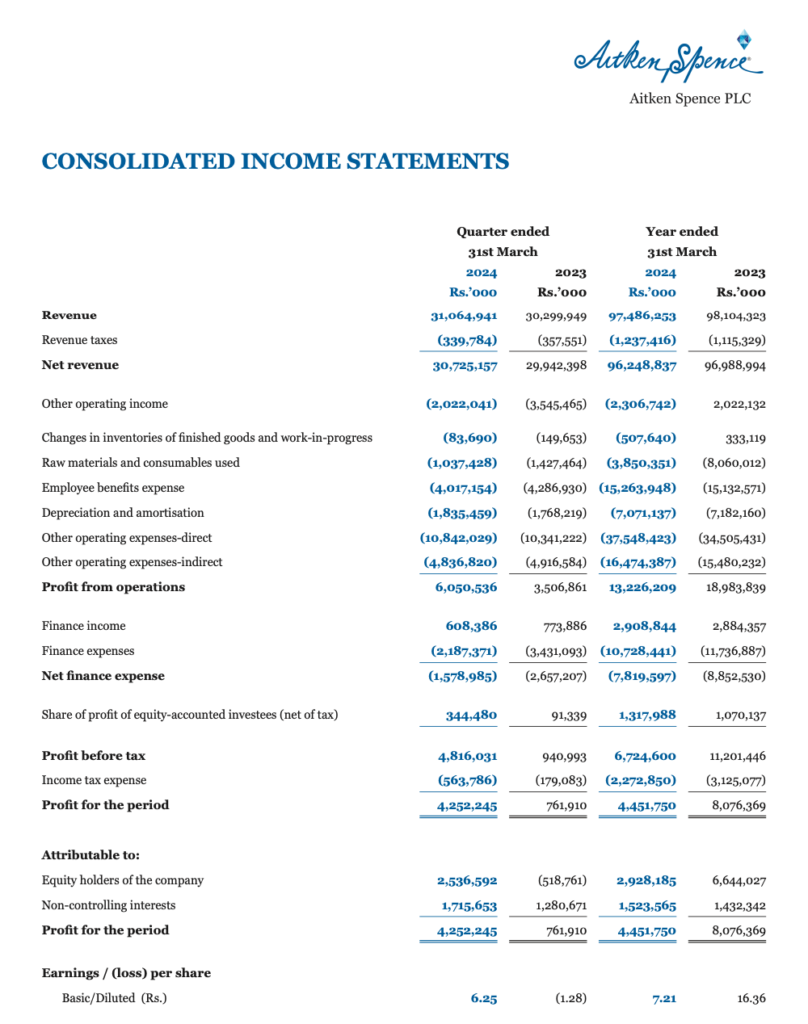

Based on the interim financial statements provided for Aitken Spence PLC for the year ended 31st March 2024, we can analyze the company’s profitability and financial position.

Profitability:

- The company reported a profit for the period of LKR 4,451,750,000 for the year ended 31st March 2024, as compared to a profit of LKR 8,076,369,000 for the previous year. This indicates a 44.8% decrease in profitability year-over-year.

- Earnings per share (EPS) for the year ended 31st March 2024 were negative at LKR 7.21 compared to LKR 16.36 for the previous year. This suggests a significant decline in profitability on a per-share basis.

- Net Asset Value per Share (NAV) as at 31st March 2024 is LKR 181.86 declined compares to LKR 183.26 as at 31st March 2023.

From the available data, it is clear that Aitken Spence PLC experienced a decrease in profitability in the year ended 31st March 2024 compared to the previous year. The negative EPS indicates that the company faced challenges that affected its earnings. To fully understand the financial position, including assets, liabilities, and equity, the complete financial statements would be necessary. It is also important to consider the notes to the financial statements for any additional information that could explain the changes in profitability and financial position.

