Overview of Financial Performance

The financial performance of Richard Pieris and Company PLC for the twelve months ended 31 March 2024 indicates several critical issues. The company has experienced significant declines in profitability, efficiency, and overall financial health compared to the previous year, with key metrics highlighting ongoing financial difficulties.

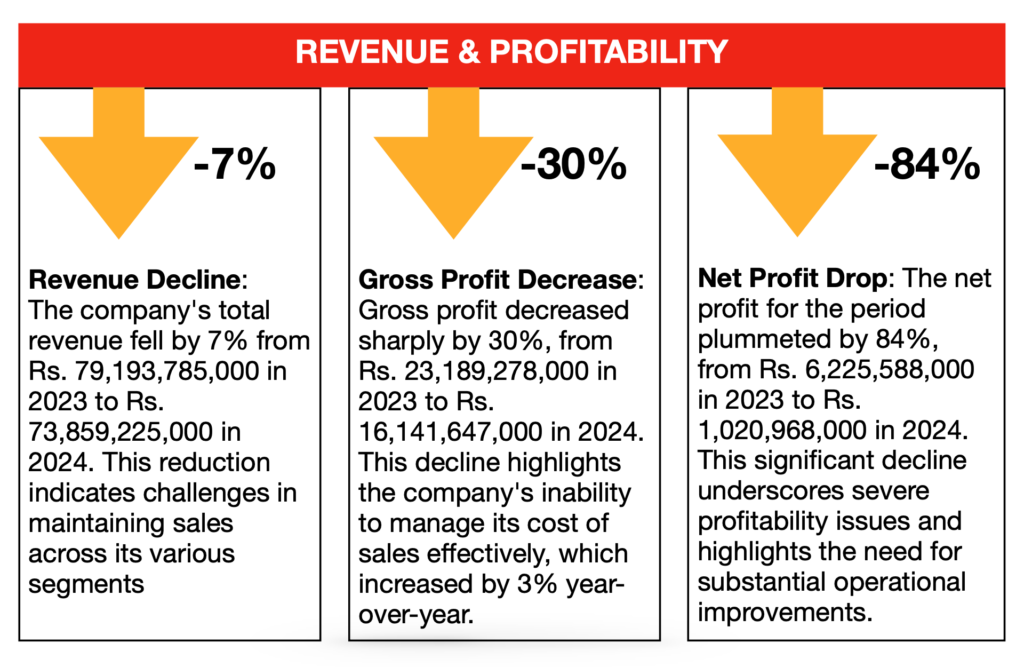

Revenue and Profitability

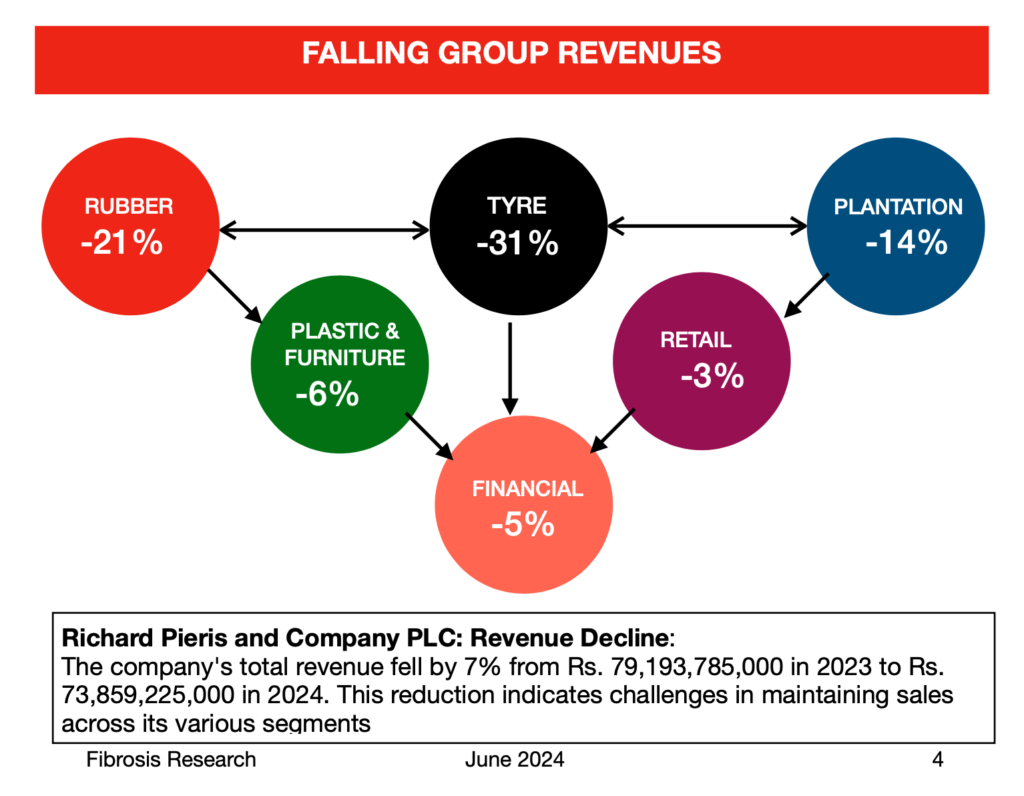

- Revenue Decline: The company’s total revenue fell by 7% from Rs. 79,193,785,000 in 2023 to Rs. 73,859,225,000 in 2024. This reduction indicates challenges in maintaining sales across its various segments.

- Gross Profit Decrease: Gross profit decreased sharply by 30%, from Rs. 23,189,278,000 in 2023 to Rs. 16,141,647,000 in 2024. This decline highlights the company’s inability to manage its cost of sales effectively, which increased by 3% year-over-year.

- Net Profit Drop: The net profit for the period plummeted by 84%, from Rs. 6,225,588,000 in 2023 to Rs. 1,020,968,000 in 2024. This significant decline underscores severe profitability issues and highlights the need for substantial operational improvements.

Cost and Expenses

- Cost of Sales: The cost of sales increased by 3%, reaching Rs. 57,717,578,000 in 2024 compared to Rs. 56,004,507,000 in 2023. This rise in costs amidst declining revenue is a clear sign of inefficiencies and operational challenges.

- Administrative Expenses: Administrative expenses increased by 4%, reaching Rs. 9,274,262,000 in 2024 compared to Rs. 8,894,221,000 in 2023. This rise in administrative costs, despite declining revenues, suggests poor cost control and management inefficiencies.

