentures with a face value of Rs.12.76 billion. The remaining debentures are eligible for conversion till 12 August 2025.

- OCTAVE, the Data and Advanced Analytics Centre of Excellence of the Group, transitioned into an independent advanced analytics practice as originally designed when the Group’s analytics transformation programme was initiated in 2019. The ongoing assessment of the impact to business of these advanced analytics solutions, post roll-out and complete business-wide adoption has provided strong evidence that the anticipated benefits that were evident through initial pilot projects are being sustained at scale once fully implemented.

- As a part of the Group’s ongoing efforts towards increasing emphasis on Environmental, Social and Governance (ESG) aspects, the Group undertook initiatives to further strengthen its ESG framework and identify focus areas for each industry Group that dovetail into Group level priorities based on relevance and materiality.

- The Group’s carbon footprint per million rupees of revenue increased by 14%, while water withdrawn per million rupees of revenue increased by 9%, respectively. At a Group level, the efficiency indicators demonstrate a negative trend, primarily on account of the muted revenue growth of 1% whereas activity levels across the main contributing areas to the carbon footprint of Retail, Consumer Foods and Leisure have increased.