Vallibel One PLC is a leading diversified conglomerate in Sri Lanka, engaged in multiple sectors including lifestyle, finance, aluminum, leisure, consumer, and investments. The company has demonstrated resilience and a commitment to sustainable growth amidst challenging economic conditions.

Financial Performance

Revenue and Profitability:

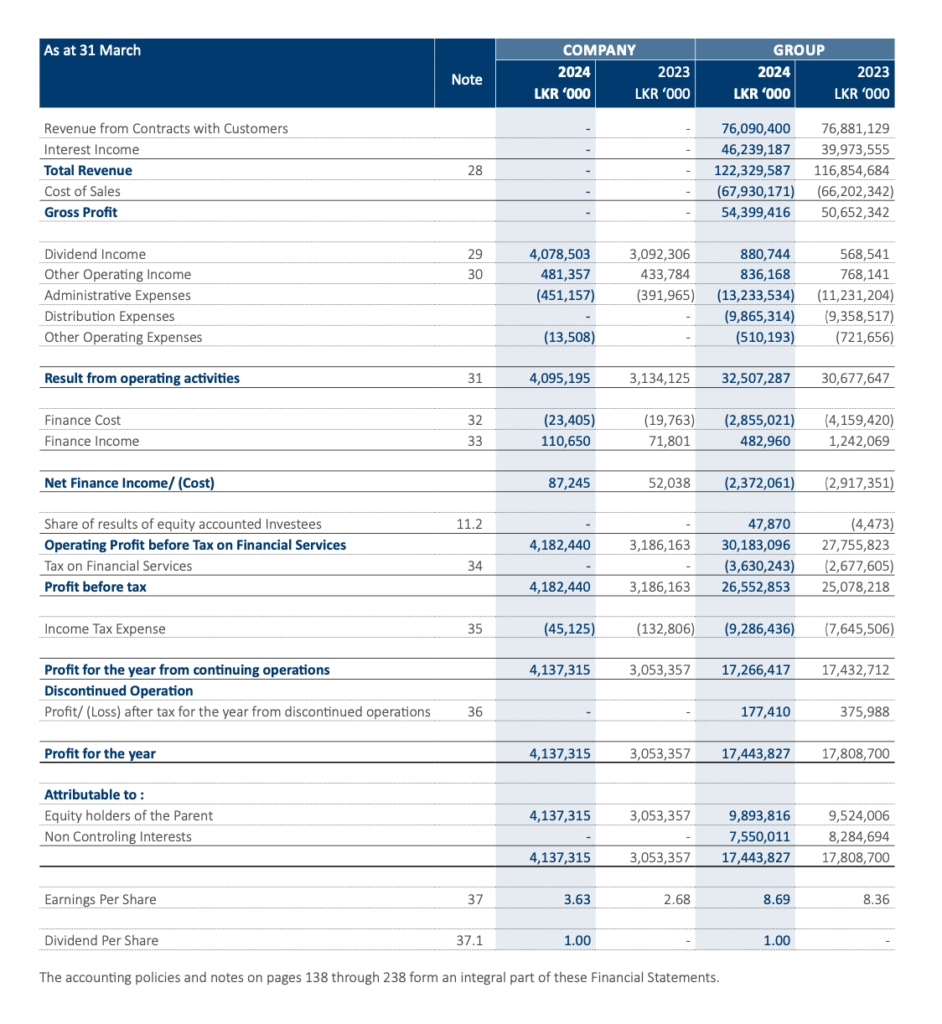

- Revenue: Vallibel One PLC reported a total revenue of LKR 122,330 million for the year ended 31st March 2024, representing a 4.69% increase from LKR 116,855 million in the previous year.

- Gross Profit: The gross profit for the year was LKR 54,399 million, up by 7.40% from LKR 50,652 million in 2022/23.

- Profit Before Tax: The company achieved a profit before tax of LKR 26,553 million, a 5.88% increase from LKR 25,078 million in the previous year.

- Profit After Tax: Despite an increase in income tax expenses by 21.45% to LKR 9,286 million, the company reported a profit after tax of LKR 17,444 million, a slight decrease of 2.05% from LKR 17,809 million in the previous year.

- Earnings Per Share (EPS): EPS for the year stood at LKR 8.69, a 4% increase from LKR 8.36 in the previous year.

Margins and Ratios:

- Gross Profit Margin: 44.5%, up from 43.3% in 2022/23.

- Operating Profit Margin: 26.6%, a slight decrease from 26.9% in the previous year.

- Net Profit Margin: 14.3%, down from 15.6% in 2022/23.

- Return on Assets (ROA): 5.0%, compared to 5.8% in the previous year.

- Return on Equity (ROE): 12.5%, down from 14.9% in the previous year.

Key Indicators

Asset Base:

- Total Assets: The total assets of Vallibel One PLC grew by 11.93% to LKR 346,593 million from LKR 309,646 million in the previous year.

- Total Liabilities: Total liabilities increased by 9% to LKR 207,358 million from LKR 190,264 million.

- Net Worth: The net worth of the company rose by 17% to LKR 139,235 million from LKR 119,382 million.

Equity and Debt:

- Equity Attributable to Equity Holders of the Parent: LKR 92,039 million, up by 20% from LKR 76,925 million.

- Total Debt: Increased by 15% to LKR 55,106 million from LKR 47,879 million.

- Debt to Equity Ratio: Slight decrease to 39.58% from 40.11%.

Cash Flows

Operating Activities:

- The cash flow from operating activities remained robust, ensuring the company’s ability to meet its operational expenses and short-term obligations.

Investing Activities:

- Significant investments were made in property, plant, and equipment amounting to LKR 14,409 million, indicating ongoing capacity enhancement efforts and future growth potential.

Financing Activities:

- The company maintained a balanced approach towards financing, focusing on debt management and equity enhancement to support its strategic initiatives.

Net Asset Value

- Net Asset Value (NAV) Per Share: The NAV per share increased to LKR 80.81, up by 20% from LKR 67.54 in the previous year.

Conclusion

Vallibel One PLC has demonstrated a strong financial performance for the year ended 31st March 2024. The company’s strategic focus on process excellence, innovation, and sustainable growth has enabled it to navigate economic challenges effectively. With a robust asset base, prudent financial management, and a commitment to creating long-term value, Vallibel One PLC remains well-positioned for future growth.