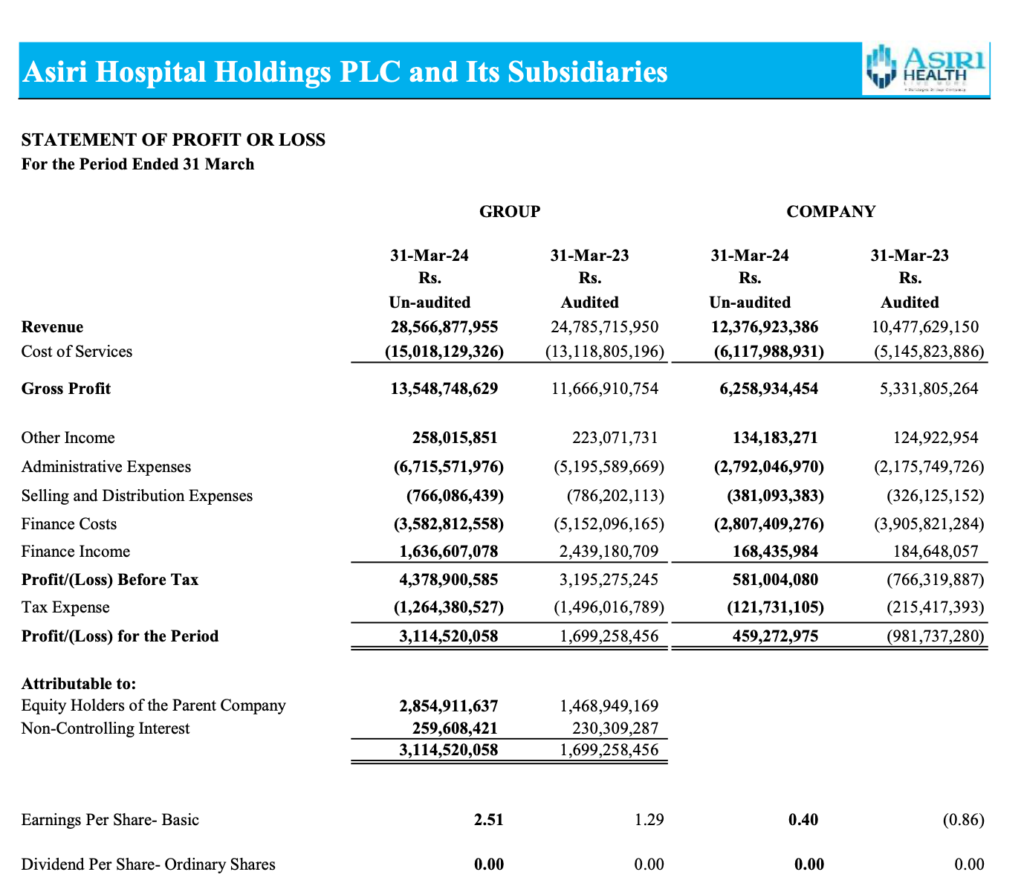

Asiri Hospital Holdings PLC demonstrated strong financial performance for the year ended 31st March 2024, with notable improvements in revenue, gross profit, and net profit. The company’s strategic initiatives and operational efficiencies contributed to its financial success. However, rising administrative expenses and reduced finance income highlight areas requiring strategic focus.

Financial Performance Highlights

Key Financial Metrics:

- Revenue: Rs. 28,566,877,955 (15.23% increase from 2023)

- Cost of Services: Rs. 15,018,129,326 (14.47% increase from 2023)

- Gross Profit: Rs. 13,548,748,629 (16.14% increase from 2023)

- Profit Before Tax: Rs. 4,378,900,585 (37.01% increase from 2023)

- Net Profit for the Period: Rs. 3,114,520,058 (83.31% increase from 2023)

- Earnings Per Share (EPS): Rs. 2.51 (94.57% increase from 2023)

Detailed Financial Analysis

- Revenue and Cost Analysis:

- Revenue: The company achieved a 15.23% increase in revenue, growing from Rs. 24,785,715,950 in 2023 to Rs. 28,566,877,955 in 2024. This increase reflects successful business strategies, including possibly higher patient volumes, service expansions, or price adjustments.

- Cost of Services: The cost of services rose by 14.47% to Rs. 15,018,129,326 from Rs. 13,118,805,196 in the previous year. This increase is in line with revenue growth, indicating stable cost management in operational activities.

- Profitability Analysis:

- Gross Profit: The gross profit improved by 16.14%, reaching Rs. 13,548,748,629 compared to Rs. 11,666,910,754 in 2023. This indicates effective cost control relative to revenue growth.

