1. Statement of Financial Position

Assets:

- Total Assets: The total assets of LOLC Holdings PLC increased from Rs. 1,566,132 million in 2023 to Rs. 1,735,119 million in 2024. This reflects a significant growth of approximately 10.8%.

- Cash and Cash Equivalents: Cash and cash equivalents saw an increase from Rs. 91,047 million in 2023 to Rs. 108,937 million in 2024.

- Investment Securities: Investment securities grew substantially from Rs. 113,253 million in 2023 to Rs. 144,202 million in 2024.

- Financial Assets at Amortised Cost: The financial assets at amortised cost, which include finance lease receivables, advances, and other loans, remained relatively stable, showing a slight decrease from Rs. 737,384 million in 2023 to Rs. 734,819 million in 2024.

Liabilities and Equity:

- Total Liabilities: Total liabilities increased from Rs. 1,132,158 million in 2023 to Rs. 1,246,426 million in 2024, marking an increase of approximately 10.1%.

- Bank Overdrafts: Bank overdrafts decreased from Rs. 14,907 million in 2023 to Rs. 10,260 million in 2024.

- Interest-Bearing Borrowings: There was a significant rise in interest-bearing borrowings from Rs. 508,886 million in 2023 to Rs. 578,361 million in 2024.

- Equity: Total equity improved from Rs. 433,974 million in 2023 to Rs. 488,693 million in 2024, indicating a growth of around 12.6%.

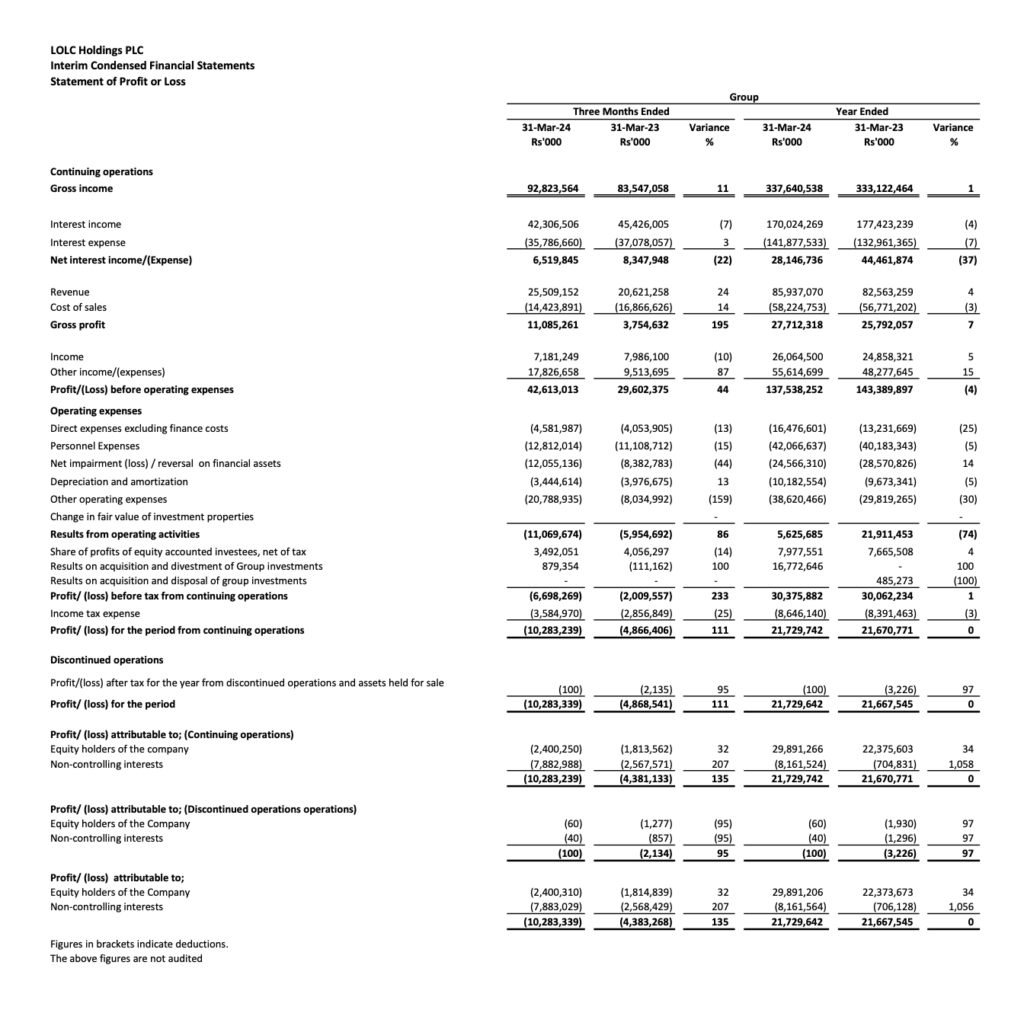

2. Statement of Profit or Loss

Continuing Operations:

- Gross Income: The gross income for the group increased from Rs. 333,122 million in 2023 to Rs. 337,641 million in 2024, representing a growth of 1%.

- Net Interest Income: Net interest income for the group decreased significantly by 37%, from Rs. 44,462 million in 2023 to Rs. 28,147 million in 2024.

- Gross Profit: The gross profit improved by 7%, from Rs. 25,792 million in 2023 to Rs. 27,712 million in 2024.

- Operating Profit: The results from operating activities decreased drastically by 74%, from Rs. 21,911 million in 2023 to Rs. 5,626 million in 2024.

Discontinued Operations:

- The profit after tax for the year from discontinued operations improved, showing a smaller loss of Rs. 100,000 in 2024 compared to Rs. 3,226,000 in 2023.

3. Statement of Comprehensive Income

- Total Comprehensive Income: The total comprehensive income for the year decreased by 79%, from Rs. 31,518 million in 2023 to Rs. 6,705 million in 2024.

- Profit Attributable to Equity Holders: The profit attributable to equity holders for continuing operations increased by 34%, from Rs. 22,376 million in 2023 to Rs. 29,891 million in 2024.

4. Statement of Changes in Equity

- Equity Movement: The total equity attributable to the shareholders of the company increased from Rs. 254,470 million in 2023 to Rs. 295,805 million in 2024.

- Non-Controlling Interests: Non-controlling interests increased from Rs. 179,504 million in 2023 to Rs. 192,773 million in 2024.

5. Statement of Cash Flows

- Operating Activities: Net cash used in operating activities was Rs. 111,292 million in 2024, a decrease from Rs. 84,070 million in 2023.

- Investing Activities: Cash flow from investing activities showed significant investments and disposals, reflecting the company’s active management of its investment portfolio.

6. Notes to the Financial Statements

- Detailed notes to the financial statements provide insights into the valuation of financial assets and liabilities, operating segments, and additional financial disclosures necessary for a comprehensive understanding of the company’s financial health.

LOLC Holdings PLC demonstrated substantial asset growth and an improvement in total equity for the financial year ended 31st March 2024. However, the company faced challenges in maintaining net interest income and operating profit, indicating areas for potential strategic improvement.