Abans Finance PLC, a key non-banking financial institution in Sri Lanka, has demonstrated resilience and strategic foresight amidst a challenging economic environment. The company’s financial performance for the year ended 31st March 2024 reflects significant achievements and strategic growth despite adverse economic conditions.

Financial Highlights

- Income and Profitability

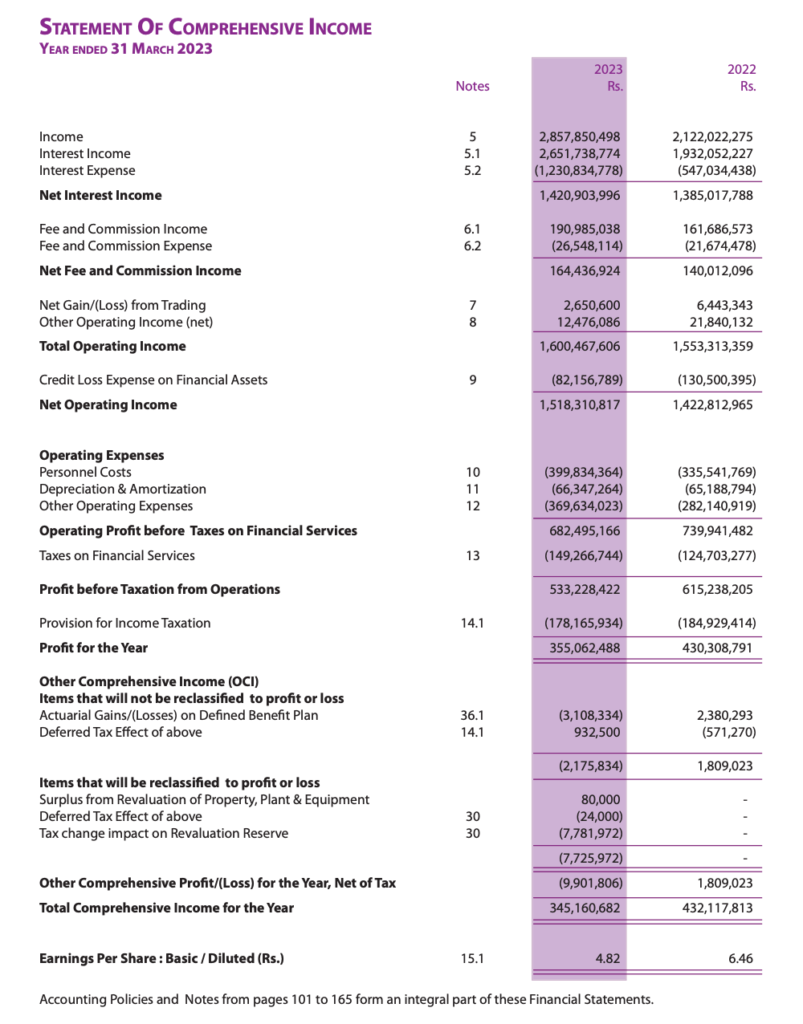

- Total Income: Rs. 2,857.85 million, a 34.68% increase from the previous year (Rs. 2,122.02 million).

- Net Interest Income: Rs. 1,420.90 million, a 2.59% increase from the previous year (Rs. 1,385.02 million).

- Net Fee and Commission Income: Rs. 164.44 million, a 17.44% increase from the previous year (Rs. 140.01 million).

- Total Operating Income: Rs. 1,600.47 million, a 3.04% increase from the previous year (Rs. 1,553.31 million).

- Profit After Tax: Rs. 355.06 million, a 17.5% decrease from the previous year (Rs. 430.31 million) due to significant increases in finance costs.

- Financial Position

- Total Assets: Rs. 11,188.66 million, a 6.88% increase from the previous year (Rs. 10,468.50 million).

- Total Loans and Advances to Customers: Rs. 8,807.13 million, an 8.61% increase from the previous year (Rs. 8,108.90 million).

- Public Deposits: Rs. 5,376.61 million, a 20.88% increase from the previous year (Rs. 4,448.01 million).

- Borrowings: Rs. 1,955.11 million, a 27.34% decrease from the previous year (Rs. 2,690.70 million).

- Shareholders’ Funds: Rs. 2,969.96 million, a 22.47% increase from the previous year (Rs. 2,425.12 million).

- Profitability Ratios

- Return on Assets (ROA): 3.28%, down from 4.37% in the previous year.

- Return on Equity (ROE): 13.16%, down from 19.48% in the previous year.

- Net Interest Margin (NIM): 13.12%, down from 13.98% in the previous year.

- Cost to Income Ratio: 51.37%, up from 43.96% in the previous year.

- Earnings Per Share (EPS): Rs. 4.82, down from Rs. 6.46 in the previous year.

- Price to Earnings Ratio (P/E): 4.85, up from 4.26 in the previous year.

- Net Asset Value per Share (NAV): Rs. 40.30, up from Rs. 36.43 in the previous year.

- Market Value per Share: Rs. 23.40, down from Rs. 28.90 in the previous year.

- Market Capitalization: Rs. 1,724 million, down from Rs. 1,924 million in the previous year.

- Regulatory Ratios

- Tier 1 Capital Ratio: 19.79%, up from 15.63% in the previous year.

- Tier 2 Capital Ratio: 20.84%, up from 16.70% in the previous year.

- Statutory Liquid Assets Ratio: 27.81%, up from 26.76% in the previous year.

Management Discussion and Analysis

- Market Conditions and Challenges

- The past year presented significant challenges due to economic recession, fuel crisis, and rising costs.

- The company focused on core products such as leasing for motorcycles and three-wheelers, which contributed 83% to the total portfolio.

- Operational Performance

- The company maintained a strong liquidity position and improved cash flow.

- Despite economic challenges, the recoveries team played a crucial role in managing the non-performing loan book, keeping it under 10% for the two-wheel portfolio.

- Future Outlook

- Abans Finance PLC plans to scale down excess liquidity buffers and diversify the lending portfolio across sectors and geographic areas.

- Continued investments in information technology and risk management are expected to yield significant benefits in the future.

Financial Review

- Revenue Composition

- Interest-based income, including finance leases and loans, accounted for 92.8% of the total income.

- Non-interest based income grew by 8.5% YoY to Rs. 206.11 million.

- Expenses and Cost Management

- Operating expenses increased by 22.39% to Rs. 835.8 million due to inflation and economic conditions.

- The cost to income ratio increased to 51.37%.

- Credit Quality

- The company implemented stringent measures to enhance credit quality, including realignment of the product mix towards small ticket leases.

Conclusion

Abans Finance PLC has demonstrated strong financial performance and strategic growth despite a challenging economic environment. The company’s focus on core products, strategic investments, and robust risk management practices have positioned it well for future growth.