- Administrative Expenses: There was a 29.27% increase in administrative expenses, rising to Rs. 6,715,571,976 from Rs. 5,195,589,669. This significant rise suggests inefficiencies or increased spending in administrative operations, which need to be addressed to maintain profitability.

- Selling and Distribution Expenses: A slight decrease of 2.56% in selling and distribution expenses, down to Rs. 766,086,439 from Rs. 786,202,113, indicates effective management in these areas.

- Financial Costs and Income:

- Finance Costs: Finance costs decreased significantly by 30.46%, dropping to Rs. 3,582,812,558 from Rs. 5,152,096,165. This reduction indicates improved debt management and possibly refinancing at lower interest rates.

- Finance Income: There was a 32.92% decrease in finance income, falling to Rs. 1,636,607,078 from Rs. 2,439,180,709. This decrease suggests less effective investment strategies or lower returns on investments.

- Taxation and Net Profit:

- Tax Expense: Tax expenses decreased by 15.48% to Rs. 1,264,380,527 from Rs. 1,496,016,789, positively impacting net profitability.

- Net Profit: The net profit for the period increased by 83.31%, reaching Rs. 3,114,520,058 compared to Rs. 1,699,258,456 in 2023. This substantial increase is driven by revenue growth, reduced finance costs, and lower tax expenses.

- Earnings Per Share (EPS): EPS almost doubled, rising to Rs. 2.51 from Rs. 1.29, reflecting improved profitability and value for shareholders.

Analysis of Assets and Liabilities

Assets:

- Non-current Assets: Total non-current assets for the group were Rs. 38,554 million, a slight decrease from Rs. 40,758 million in the previous year. This includes property, plant, and equipment worth Rs. 32,558 million and right-of-use assets of Rs. 1,145 million. The company also held goodwill of Rs. 610 million.

- Current Assets: Total current assets increased to Rs. 12,360 million from Rs. 9,527 million, driven by an increase in loans granted to related parties, which rose to Rs. 7,478 million from Rs. 5,456 million, and trade and other receivables, which increased to Rs. 1,061 million from Rs. 802 million.

- Total Assets: The total assets stood at Rs. 50,915 million, marginally higher than the previous year’s Rs. 50,285 million.

Liabilities:

- Non-current Liabilities: These amounted to Rs. 9,559 million, a minor decrease from Rs. 9,871 million. Major components included interest-bearing loans and borrowings (Rs. 3,982 million) and deferred tax liabilities (Rs. 4,792 million).

- Current Liabilities: These decreased to Rs. 19,024 million from Rs. 21,238 million. The decline was largely due to a reduction in interest-bearing loans and borrowings, which fell to Rs. 10,165 million from Rs. 12,809 million, and trade and other payables.

- Total Liabilities: The total liabilities decreased to Rs. 28,583 million from Rs. 31,110 million.

Equity:

- Total Equity: The equity attributable to equity holders of the parent company increased to Rs. 20,597 million from Rs. 17,717 million, while non-controlling interests increased to Rs. 1,735 million from Rs. 1,458 million, bringing the total equity to Rs. 22,332 million.

- Retained Earnings: Retained earnings saw a substantial increase to Rs. 7,344 million from Rs. 4,601 million, reflecting the profit generated during the period.

- Net Assets Per Share: The net assets per share increased to Rs. 18.11 from Rs. 15.58 in the previous year.

SWOT Analysis

Strengths:

- Revenue Growth: The company experienced strong revenue growth, reflecting effective market positioning and operational strategies.

- Profitability: Significant improvements in gross and net profit highlight robust financial health and operational efficiency.

Weaknesses:

- Administrative Expenses: The rapid increase in administrative expenses could undermine profitability if not managed effectively.

- Finance Income: The decline in finance income suggests a need to revisit and optimize investment strategies.

Opportunities:

- Operational Efficiency: Further improvements in operational efficiency could enhance profitability and cost-effectiveness.

- Market Expansion: Expanding services or entering new markets could drive future revenue growth and diversify income streams.

Threats:

- Cost Inflation: Rising operational and administrative costs could pressure profit margins and overall financial performance.

- Economic Conditions: Adverse economic conditions may impact patient volumes and payment capabilities, potentially affecting revenue.

Conclusion

Asiri Hospital Holdings PLC has demonstrated strong financial performance for the year ended 31st March 2024, marked by significant revenue growth and improved profitability. However, rising administrative expenses and reduced finance income are areas of concern that need to be addressed. By implementing effective cost management strategies, optimizing investments, and maintaining clear communication with shareholders, the company can further strengthen its financial position and ensure sustainable growth and profitability.