Asia Capital PLC’s financial performance for the year ended 31st March 2024 has been markedly poor, indicating significant challenges in profitability and overall financial health. The company’s income statements, balance sheets, and cash flow statements reflect substantial declines and unfavorable key financial ratios. Net assets continue to remain negative indicating that the company’s liabilities exceed its assets, which is a serious concern for solvency and financial stability.

Profitability

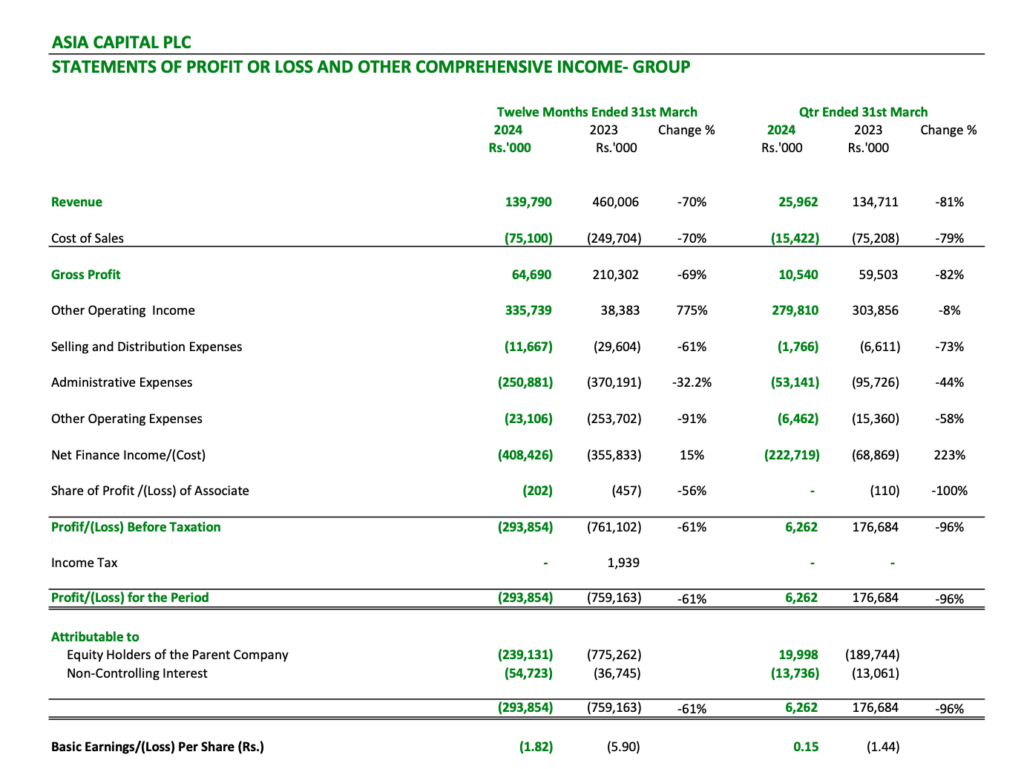

- Revenue Decline: Asia Capital PLC’s revenue dropped dramatically by 70%, from Rs. 460 million in 2023 to Rs. 140 million in 2024. For the quarter ending March 2024, revenue fell by 81% compared to the same period in 2023. This severe decline underscores significant challenges in maintaining sales and market presence.

- Gross Profit: Gross profit decreased by 69%, from Rs. 210 million in 2023 to Rs. 65 million in 2024, indicating poor cost management and reduced sales volume. The quarter ending March 2024 showed an 82% drop in gross profit.

- Operating Loss: The operating loss for the year was Rs. 293 million, a 61% improvement from the previous year’s loss of Rs. 759 million. Despite the reduction, this still represents substantial operational inefficiency and ongoing financial difficulties.

- Net Finance Cost: Net finance costs increased by 15%, from Rs. 356 million in 2023 to Rs. 408 million in 2024, indicating a heavy interest burden that exacerbates the company’s financial instability.

- Net Loss: The net loss for the year was Rs. 293 million, compared to Rs. 759 million in the previous year. Although there is a reduction, the persistent losses highlight ongoing financial struggles.

Cash Flows

- Operating Cash Flow: The net cash used in operating activities was Rs. 90.5 million, reflecting a significant cash outflow compared to the previous year. This indicates that the company is struggling to generate sufficient cash from its core business operations.

- Investing Cash Flow: The net cash used in investing activities was Rs. 111.5 million, compared to Rs. 133.3 million generated in the previous year. This significant outflow is due to poor investment returns and possibly unprofitable capital expenditures.

- Financing Cash Flow: The net cash used in financing activities was Rs. 135.1 million, indicating the company faced challenges in raising funds and possibly repaid debt without sufficient inflows.

