Based on the provided context from Talawakelle Tea Estates PLC’s annual report for the year ended 31st March 2024, the key financial ratios and aspects of the group’s profitability and financial performance are as follows:

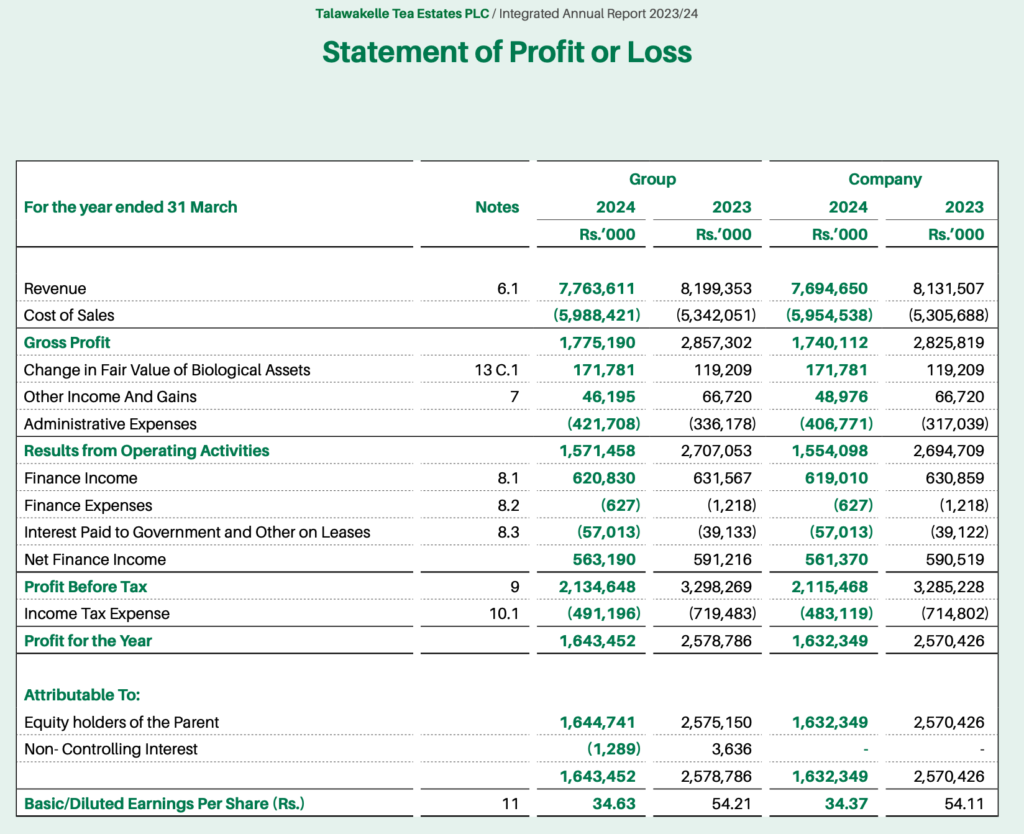

- Revenue: Group turnover reached Rs. 7,763.6 million, which indicates a decline from the previous year’s revenue of Rs. 8,199.3 million.

- Profit After Tax (PAT): The company reported a profit after tax of Rs. 1,645 million, which is a 36% decrease from the previous year’s PAT of Rs. 2,579 million.

- Net Profit Margin: The net profit margin for the year was 21.17%, which is an improvement from the previous year’s margin of 17.29%.

- Gross Profit Margin: The gross profit margin increased to 22.86% from the previous year’s 19.46%.

- Operating Profit Margin: The operating profit margin was reported at 20.24%.

- Profit Before Tax (PBT): Profit before tax reached Rs. 2,136 million, a contraction of 35% year-on-year.

- Return on Equity (ROE): The return on equity stood at 25.8%, compared to 41.80% in the previous year.

- Dividends: Dividends paid totaled Rs. 1,275 million, with a payout ratio of 78%.

- Asset Growth: The company’s assets grew by 8% to reach Rs 9,858 million.

- Cost of Sales: Cost of sales increased by 12%, reflecting industry-wide cost escalations.

- Earnings Per Share (EPS): Basic/Diluted Earnings Per Share for year ended 31st March 2024 was Rs. 34.63 decreased from Rs. 54.21 of the previous year.

These ratios and figures provide a comprehensive view of Talawakelle Tea Estates PLC’s financial performance for the year ended 31st March 2024. The company managed to improve its profitability margins despite a decrease in revenue and an increase in costs, which affected overall profitability. The decline in ROE and the contraction in PBT are notable and may require strategic attention. The company’s investment in digital systems and climate-smart practices, along with positive cash flows from operations, suggest a focus on long-term sustainability and operational efficiency.