Lanka Milk Foods (CWE) PLC has shown several concerning trends in its financial performance for the year ended March 31, 2024. Despite a positive headline profit, deeper analysis reveals significant issues in operating expenses, debt management, and dependency on specific income streams. This report outlines these concerns, suggesting potential risks for investors.

Financial Performance Analysis

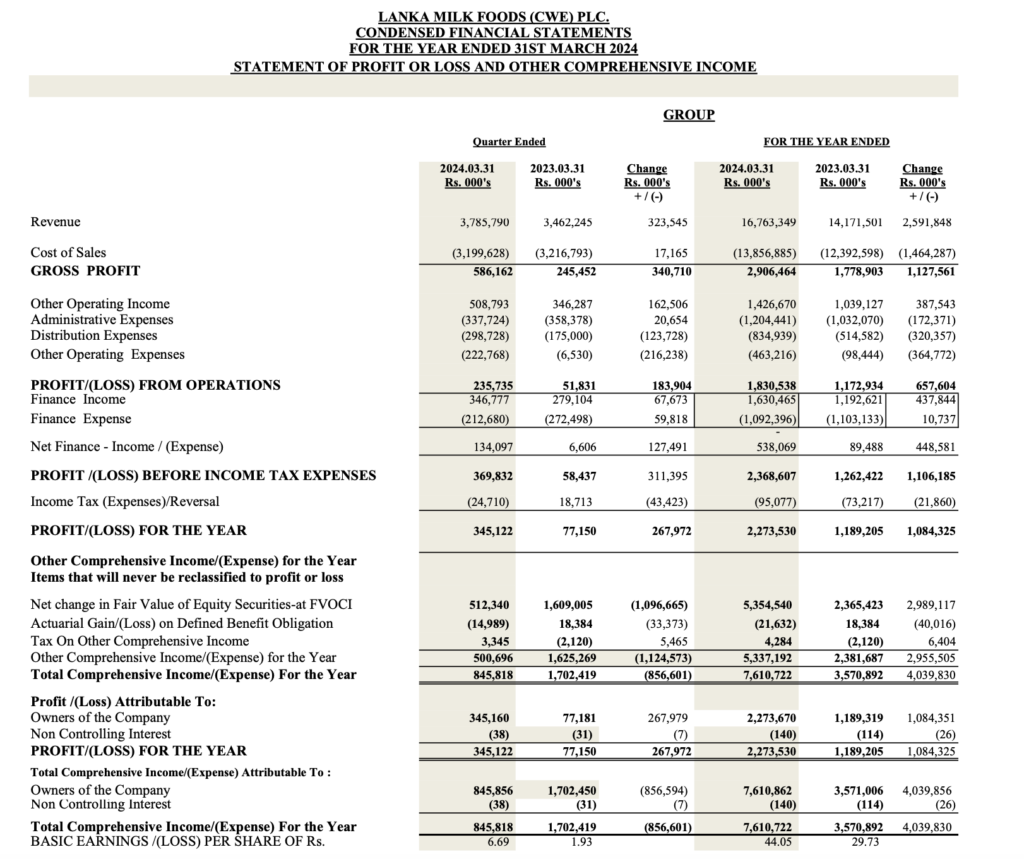

1. Revenue Growth vs. Cost of Sales: While the company experienced a 18.3% increase in revenue from Rs. 14.17 billion in 2023 to Rs. 16.76 billion in 2024, the cost of sales also increased by 11.8%, from Rs. 12.39 billion to Rs. 13.86 billion. This suggests that the company is struggling to manage its production and procurement costs efficiently, leading to a disproportionate rise in costs relative to revenue.

2. Rising Operating Expenses: Operating expenses have shown a troubling increase across several categories:

- Administrative expenses decreased slightly by 16.7%, from Rs. 1.03 billion to Rs. 1.20 billion, indicating potential inefficiencies.

- Distribution expenses surged by 62.3%, from Rs. 514.58 million to Rs. 834.94 million, which raises questions about the company’s logistics and supply chain management.

- Other operating expenses saw a dramatic increase from Rs. 98.44 million to Rs. 463.22 million, suggesting possible operational inefficiencies or one-time costs that are not sustainable.

3. Profitability Concerns: Despite reporting a gross profit increase of 63.4%, from Rs. 1.78 billion to Rs. 2.91 billion, net profit margins remain a concern. The profit before tax rose by 87.7%, but this growth is overshadowed by the significant reliance on other operating income and finance income, which may not be sustainable long-term.