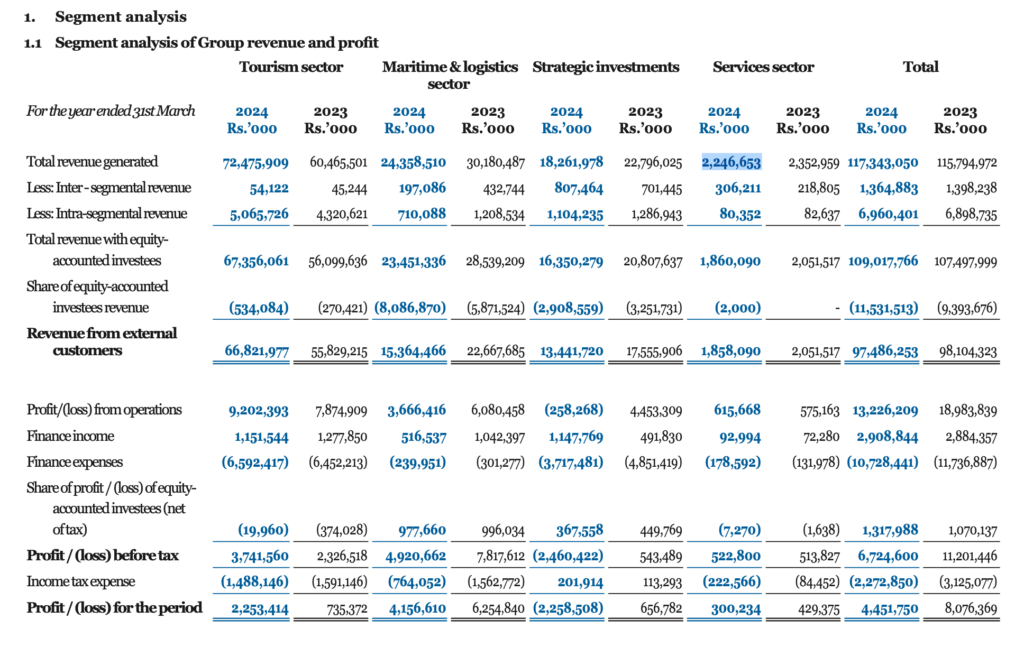

Segment Analysis

The segment analysis for Aitken Spence PLC for the year ended 31st March 2024, as per the provided context, can be summarized as follows:

Revenue by Segment:

- Tourism sector: Rs. 72,475,909,000

- Maritime & logistics sector: Rs. 24,358,510,000

- Strategic investments: Rs. 18,261,978,000

- Services sector: Rs. 2,246,653,000

Profit / (Loss) for the Period by Segment:

- Tourism sector: Rs. 2,253,414,000

- Maritime & logistics sector: Rs. 300,234,000

- Strategic investments: Rs. (2,258,508,000)

- Services sector: Rs. 300,234,000

- Total: Rs 4,451,750,000

Segment Assets as at 31st March 2024:

- Tourism sector: Rs. 116,903,639,000

- Maritime & logistics sector: Rs. 23,241,765,000

- Strategic investments: Rs. 66,287,330,000

- Services sector: Rs. 5,746,153,000

- Total: Rs. 212,178,887,000

Investments in Equity-Accounted Investees:

- The total investments in equity-accounted investees as at 31st March 2024 is Rs. 9,946,837,000.

Please note that the total revenue and profit for the services sector are not explicitly provided in the context. To obtain these figures, one would need to subtract the sum of the known segments from the total group revenue and profit. Additionally, the total revenue and profit for the group are Rs. 97,486,253,000 and Rs. 4,451,750,000, respectively, as per the context provided.

This segment analysis provides an overview of which sectors are the most and least profitable for Aitken Spence PLC and where the company has allocated its assets. It is evident that the tourism sector is a significant contributor to both revenue and profit, while strategic investments have incurred a loss for the period. The maritime & logistics sector shows a profit, indicating it is a stable segment for the company. The services sector’s figures would need to be calculated for a complete analysis.