HNB Finance PLC has undergone significant transformation and achieved remarkable financial turnaround during the fiscal year ending 31st March 2024. The company has strategically navigated economic challenges and leveraged its robust operational capabilities to deliver substantial growth and improved financial performance.

Financial Performance Highlights

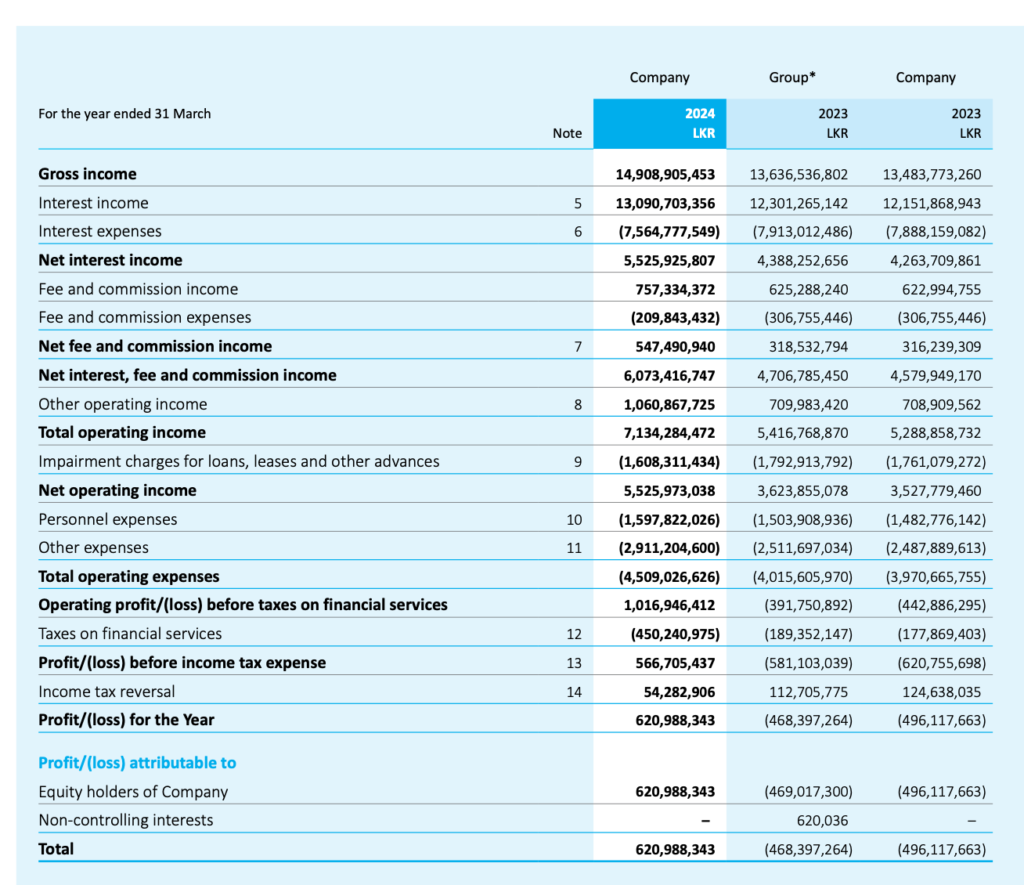

- Income and Profitability

- Gross Income: LKR 14,909 million, representing an increase from LKR 13,637 million in the previous year.

- Net Interest Income: LKR 5,526 million, a significant rise from LKR 4,388 million.

- Total Operating Income: LKR 7,134 million, up from LKR 5,417 million.

- Profit Before Taxation: LKR 567 million, compared to a loss of LKR 581 million in the previous year.

- Profit After Taxation: LKR 621 million, a notable improvement from the loss of LKR 468 million in the previous year.

- Financial Position

- Total Assets: LKR 53,458 million, a slight decrease from LKR 54,657 million.

- Lending Portfolio: LKR 33,636 million, down from LKR 38,857 million.

- Customer Deposits: LKR 41,261 million, compared to LKR 43,736 million.

- Fixed Deposits: LKR 38,680 million, down from LKR 40,519 million.

- Savings Deposits: LKR 2,581 million, down from LKR 3,217 million.

- Borrowings: LKR 4,157 million, slightly down from LKR 4,406 million.

- Shareholders’ Funds: LKR 5,652 million, up from LKR 5,057 million.

- Key Ratios

- Return on Equity (ROE): 11.60%, up from -9.81%.

- Return on Assets (ROA): 1.15%, up from -1.82%.

- Earnings Per Share (EPS): LKR 0.36, improved from LKR -0.27.

- Net Assets Per Share: LKR 3.29, up from LKR 2.94.

- Interest Cover: 1.08 times, improved from 0.92 times.

- Debt-to-Equity Ratio: 8.04 times, down from 9.81 times.

- Core Capital to Risk-Weighted Assets Ratio (Tier I): 8.81%, up from 7.08%.

- Total Risk-Weighted Capital Ratio (Tier I and II): 14.10%, up from 12.49%.

Strategic Initiatives and Operational Achievements

- Transformation and Digitalization

- HNB Finance PLC has placed a strong emphasis on digitalization and automation, implementing technology-friendly initiatives that streamline workflows and enhance customer interfaces.

- Significant investments in IT development amounting to LKR 605 million were made to bolster operational efficiency and customer satisfaction.

- Asset Quality and Diversification

- The company has strategically diversified its asset portfolio, moving away from traditional blends to more secure and diversified assets.

- Enhanced focus on leasing and gold loan markets contributed to better alignment with customer needs and improved stakeholder confidence.

- Cost Management and Operational Efficiency

- HNB Finance PLC concentrated on optimizing cost structures and enforcing the optimum utilization of resources to enhance operational efficiency.

- This resulted in significant improvements in profitability, with profit after tax soaring by 233% compared to the previous year.

- Risk Management

- The company implemented rigorous risk management practices to sustain asset quality and navigate economic challenges.

- An aggressive approach to loan recovery and stringent monitoring of loan portfolios were adopted to minimize potential losses and improve asset quality.

- Human Resources and Corporate Governance

- HNB Finance PLC faced challenges in employee retention due to high turnover and brain drain but initiated proactive measures such as recruitment drives for interns to replenish talent.

- Strong corporate governance structures were maintained, with multiple committees overseeing business activities and ensuring compliance with regulatory requirements.

- Social Responsibility and Sustainability

- The company actively participated in community engagement and environmental sustainability initiatives, including financial literacy programs and responsible e-waste management.

- HNB Finance PLC’s commitment to social responsibility was further demonstrated through its contributions to community support and environmental conservation efforts.

Future Outlook

HNB Finance PLC is committed to continuing its journey of growth and innovation, with a focus on digital transformation, diversification, and robust governance. The company aims to enhance its market presence, optimize asset blends, and pursue sustainable growth strategies to ensure long-term success.