Introduction

This analytical report delves into the profitability, financial performance, and key financial ratios of First Capital Holdings PLC for the year ended 31st March 2024. The insights are derived from the interim financial statements provided by the company.

Profitability Analysis

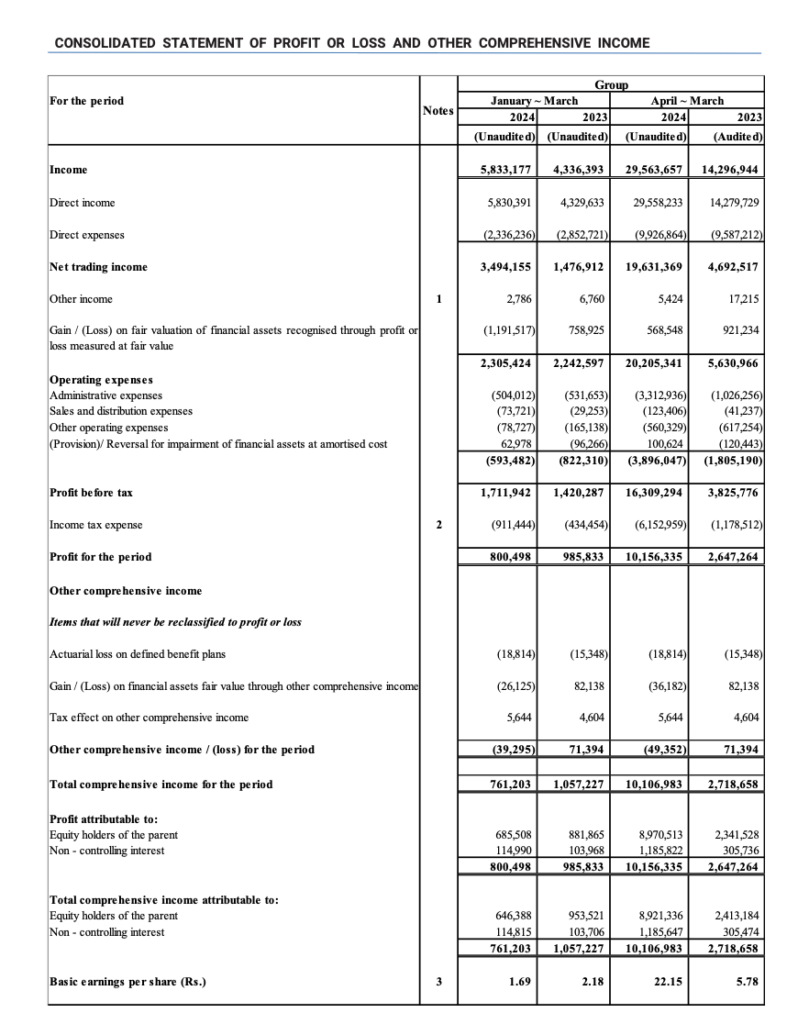

Net Profit First Capital Holdings PLC recorded a significant surge in net profit, reaching LKR 10,156 million, up from LKR 2,647 million in the prior year. This represents a remarkable increase of approximately 284%. The dramatic rise in net profit can be attributed to enhanced revenue generation and efficient cost management practices. This level of profitability showcases the company’s strong market position and successful execution of its strategic initiatives.

Operating Profit The operating profit for the year was LKR 16,038 million, marking a substantial increase from LKR 3,753 million in the previous year. This growth of approximately 327% in operating profit indicates that the core operations of the company have been highly profitable. The robust increase suggests that First Capital Holdings PLC has effectively capitalized on market opportunities while maintaining control over operating costs.

Financial Performance Analysis

Revenue Growth The company’s total revenue exhibited significant growth, underscoring its strong performance across different business segments. Revenue rose to LKR 29,563 million from LKR 14,296 million in the previous year. The primary dealer operations in government securities, corporate finance advisory services, asset management, and stock brokering have all contributed to this revenue surge. The increased revenue reflects both volume growth and potential improvements in market conditions.

Expense Management Operating expenses rose to LKR 3,997 million from LKR 1,685 million in the previous year. Despite this increase, the proportional growth in operating profit and net profit suggests that the company has managed its expenses well relative to its revenue growth. The ability to scale operations efficiently is evident from the widening gap between revenue and expenses.

