Highlights and Observations

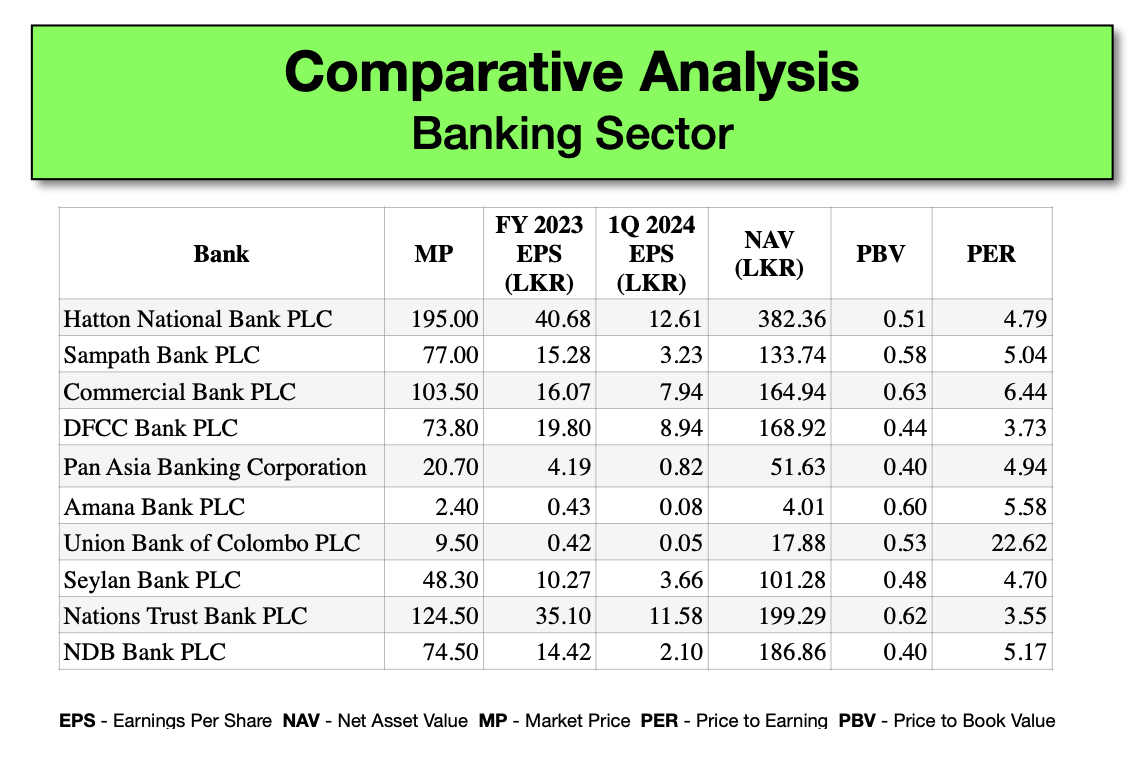

• Hatton National Bank: Strong performance with the highest EPS and NAV, indicating robust profitability and a solid equity base.

• Commercial Bank: Exceptional growth in NII and net profit, showcasing effective interest rate management and operational efficiency.

• Nations Trust Bank: Leading in ROE and ROA, reflecting high profitability and efficient asset utilization. Trading at lowest PERx (FY 2023) among peers

• DFCC Bank: Significant YoY growth in net operating income and profit after tax, despite a decrease in NII.

• Union Bank: Faced challenges with the lowest EPS, ROE, and ROA, indicating areas for potential improvement in profitability and asset management.

• Amana Bank: Strong growth in net profit and a substantial decrease in impairment charges, though it has the lowest NAV among peers.

• Pan Asia Bank and NDB Bank: Trading at lowest PBVx (1Q2024) among the peers

The comparative analysis of Q1 2024 financial performance reveals a diverse landscape of strengths and challenges across the banks. Hatton National Bank and Commercial Bank stand out for their strong profitability and asset base. In contrast, Union Bank and Amana Bank show potential for improvement in key financial metrics. Overall, the banks have demonstrated resilience and strategic adaptability in navigating economic conditions, with a focus on digital transformation, sustainable finance, and compliance with regulatory requirements.

Download Full Report: https://lankabizz.net/product/banking-sector-analysis/