The financial performance of LAUGFS Power PLC for the year ended March 31, 2024, shows both stability and growth, with notable highlights in hydro and solar energy segments.

Performance Highlights

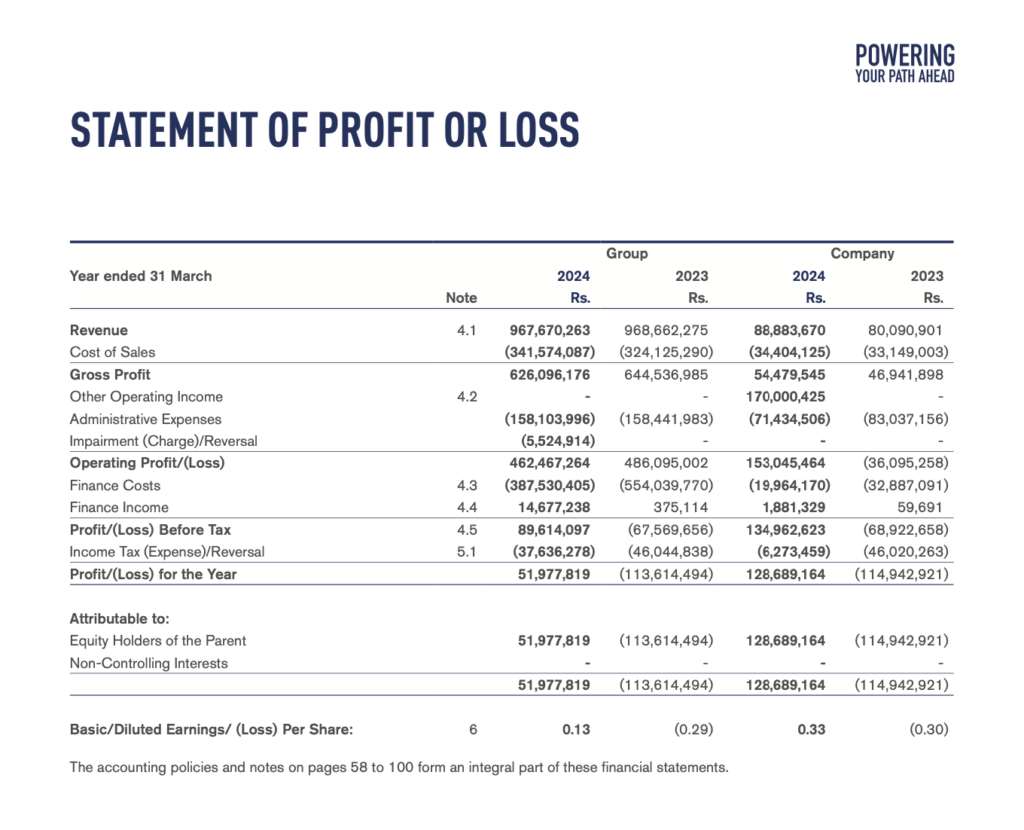

- Revenue: Total revenue for 2023/24 remained stable at Rs. 967.67 million, a slight decrease from Rs. 968.66 million in 2022/23. Hydro revenue saw an increase from Rs. 59.63 million in 2022/23 to Rs. 67.19 million in 2023/24, while solar revenue slightly decreased from Rs. 909.04 million to Rs. 900.48 million.

- Gross Profit: Gross profit stood at Rs. 626.10 million, down 3% from Rs. 644.54 million in the previous year.

- EBITDA: Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA) were Rs. 731.21 million, showing a marginal decrease of 1% from Rs. 741.45 million.

- Net Profit: The company turned around from a loss of Rs. 113.61 million in 2022/23 to a profit of Rs. 51.98 million in 2023/24. This significant improvement highlights the company’s ability to navigate challenging economic conditions.

Financial Ratios

- Gross Profit Margin: The gross profit margin slightly decreased to 65% from 67%.

- EBITDA Margin: EBITDA margin remained stable at 76%.

- Net Profit Margin: Net profit margin improved from -12% to 5%, indicating better cost management and operational efficiency.

- Earnings Per Share (EPS): EPS improved from a negative Rs. 0.29 to Rs. 0.13, reflecting the company’s return to profitability.

- Net Assets Value per Share: Increased from Rs. 4.99 to Rs. 5.12, demonstrating growth in shareholders’ equity.

Asset and Liability Overview

- Total Assets: The company reported a decrease in total assets from Rs. 4.93 billion to Rs. 4.33 billion, primarily due to reductions in both current and non-current assets.

- Total Liabilities: Total liabilities also decreased significantly from Rs. 3.00 billion to Rs. 2.35 billion, reflecting better debt management.

- Total Equity: Total equity improved from Rs. 1.93 billion to Rs. 1.98 billion, showcasing financial stability.

Segment Performance

- Hydro Power: The hydro power segment showed strong performance with an increase in energy generation from 4.09 million kWh to 5.36 million kWh, attributed to improved rainfall patterns and water availability.

- Solar Power: Solar power generation remained stable, with slight variations due to weather conditions and panel efficiency over time.

Strategic Initiatives and Future Outlook

LAUGFS Power is focusing on expanding its renewable energy portfolio, including solar and hydro projects. Key upcoming projects include a 10MW solar project and additional mini-hydro projects. The company is also exploring wind power generation with a planned 50MW project in Mannar, reflecting its commitment to diversifying and expanding its renewable energy sources.

ESG Commitment

LAUGFS Power continues to emphasize its environmental, social, and governance (ESG) responsibilities, securing 21,100 Verified Emission Reductions (VERs) through the Gold Standard, symbolizing its dedication to sustainability and reducing its carbon footprint.