The fiscal year ending 31st March 2024 was a challenging period for Kapruka Holdings PLC. The company’s financial performance was marked by significant setbacks, including declining revenues, increased expenses, and substantial losses, indicating underlying issues in strategic planning and operational efficiency.

Decline in Revenue and Profitability

Kapruka Holdings PLC reported alarming financial outcomes:

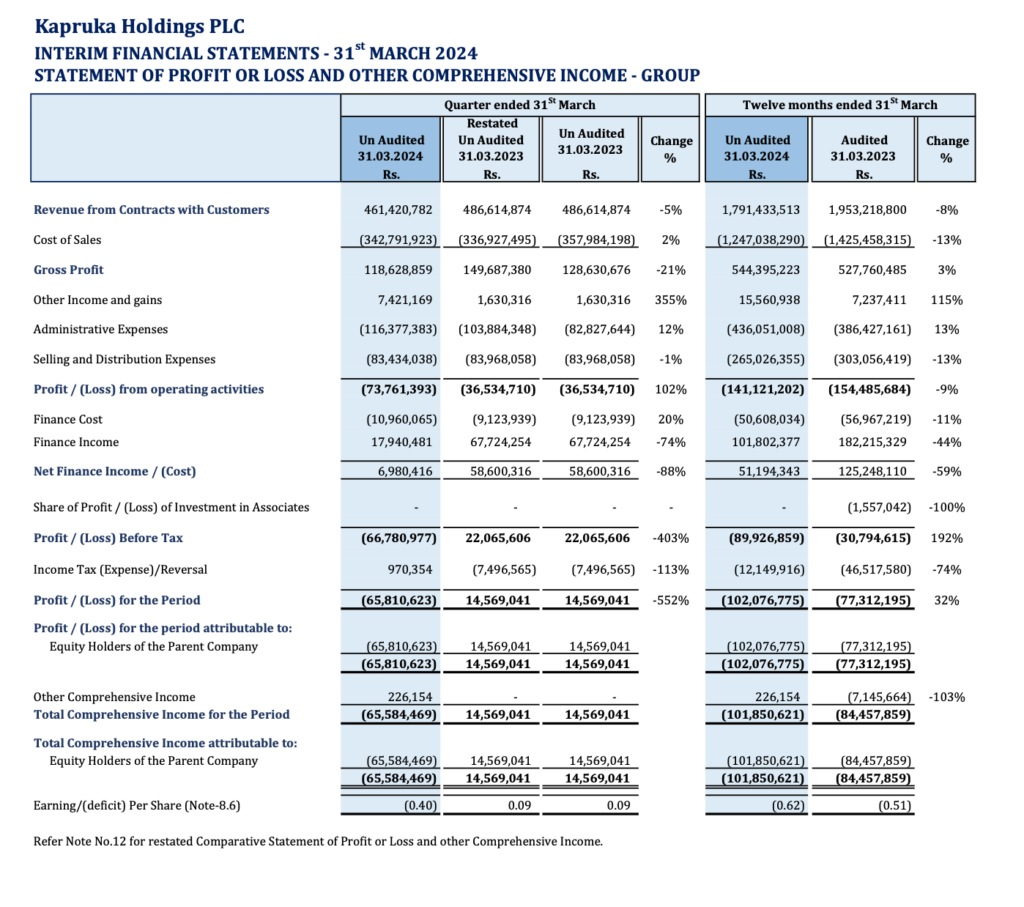

- Group Revenue: Decreased to LKR 1.79 billion for the year, a drop from the previous year’s LKR 1.95 billion, indicating an 8% decline.

- Group Loss Before Tax: A substantial loss of LKR 89.9 million for the year, with LKR 66.7 million lost in the last quarter alone.

- Company Revenue: Dropped to LKR 203 million for the year, with LKR 50.8 million in the last quarter.

- Company Profit Before Tax: A mere LKR 34 million for the year, showing a significant decrease from prior profits.

The decline in revenue and profitability reflects poorly on the company’s ability to sustain its market position and adapt to economic challenges. This downturn is exacerbated by a decrease in local sales, attributed to the contracting Sri Lankan economy and increased VAT.

Escalating Expenses

- Cost of Sales: Despite a 13% decrease, it remains high at LKR 1.25 billion, indicating inefficiencies in managing production costs.

- Administrative Expenses: Increased by 13% to LKR 436 million, highlighting rising overheads that are not being controlled effectively.

- Selling and Distribution Expenses: Although reduced by 13%, these expenses still stand at LKR 265 million, suggesting that the cost reductions are insufficient to offset declining revenues.

The significant rise in administrative expenses points to poor cost management and an inability to streamline operations effectively.

Poor Financial Management

- Finance Cost: LKR 50.6 million, representing a high cost of borrowing despite an 11% decrease from the previous year.

- Net Finance Income: Plummeted by 59% to LKR 51.2 million, reflecting poor financial management and investment returns.

The drastic reduction in net finance income indicates inefficient use of financial resources and investments, contributing to the overall financial instability of the company.

Segmental Underperformance

Each segment within Kapruka Holdings PLC contributed to the financial decline:

- E-Commerce: Despite generating LKR 1.72 billion, it incurred significant expenses, leading to a segmental loss.

- USA LLC (Cross Border): Only generated LKR 60.9 million, insufficient to cover its operational costs.

- Kapruka Production: Produced LKR 178.9 million but still contributed to the overall loss.

- Tech-Root (Web Services): Generated a mere LKR 23.4 million, insufficient to make a substantial impact on the company’s overall financial health.

The underperformance across all segments highlights a fundamental issue in the company’s strategic direction and market positioning.

Asset and Equity Concerns

- Total Assets: LKR 1.74 billion as of 31st March 2024, only a slight increase from LKR 1.64 billion, reflecting stagnation rather than growth.

- Total Equity: LKR 1.22 billion, a marginal increase from LKR 1.20 billion, indicating a lack of substantial improvement in shareholder value.

The minimal growth in assets and equity points to a lack of effective asset management and an inability to generate significant returns for shareholders.

Negative Cash Flow

- Net Cash Flow from Operating Activities: Despite being positive at LKR 5.99 million, it is significantly lower than expected for a company of this size.

- Net Cash Flow from Investing Activities: A negative LKR 49.4 million, due to continued investments that are not yielding returns.

- Net Cash Flow from Financing Activities: While positive at LKR 55.6 million, it primarily reflects increased borrowing rather than genuine financial health.

The negative cash flow from investing activities and the reliance on borrowing for positive cash flow indicate financial instability and a lack of sustainable income streams.

Conclusion

The financial performance of Kapruka Holdings PLC for the year ended 31st March 2024 raises serious concerns about its operational efficiency, cost management, and strategic direction. The significant decline in revenue, increased expenses, and overall financial losses point to deeper systemic issues that need to be addressed to ensure the company’s long-term viability and shareholder value.

For detailed review of the financial statements and additional information, please refer to the complete interim financial report of Kapruka Holdings PLC for the year ended 31st March 2024