Overview

Browns Investments PLC has presented their interim financial report for the year ending 31st March 2024. This report provides a detailed analysis of their financial performance, profitability, and various components affecting their financial health. Below are the key findings from the interim financial statements.

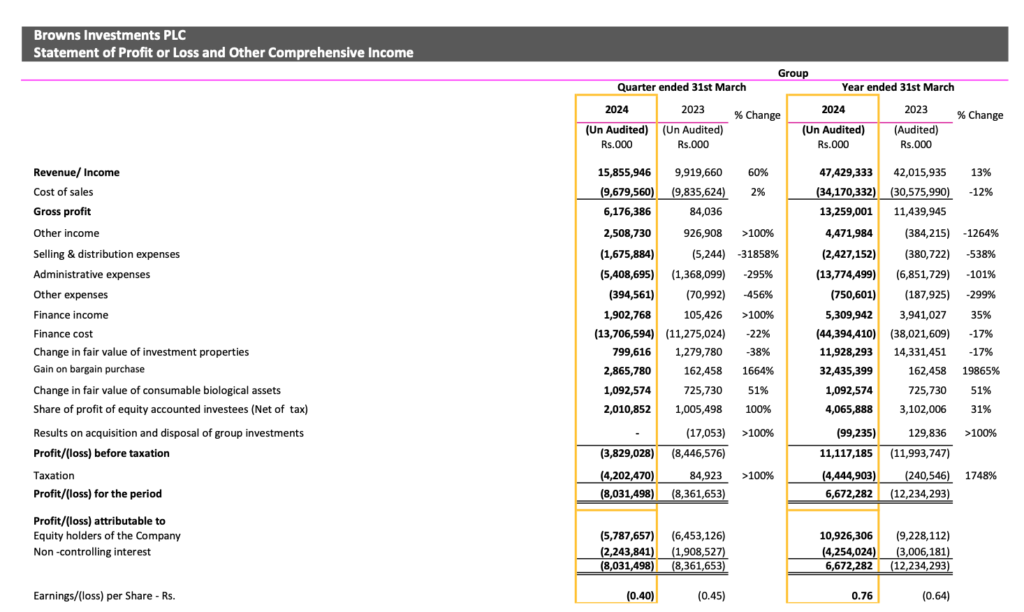

Revenue and Gross Profit

- Revenue/Income: Browns Investments PLC reported a revenue of Rs. 47,429.3 million for the year ended 31st March 2024, an increase of 13% from Rs. 42,015.9 million in the previous year. For the quarter ended 31st March 2024, the revenue was Rs. 15,855.9 million, showing a significant increase of 60% from Rs. 9,919.7 million in the same quarter of 2023

- Gross Profit: The gross profit for the year was Rs. 13,259.0 million, compared to Rs. 11,439.9 million in 2023. This represents a 16% increase year-on-year. For the quarter, the gross profit rose dramatically to Rs. 6,176.4 million from Rs. 84.0 million in the previous year’s quarter.

Expenses

- Cost of Sales: The cost of sales increased by 12% year-on-year to Rs. 34,170.3 million from Rs. 30,576.0 million in 2023. For the quarter, it decreased slightly by 2% to Rs. 9,679.6 million from Rs. 9,835.6 million.

- Administrative Expenses: There was a significant rise in administrative expenses, amounting to Rs. 13,774.5 million in 2024 compared to Rs. 6,851.7 million in 2023, marking a 101% increase. For the quarter, administrative expenses surged to Rs. 5,408.7 million from Rs. 1,368.1 million, a 295% increase.

Other Income and Expenses

- Other Income: Other income increased substantially to Rs. 4,471.9 million in 2024 from a negative Rs. 384.2 million in 2023, showing a significant recovery. For the quarter, other income was Rs. 2,508.7 million compared to Rs. 926.9 million in the previous year.

- Finance Income and Costs: Finance income increased to Rs. 5,309.9 million from Rs. 3,941.0 million in 2023. However, finance costs also rose to Rs. 44,394.4 million from Rs. 38,021.6 million, indicating higher interest expenses and financial obligations.

Profitability

- Profit Before Taxation: The company reported a profit before taxation of Rs. 11,117.2 million for the year ended 31st March 2024, compared to a loss of Rs. 11,993.7 million in 2023. This indicates a significant turnaround in profitability. For the quarter, the company reported a loss before taxation of Rs. 3,829.0 million compared to a loss of Rs. 8,446.6 million in the previous year’s quarter.

- Net Profit: The net profit for the year was Rs. 6,672.3 million, compared to a net loss of Rs. 12,234.3 million in 2023. The quarterly performance showed a reduced net loss of Rs. 8,031.5 million from Rs. 8,361.7 million in the same quarter of 2023.

Financial Position

- Total Assets: The total assets of the company as of 31st March 2024 were Rs. 498,164.9 million, up from Rs. 414,809.4 million in 2023. This represents a 20% increase in asset base.

- Total Equity: Total equity increased to Rs. 183,696.6 million from Rs. 171,910.7 million, reflecting an improvement in shareholder value.

Conclusion

Browns Investments PLC has demonstrated a strong financial performance for the year ending 31st March 2024, showing significant improvements in revenue, gross profit, and overall profitability. Despite an increase in costs and expenses, the company has managed to turn around its financial position from a net loss to a net profit. The company’s asset base and equity have also shown substantial growth, indicating a positive outlook for future financial health and stability.

For more detailed analysis and specific financial data, refer to the full interim financial statements Browns Investments PLC