The fiscal year ending 31st March 2024 was a period of significant challenges for United Motors PLC. The company’s financial performance reflects a mix of strategic successes and difficulties, particularly influenced by the prolonged import restrictions and the overall economic environment in Sri Lanka.

Revenue and Profitability

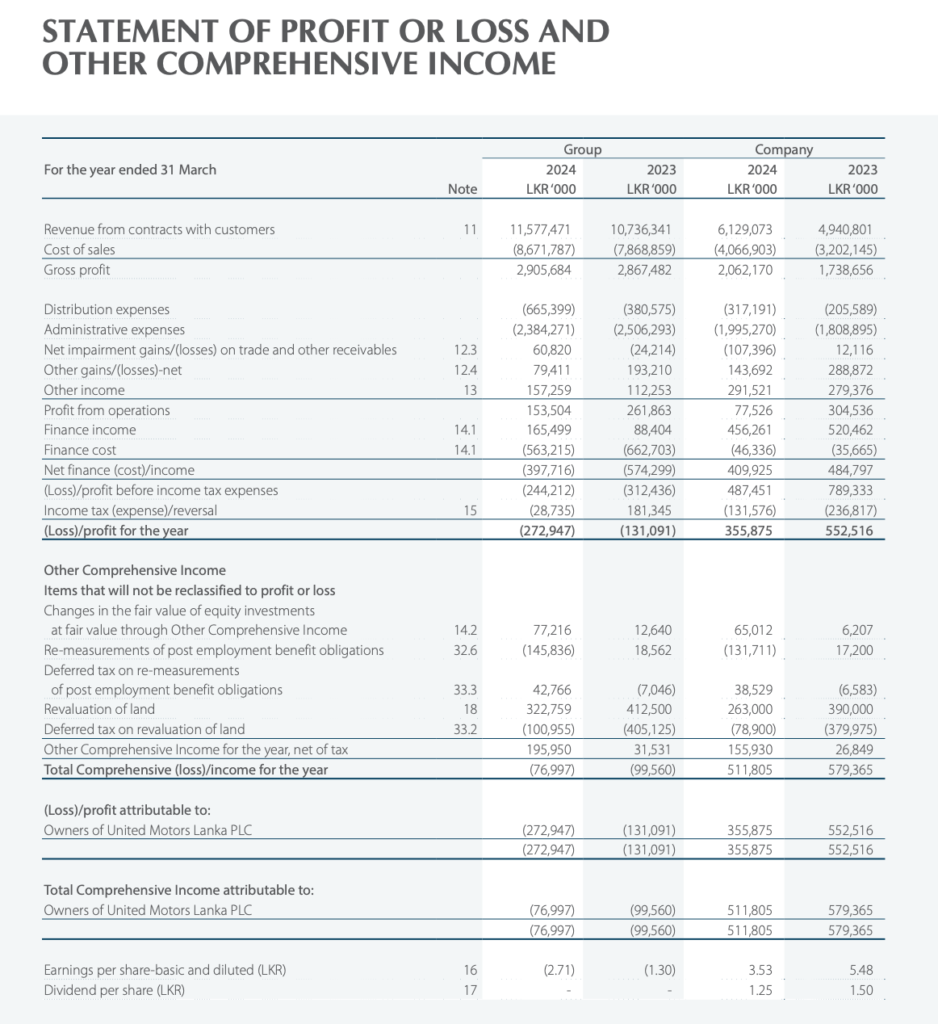

United Motors PLC reported the following financial outcomes:

- Group Turnover: LKR 11.58 billion, up by 7.83% from the previous year’s LKR 10.74 billion.

- Group Loss Before Tax: LKR 244.2 million, an improvement from the previous year’s loss of LKR 312.4 million.

- Company Turnover: LKR 6.13 billion, up by 24.05% from the previous year’s LKR 4.94 billion.

- Company Profit Before Tax: LKR 487.5 million, down by 38.25% from the previous year’s LKR 789.3 million.

Despite the increase in turnover, profitability remains a challenge, with significant losses reported at the group level. The decline in company-level profit before tax highlights the impact of operational challenges and increased costs.

Segmental Performance

The performance of United Motors PLC’s various segments shows a mixed picture:

- Vehicles: The vehicle segment continued to struggle due to the prolonged import ban, resulting in a reduced market share and lower sales volumes.

- Lubricants: The lubricants division reported stable revenue but faced stiff competition, impacting profitability.

- Heavy Equipment: Sales in this segment were severely affected by the economic downturn and reduced demand in the construction industry.

- Spare Parts: The spare parts division reported a marginal increase in turnover, reflecting steady demand.

Financial Position

The company’s financial position highlights both strengths and areas of concern:

- Investment in PPE and Intangible Assets: Group investment increased by 167.83% to LKR 120.5 million, indicating strategic investments for future growth.

- Current Assets: Group current assets increased by 3.31% to LKR 9.45 billion, while company current assets decreased by 7.48% to LKR 6.11 billion.

- Current Liabilities: Group current liabilities increased by 30.90% to LKR 5.65 billion, reflecting higher short-term obligations.

- Shareholders’ Funds: Group shareholders’ funds decreased by 1.49% to LKR 13.43 billion, while company shareholders’ funds increased by 2.71% to LKR 14.63 billion.

Cash Flow

- Net Cash Flow from Operating Activities: Positive at LKR 601.3 million, reflecting improved operational cash generation.

- Net Cash Flow from Investing Activities: Negative at LKR 154.5 million, due to continued investments.

- Net Cash Flow from Financing Activities: Positive at LKR 422.7 million, indicating effective management of financial resources.

Strategic Initiatives

United Motors PLC undertook several strategic initiatives to mitigate the impact of the challenging environment:

- Acquisition of Dutch Lanka Trailer Manufacturers Limited: This acquisition is expected to enhance the company’s capabilities and expand its market presence in the export sector.

- Local Manufacturing: Focus on increasing local assembly operations to reduce dependence on imports.

- Market Diversification: Expanding into new markets, such as the Maldives for heavy machinery sales, to diversify revenue streams.

Future Outlook

The outlook for United Motors PLC remains cautiously optimistic. The company is preparing for the potential lifting of import restrictions, which could significantly boost its core automotive business. Additionally, the focus on local assembly and strategic acquisitions is expected to drive future growth and profitability.

Conclusion

The financial performance of United Motors PLC for the year ended 31st March 2024 highlights both the resilience and the challenges faced by the company. While turnover has increased, profitability remains a significant challenge. Strategic initiatives and a focus on operational efficiencies are expected to position the company for future growth.

For a detailed review of the financial statements and additional information, please refer to the complete annual report of United Motors PLC for the year ended 31st March 2024