- Overall Cash Position: The overall cash and cash equivalents position deteriorated, with a net decrease of Rs. 114.1 million, worsening from the previous year’s Rs. 86.3 million decrease.

Asset and Liability Position

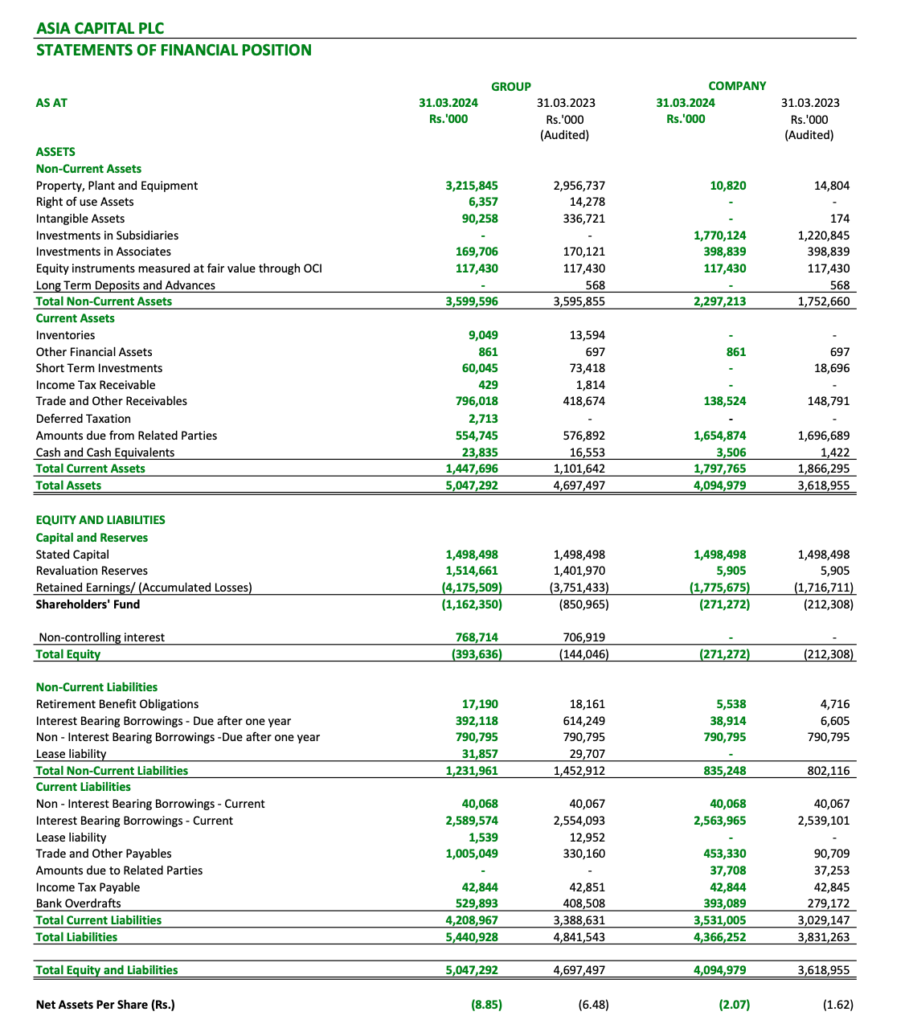

- Total Assets: Total assets increased slightly from Rs. 4,697 million in 2023 to Rs. 5,047 million in 2024. However, this is overshadowed by the massive liabilities the company faces.

- Total Liabilities: Total liabilities rose significantly from Rs. 4,841 million in 2023 to Rs. 5,441 million in 2024, indicating worsening financial leverage and potential solvency issues.

- Net Assets: The net assets are negative at Rs. 394 million, indicating that the company’s liabilities exceed its assets, which is a serious concern for solvency and financial stability.

Key Financial Ratios

- Current Ratio: The current ratio remains unfavorable, highlighting potential liquidity issues and the company’s inability to cover short-term obligations effectively.

- Debt to Equity Ratio: With total liabilities exceeding total assets, the debt to equity ratio is highly negative, indicating extreme financial leverage and potential insolvency.

- Basic Earnings Per Share (EPS): EPS deteriorated significantly from a loss of Rs. 5.90 per share in 2023 to a loss of Rs. 1.82 per share in 2024, reflecting reduced earnings attributable to shareholders.

Asia Capital PLC’s financial performance for the year ended 31st March 2024 is alarming. The substantial revenue declines, continued losses, negative cash flows, and unfavorable financial ratios indicate severe operational inefficiencies and financial distress. Immediate and strategic actions are needed to address these issues and improve the company’s financial health and stability.