Cash Flow and Liquidity Issues

1. Negative Operating Cash Flow: The company reported a net cash outflow from operating activities of Rs. 1.56 billion, indicating that its core operations are not generating sufficient cash. This is a critical red flag as it suggests that the company may struggle to maintain its operations without external financing.

2. High Dependency on Finance Income: Net finance income significantly contributed to the profit before tax, with a net finance income of Rs. 538.07 million in 2024 compared to Rs. 89.49 million in 2023. This indicates a heavy reliance on finance income, which may not be sustainable if interest rates or investment returns fluctuate.

Debt and Financial Stability

1. Increasing Borrowings: The company’s total borrowings have increased, with short-term borrowings jumping to Rs. 2.65 billion from Rs. 250 million, indicating a potential liquidity crunch. High levels of debt raise concerns about the company’s ability to manage its financial obligations.

2. Dividend Payments Despite Cash Flow Issues: The company paid dividends amounting to Rs. 451.98 million despite negative operating cash flows, which could be viewed as a financially imprudent decision. It suggests that the company might be prioritizing shareholder returns over maintaining a healthy cash reserve.

Operational Efficiency

1. Inefficiency in Asset Utilization: The company’s return on assets (ROA) remains low, with significant investments in biological assets and property, plant, and equipment not translating effectively into higher profitability.

2. High Inventory Levels: Inventories increased to Rs. 3.56 billion from Rs. 2.79 billion, raising concerns about inventory management and potential obsolescence risks. High inventory levels can indicate overproduction or declining sales.

Quarterly Performance Comparison

Q1-June 2023 Quarter

- Revenue: Rs. 4,339.31 million, increased by Rs. 1,199.68 million from the previous year.

- Gross Profit: Rs. 754.69 million, decreased by Rs. 58.83 million.

- Profit/(Loss) Before Tax: Rs. 267.94 million, a significant drop of Rs. 660.35 million.

- Net Profit: Rs. 245.20 million, decreased by Rs. 637.78 million

Q2-September 2023 Quarter

- Revenue: Rs. 4,370.32 million, increased by Rs. 605.44 million from the previous year.

- Gross Profit: Rs. 933.19 million, increased by Rs. 541.32 million.

- Profit/(Loss) Before Tax: Rs. 892.64 million, increased by Rs. 837.15 million.

- Net Profit: Rs. 869.90 million, increased by Rs. 833.24 million.

Q3-December 2023 Quarter

- Revenue: Rs. 4,339.31 million, showing no significant change compared to June 2023 .

- Gross Profit: Not explicitly mentioned, but operational challenges are implied.

- Profit/(Loss) Before Tax: Rs. 1,998.78 million, an increase from previous quarters but reflects high dependency on non-operational income .

- Net Profit: Rs. 1,928.51 million, a significant increase but primarily due to one-time gains .

Q4-March 2024 Quarter

- Revenue: Rs. 6,729.73 million, an increase of Rs. 2,657.59 million from the previous year .

- Gross Profit: Rs. 1,732.26 million, increased by Rs. 834.42 million .

- Profit/(Loss) Before Tax: Rs. 2,319.06 million, increased by Rs. 809.86 million .

- Net Profit: Rs. 2,273.53 million, increased by Rs. 1,084.32 million.

Analysis of Key Issues

- Inconsistent Revenue Growth:

- The company’s revenue shows inconsistency with notable fluctuations between quarters. The December 2023 quarter’s revenue stagnated compared to June 2023, suggesting market or operational challenges.

- Declining Gross Profit Margin:

- Despite the increase in revenue, the gross profit margin has not shown proportional improvement. This indicates rising costs or inefficiencies in production and operations.

- Volatile Net Profits:

- The net profit has seen significant variations, with substantial increases in certain quarters primarily due to non-operational income or one-time gains, rather than sustainable operational performance.

- High Dependence on Non-Operational Income:

- The marked increase in net profit for the December 2023 and March 2024 quarters can be attributed to gains from financial instruments rather than core business operations, highlighting a potential risk if these non-operational incomes are not sustained.

- Operational Efficiency Issues:

- High administrative and distribution expenses are persistent, suggesting inefficiencies that need to be addressed to improve overall profitability.

Conclusion and Recommendations

Lanka Milk Foods (CWE) PLC faces multiple financial and operational challenges. The significant increases in operating expenses, heavy reliance on finance income, negative operating cash flow, and rising debt levels all pose substantial risks. Potential investors should exercise caution and consider these factors when making investment decisions. The company needs to focus on improving operational efficiencies, better managing its costs, and ensuring sustainable cash flow from its core operations.

Download Full Report: https://lankabizz.net/product/lanka-milk-foods-cwe-plc/