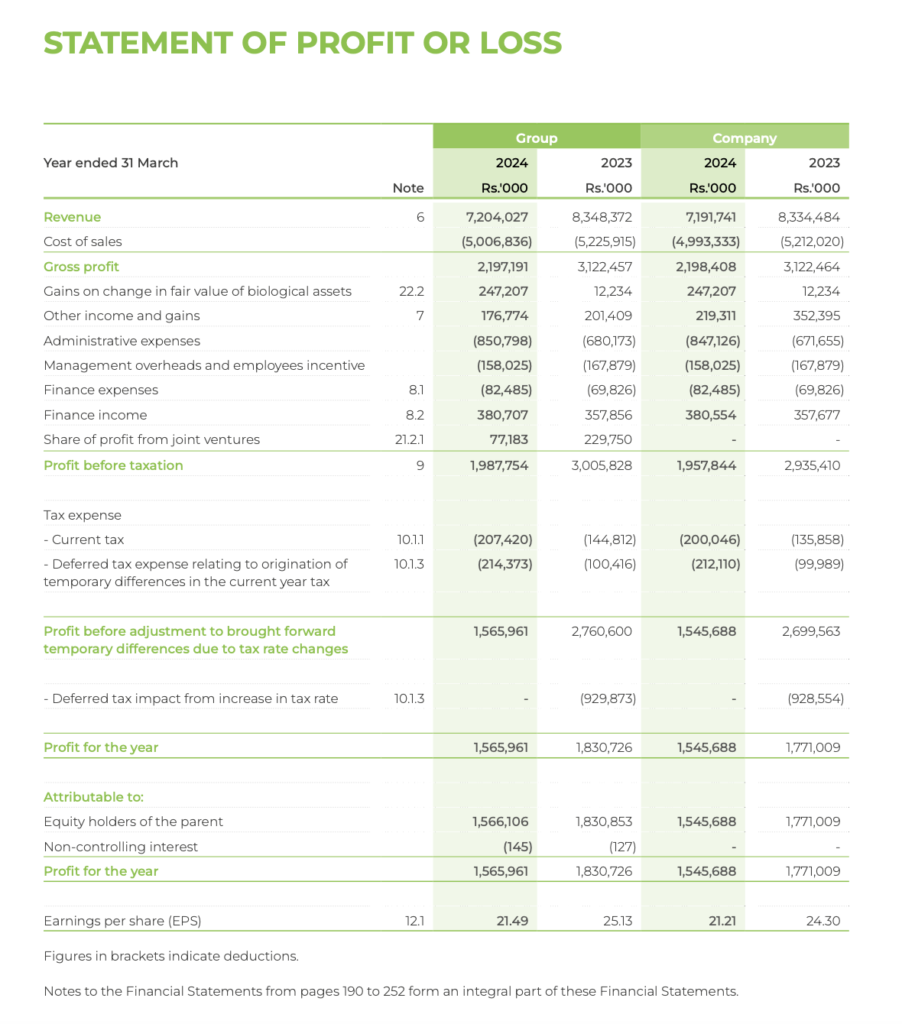

For the fiscal year ending 31st March 2024, Elpitiya Plantations PLC reported a total revenue of Rs. 7,204 million, a decrease from the previous year’s Rs. 8,348 million. This decline was attributed to adverse exchange rate fluctuations affecting commodity prices for tea, rubber, and oil palm. The gross profit also saw a reduction from Rs. 3,122 million to Rs. 2,197 million.

Profitability

Despite the challenging economic environment, Elpitiya Plantations maintained a profit before tax of Rs. 1,988 million, down from Rs. 3,006 million the previous year. The net profit for the year was Rs. 1,566 million, a decrease from Rs. 1,831 million in 2023. This reduction was primarily due to increased administration expenses and finance costs, despite a 4% year-on-year reduction in the cost of sales.

Key profitability ratios for the year were:

- Gross Profit Margin: 30% (down from 37% in 2023)

- Operating Profit Margin: 19% (down from 30% in 2023)

- Net Profit Margin: 22% (unchanged from 2023)

- Return on Equity: 18% (down from 21% in 2023)

- Return on Assets: 13% (down from 15% in 2023)

- Return on Capital Employed (ROCE): 18% (down from 21% in 2023).

Cash Flows

Cash and cash equivalents at the end of the year stood at Rs. 104 million, a significant decrease from Rs. 386 million in the previous year. This decline in cash reserves reflects the company’s increased operational and capital expenditures during the year.

Net Asset Position

The total assets of Elpitiya Plantations PLC were valued at Rs. 12,446 million, slightly up from Rs. 12,017 million in the previous year. Shareholders’ funds remained relatively stable at Rs. 8,539 million compared to Rs. 8,517 million in 2023, indicating a steady net asset position despite the financial challenges faced during the year.

Key Ratios

- Debt to Equity Ratio: 0.01 times, showing a strong equity base with minimal reliance on debt (unchanged from the previous year).

- Equity to Assets Ratio: 0.69 times, slightly down from 0.71 times, indicating a robust equity base relative to total assets.

- Interest Cover: 25 times, reduced from 44 times in 2023, reflecting decreased profitability but still indicating strong coverage of interest obligations.

- Current Ratio: 5 times, unchanged, indicating strong liquidity and the ability to meet short-term liabilities.

Market Performance and Shareholder Returns

The earnings per share (EPS) for the year were Rs. 21, down from Rs. 25. The dividend per share (DPS) was Rs. 5, significantly reduced from Rs. 19 the previous year. The closing market value per share as of 31st March 2024 was Rs. 105, up from Rs. 77, reflecting improved investor confidence. The dividend payout ratio was 23%, with a dividend yield of 5%, both reflecting a conservative approach to dividend distribution in light of the reduced profitability.

Conclusion

Elpitiya Plantations PLC navigated a challenging economic environment in the fiscal year 2023/24, with significant impacts from exchange rate fluctuations and increased costs. Despite a decrease in revenue and profitability, the company maintained a strong net asset position and liquidity, underscoring its financial resilience. The strategic focus on diversification and prudent financial management positions the company for sustainable growth in the future.