Total Comprehensive Income The total comprehensive income, which includes net profit and other comprehensive income, reached LKR 10,107 million, up from LKR 2,719 million in the previous year. This significant rise highlights not only operational success but also positive outcomes from other comprehensive income components, potentially including gains from investments or revaluation gains.

Net Asset Position

The net asset position of First Capital Holdings PLC (the Company) indicates the strength of its balance sheet and reflects its ability to cover its liabilities with its assets. As of 31st March 2024, the Company’s net asset position demonstrates a healthy financial status, showing an increase from the previous year.

Net Asset Value

The net assets of the Company and the Group, as of 31st March 2024, are detailed as follows:

- Net Assets per Share: The net assets per share have increased from LKR 15.05 in 2023 to LKR 17.58 in 2024 .

- Total Equity: The total equity of the Group increased from LKR 6,680.833 million in 2023 to LKR 7,940.479 million in 2024 .

Key Components of Net Assets

The net asset value is primarily derived from the following components:

- Stated Capital: The stated capital remained constant at LKR 227.5 million.

- Risk Reserve: Increased significantly from LKR 1,497.150 million in 2023 to LKR 2,492.889 million in 2024.

- Retained Earnings: Retained earnings slightly decreased from LKR 4,586.330 million to LKR 4,436.368 million, indicating a distribution or utilization of profits during the year.

- Fair Valuation Reserve: This reserve, reflecting adjustments for changes in the fair value of financial assets, improved from a negative balance of LKR 215.818 million to a negative LKR 37.759 million.

- Non-Controlling Interest: Increased from LKR 585.671 million to LKR 821.481 million, indicating growth in the equity attributed to minority shareholders .

Financial Performance Impact

The increase in net assets per share and total equity indicates a positive financial performance. Key contributing factors include:

- Profitability: The significant rise in the risk reserve and the relatively stable retained earnings suggest robust profitability, allowing the Company to reinforce its reserves.

- Fair Value Adjustments: The reduction in the negative balance of the fair valuation reserve indicates favorable market conditions or improved financial asset valuations.

The net asset position of First Capital Holdings PLC for the year ended 31st March 2024 shows a marked improvement, reflecting the Company’s strong financial health and ability to generate value for its shareholders. The increase in both net assets per share and total equity is indicative of sound management and profitable operations.

This analysis underscores the Company’s stability and growth potential, positioning it well to leverage future opportunities and sustain its financial performance.

Key Financial Ratios Analysis

Debt to Equity Ratio The debt to equity ratio decreased from 8.61 to 7.74 times. This reduction indicates a strengthening of the company’s equity base relative to its debt. A lower debt to equity ratio is favorable as it suggests lower financial risk and a more sustainable capital structure.

Quick Asset Ratio The quick asset ratio improved slightly from 1.17 to 1.28 times. This ratio measures the company’s ability to cover its short-term liabilities with its most liquid assets. The increase indicates better liquidity management, enhancing the company’s capability to meet its immediate financial obligations without relying on inventory sales.

Interest Cover Ratio The interest cover ratio rose from 1.40 to 2.66 times, reflecting a significant improvement in the company’s ability to meet its interest expenses from its earnings before interest and taxes (EBIT). This indicates enhanced financial health and a reduced risk of insolvency.

Market Price per Share The highest market price per share during the quarter ended 31st March 2024 was LKR 34.90, with the lowest at LKR 25.50. The closing price was LKR 34.40. These figures suggest positive market sentiment and investor confidence in the company’s future prospects. The substantial increase in share price throughout the quarter highlights the market’s recognition of the company’s strong financial performance.

Conclusion

First Capital Holdings PLC has demonstrated exceptional profitability and robust financial performance for the year ended 31st March 2024. The significant increases in net profit, operating profit, and total comprehensive income underscore the company’s strong operational efficiency and strategic success. Improved key financial ratios, including the debt to equity ratio, quick asset ratio, and interest cover ratio, reflect sound financial management and a stable capital structure. The positive trend in market price per share further indicates strong investor confidence and market recognition of the company’s financial health.