- Finance Costs: Finance costs decreased by 39%, from Rs. 4,669,624,000 in 2023 to Rs. 2,849,598,000 in 2024. Despite this reduction, finance costs remain a significant burden, reflecting substantial debt levels and interest obligations that strain the company’s financial resources.

RICHARD PIERIS FINANCE

Reports a Net Loss: The net loss for the 6 months period ending 30th September 2023 stood at Rs. 274mn which indicates a serious loss of capital endangering the deposit holders. Gross stage 3 loan ratio exceeded 43% whilst Tier-1 capital adequacy ratio was only 7.8% below the statutory requirement of 8.5%.

ARPICO INSURANCE PLC

Reports a Net Loss: The net loss for the period stood at Rs.,664,063 in 2023, a stark contrast to the profit of LKR 36,236,278 recorded in 2022. This represents a complete reversal from profitability to significant loss.

KEGALLE PLANTATIONS PLC

Net Loss: The net profit for the period turned into a net loss, with a decline of 136%, from Rs. 751,156,000 in 2023 to a loss of Rs. 273,176,000 in 2024. This significant turnaround indicates severe profitability issues.

MASKELIYA PLANTATIONS PLC

Net Profit Drop: Net profit for the period plummeted by 47%, from Rs. 886,550,000 in 2023 to Rs. 468,101,000 in 2024. This significant decline underscores the company’s struggles in maintaining profitability amid rising costs and other financial pressures.

NAMUNUKULA PLANTATIONS PLC

Net Profit Decrease: Net profit for the period fell by 32%, from Rs. 2,813,817,000 in 2023 to Rs. 1,922,833,000 in 2024. This significant decline underscores severe profitability issues and highlights the need for substantial operational improvements.

