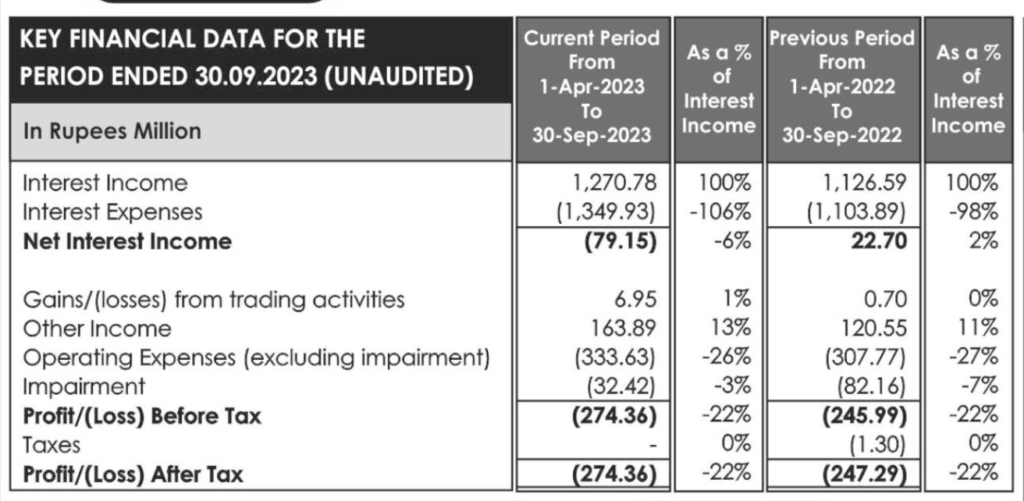

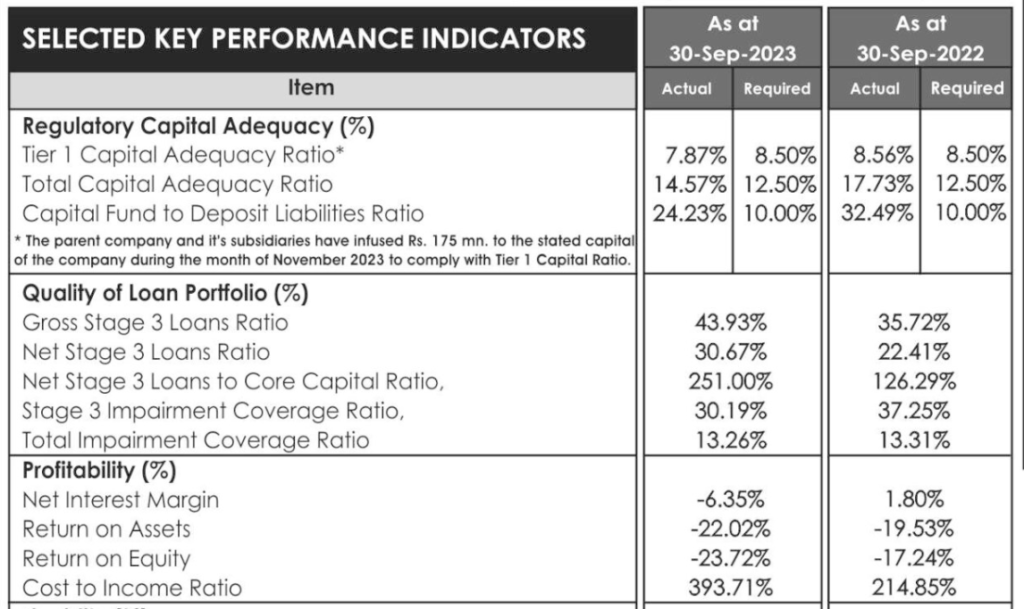

Richard Pieris Finance Ltd Reports a Net Loss. The net loss for the 6 months period ending 30th September 2023 stood at Rs. 274mn which indicates a serious loss of capital endangering the deposit holders. Gross stage 3 loan ratio exceeded 43% whilst Tier-1 capital adequacy ratio was only 7.8% below the statutory requirement of 8.5%.

Richard Pieris Finance Ltd capitalisation and leverage remain weak. Its regulatory Tier 1 capital ratio of 8.0% as well as its core capital fell below minimum prudential requirements – 8.5% and LKR2.5 billion, respectively – at end-September 2023 (1HFY24) on continued losses. This resulted in the Central Bank of Sri Lanka imposing a cap on deposit mobilisation. Furthermore, RPF’s leverage ratio, which we estimate at above 6x, is the highest among Fitch-rated peers.

Richard Pieris Finance Ltd risk profile remains the weakest among Fitch-rated peers due to its predominant exposure to subprime domestic customers. This is heightened by weak and evolving underwriting standards and risk controls, as reflected in its above-industry gross stage 3 loan ratio of 43.9% as at end-1HFY24. We do not expect a major improvement in asset-quality metrics in the near- to medium-term in the absence of a resolution of RPF’s large legacy non-performing loan portfolio.

Latest Financial Performance: https://rpfinancelk.com/wp-content/uploads/2023/06/Richard-Piris-Final-Account-English-scaled.jpg

Richard Pieris Finance Ltd is the only finance and leasing company among Fitch-rated peers to deliver a negative net interest margin in 1HFY24, following the sharp increase in domestic interest rates. Fitch expect declining interest rates to ease pressure on its funding costs and lead to a modest improvement in pre-tax profit/average assets in FY25 (end-September 2023: -3.3%). Nevertheless, the company remains vulnerable to adverse interest rate movements, given the significant negative maturity.

Richard Pieris Finance Ltd has been informed to refrain from expanding the deposit base over Rs. 10.6 Bn by Central Bank.

Fitch Affirms Richard Pieris Finance Outlook Negative

Richard Pieris Finance Ltd standalone credit profile to be significantly weaker than its support-driven rating, due to its small franchise, high-risk lending exposure and weak financial profile.

Richard Pieris Finance Ltd rating is sensitive to changes in its credit profile as well as Fitch Ratings opinion around Richard Pieris and Company PLC’s ability and propensity to extend timely and adequate extraordinary support.

Developments that could lead to negative rating action, including the possibility of a multiple-notch downgrade, include:

– a prolonged delay in the company’s capital remediation plans without credible support from its parent to cure its position

– a further tightening of regulatory restrictions in the absence of parental support to meet capital shortfalls that constrains Richard Pieris Finance Ltd’s ability to generate business volume

– a significant increase in Richard Pieris Finance Ltd’s size relative its parent that makes extraordinary support more onerous for Richard Pieris and Company PLC.

– insufficient or delayed liquidity support from Richard Pieris and Company PLC’ that hinders Richard Pieris Finance Ltd’s ability to meet its obligations in a timely manner.

– Richard Pieris and Company PLC reported 84% decline in earnings for FY 2023/24 with significant reduction in revenues and earnings across all group companies. This may affect Richard Pieris and Company PLC’s ability to provide liquidity support to Richard Pieris Finance Ltd in the immediate future.

Click Link below to Download Research Report on Richard Pieris and Company PLC and Group companies: https://easyupload.io/uexmvn

Click Link below to download Fitch Report: https://www.fitchratings.com/research/non-bank-financial-institutions/fitch-affirms-richard-pieris-finance-at-a-lka-outlook-remains-negative-07-03-2024