Based on the interim financial statements provided for Kotagala Plantations PLC for the year ended 31st March 2024, we can analyze the company’s profitability and financial position.

Profitability:

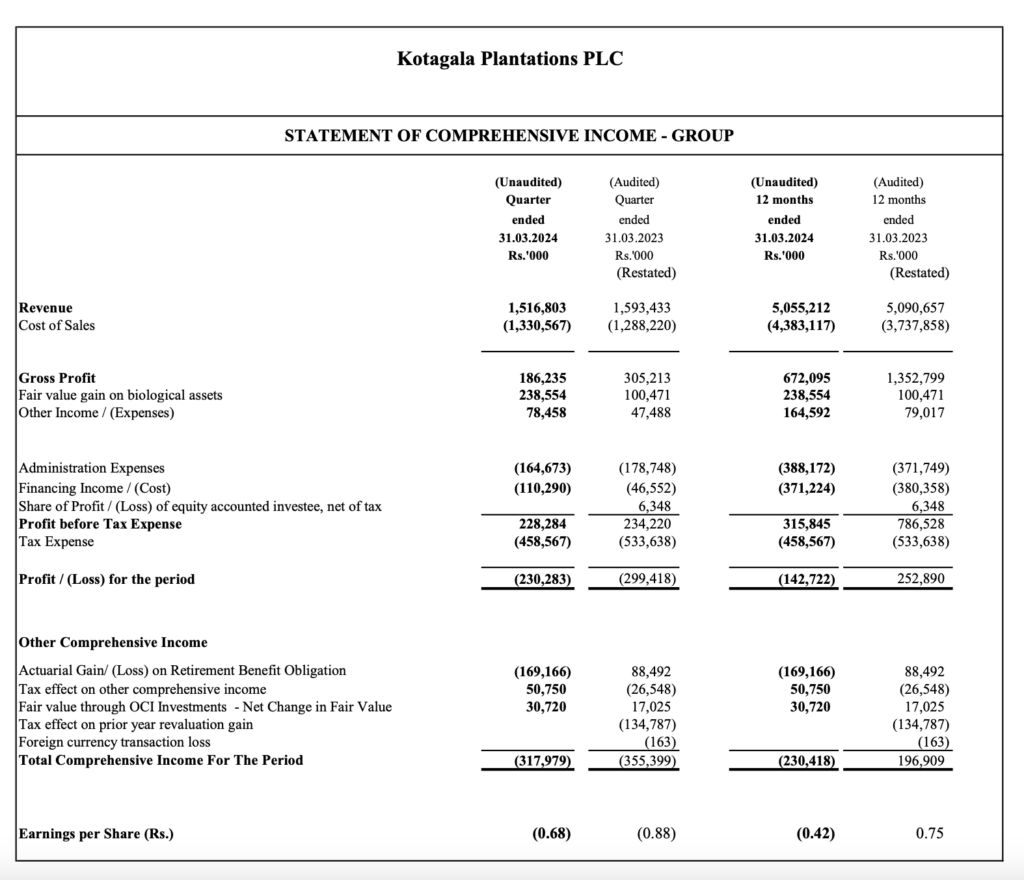

- Revenue for the 12 months ended 31st March 2024 was LKR 5,055,212,000, which shows a slight decrease from LKR 5,090,657,000 in the previous year (Interim_March2024.pdf, Page 2).

- The cost of sales for the same period was LKR 4,383,117,000, which has increased from LKR 3,737,858,000 in the previous year, indicating higher costs incurred (Interim_March2024.pdf, Page 2).

- Gross profit for the year ended 31st March 2024 was therefore lower due to the reduced revenue and increased cost of sales.

- Earnings per share (EPS) for the year ended 31st March 2024 was LKR (0.68), which is a decrease from LKR 0.75 in the previous year, reflecting a decline in profitability (Interim_March2024.pdf, Page 3).

Financial Position:

- The total equity as at 31st March 2024 is not explicitly stated in the provided context, but we can infer from the Statement of Changes in Equity that there have been changes in retained earnings and other reserves which would affect the total equity (Interim_March2024.pdf, Page 6).

- The company’s financial position in terms of asset base and liabilities is not detailed in the provided context, but the Statement of Financial Position as of 27th May 2024 would provide insights into the company’s assets, liabilities, and equity (Interim_March2024.pdf, Page 5).

From the available data, it is evident that Kotagala Plantations PLC faced challenges in maintaining its profitability in the year ended 31st March 2024, with a decrease in revenue and an increase in the cost of sales leading to a lower gross profit and a negative EPS. The financial position in terms of equity has changed, but without the complete Statement of Financial Position, a full assessment cannot be made. It is important to review the full financial statements, including the notes and management’s discussion, to gain a comprehensive understanding of the company’s financial health.