RICHARD PIERIS EXPORTS PLC

Net Profit Decline: Net profit attributable to equity holders of the parent company dropped drastically by 93%, from Rs. 978,907,000 in 2023 to Rs. 64,050,000 in 2024. This steep decline highlights the severe impact on the bottom line and raises concerns about the company’s overall financial health and ability to generate profits

RICHARD PIERIS AND COMPANY PLC

Net Profit Drop: The net profit for the period plummeted by 84%, from Rs. 6,225,588,000 in 2023 to Rs. 1,020,968,000 in 2024. This significant decline underscores severe profitability issues and highlights the need for substantial operational improvements.

Cash Flow and Liquidity

- Operating Cash Flow: Net cash from operating activities improved slightly, reaching Rs. 4,373,392,000 in 2024 compared to Rs. 3,768,754,000 in 2023. However, this increase is insufficient to counterbalance the overall financial declines and reflects the company’s ongoing liquidity challenges.

- Investing and Financing Activities: Net cash used in investing activities was Rs. 3,703,315,000, highlighting ongoing capital expenditures that are not yielding immediate financial returns. Additionally, net cash flows used in financing activities amounted to Rs. 46,298,000, further stressing the company’s cash reserves Richard Pieris and Company PLC, page 6.

- Cash Equivalents: The company ended the period with a negative cash and cash equivalents balance of Rs. 8,351,475,000, down from Rs. 9,067,851,000 at the beginning of the period. This negative cash position is a significant concern for the company’s short-term financial stability and liquidity.

Equity and Liabilities

- Equity Decline: The total equity increased marginally to Rs. 30,191,272,000 in 2024 from Rs. 29,810,999,000 in 2023. However, the increase is minimal and does not offset the broader financial challenges faced by the company Richard Pieris and Company PLC.

- Current Liabilities: Current liabilities rose to Rs. 48,778,946,000 from Rs. 45,277,835,000 the previous year. The increase in short-term obligations, coupled with declining cash reserves, poses a significant risk to the company’s financial stability and its ability to meet short-term liabilities.

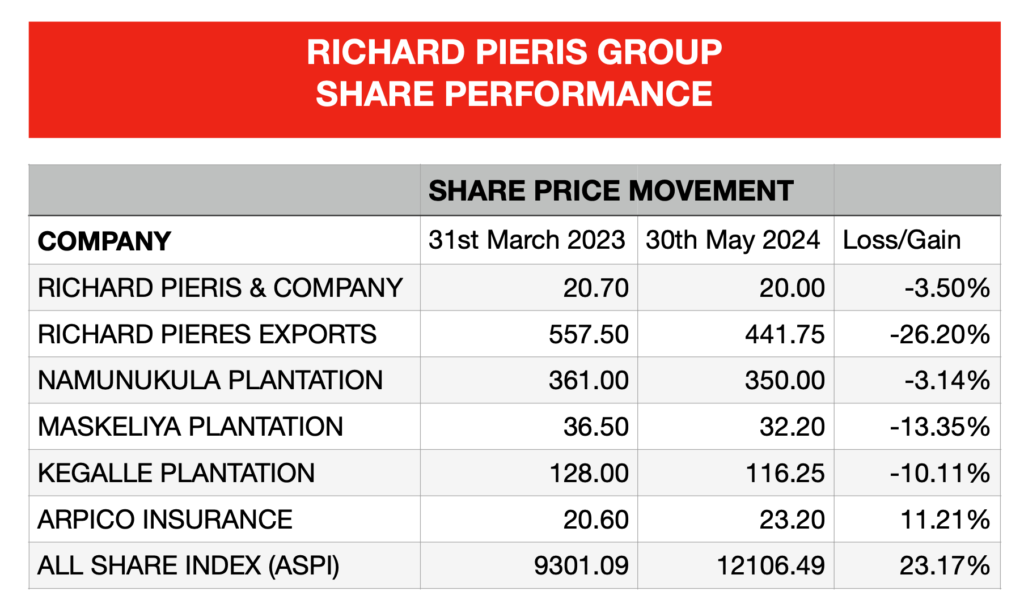

Shareholders Loss

Conclusion

Richard Pieris and Company PLC’s financial performance for the period ended 31 March 2024 presents a concerning picture of declining profitability, rising costs, and weakening liquidity. The company must take urgent steps to improve cost control, enhance operational efficiencies, and strengthen its cash flow management to stabilize its financial position and ensure long-term sustainability.

Download Full Reports: https://easyupload.io/uexmvn