Segmental Review

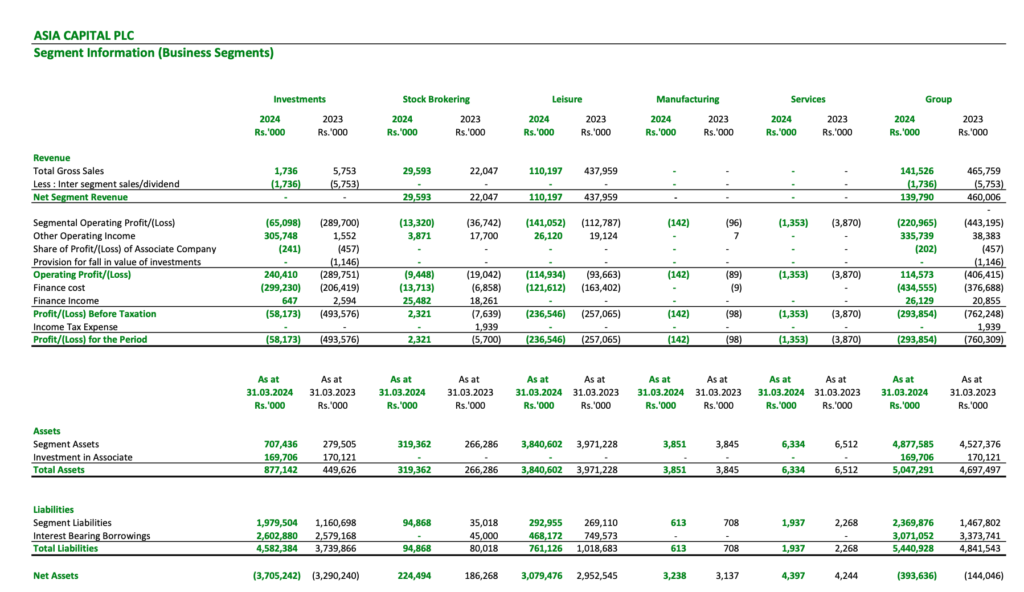

Asia Capital PLC operates across multiple business segments including Stock Brokering, Leisure, Manufacturing, Services, and Investments. The financial performance of these segments for the year ended 31st March 2024 reveals significant disparities, with most segments experiencing downturns.

Segmental Revenue

- Stock Brokering: Revenue decreased by 70%, from Rs. 460 million in 2023 to Rs. 140 million in 2024. This segment failed to maintain its market presence and sales volume.

- Leisure: The leisure segment reported a revenue of Rs. 30 million, compared to Rs. 22 million in the previous year, showing a marginal increase. However, this improvement is overshadowed by the overall poor performance of the company.

- Manufacturing: Revenue in this segment saw a significant decline from Rs. 438 million in 2023 to Rs. 110 million in 2024. This 75% drop indicates substantial operational challenges and reduced market demand.

- Services: The services segment did not generate any revenue in 2024, remaining at zero like the previous year. This indicates stagnation and a lack of growth opportunities within this segment.

- Investments: Revenue from investments was negligible, contributing minimally to the overall revenue.

Segmental Operating Profit/Loss

- Stock Brokering: The segment reported a loss of Rs. 65 million, a significant improvement from the previous year’s loss of Rs. 290 million, but still indicative of ongoing challenges in profitability.

- Leisure: This segment reported a loss of Rs. 13 million, compared to Rs. 37 million in the previous year. The reduction in losses reflects some cost management efforts, but the segment remains unprofitable.

- Manufacturing: The manufacturing segment’s operating loss widened to Rs. 141 million from Rs. 113 million, showing increased difficulties in managing production costs and market demand.

- Services: The services segment reported an operating loss of Rs. 1 million, slightly improved from a loss of Rs. 4 million in the previous year. This minor improvement does little to alleviate the segment’s unprofitable status.

- Investments: The segment reported a loss of Rs. 237 million, slightly better than the previous year’s loss of Rs. 257 million. Despite the minor improvement, the segment continues to struggle significantly.

Segmental Assets and Liabilities

- Total Segment Assets: The total assets across segments increased slightly to Rs. 5,047 million from Rs. 4,697 million in 2023. However, this marginal increase in assets does not compensate for the overall poor financial health of the segments.

- Total Segment Liabilities: Total liabilities rose significantly to Rs. 5,441 million from Rs. 4,842 million in 2023, highlighting increased financial obligations and potential solvency issues.

- Net Assets: The net assets position is negative at Rs. 394 million, further emphasizing the financial distress and asset-liability mismatch across segments.

The segmental performance of Asia Capital PLC for the year ended 31st March 2024 reflects significant financial and operational challenges across all business segments. While some segments showed minor improvements, the overall performance is marked by substantial revenue declines, persistent losses, and an alarming increase in liabilities. Immediate strategic interventions are essential to address these issues and steer the company towards financial stability and profitability.