The interim financial performance of LB Finance PLC for the period ended 30 June 2024 highlights key financial metrics compared to the same period in 2023. Below is a summary of the financial performance based on the provided interim financial statements:

Statement of Comprehensive Income (Company)

Key Figures:

- Income: Rs. 11,215,118 (‘000), a decrease of 11% from Rs. 12,534,244 (‘000) in 2023.

- Net Interest Income: Rs. 6,034,565 (‘000), an increase of 4% from Rs. 5,776,584 (‘000) in 2023.

- Fee and Commission Income: Rs. 839,128 (‘000), an increase of 37% from Rs. 613,925 (‘000) in 2023.

- Total Operating Income: Rs. 6,896,947 (‘000), an increase of 8% from Rs. 6,402,315 (‘000) in 2023.

- Net Operating Income: Rs. 6,790,213 (‘000), an increase of 8% from Rs. 6,297,523 (‘000) in 2023.

- Total Operating Expenses: Rs. 2,381,251 (‘000), an increase of 15% from Rs. 2,078,123 (‘000) in 2023.

- Profit Before Taxation: Rs. 3,531,459 (‘000), an increase of 5% from Rs. 3,377,284 (‘000) in 2023.

- Profit for the Period: Rs. 2,201,962 (‘000), an increase of 5% from Rs. 2,104,703 (‘000) in 2023.

- Basic Earnings per Share: Rs. 3.98, an increase of 5% from Rs. 3.80 in 2023.

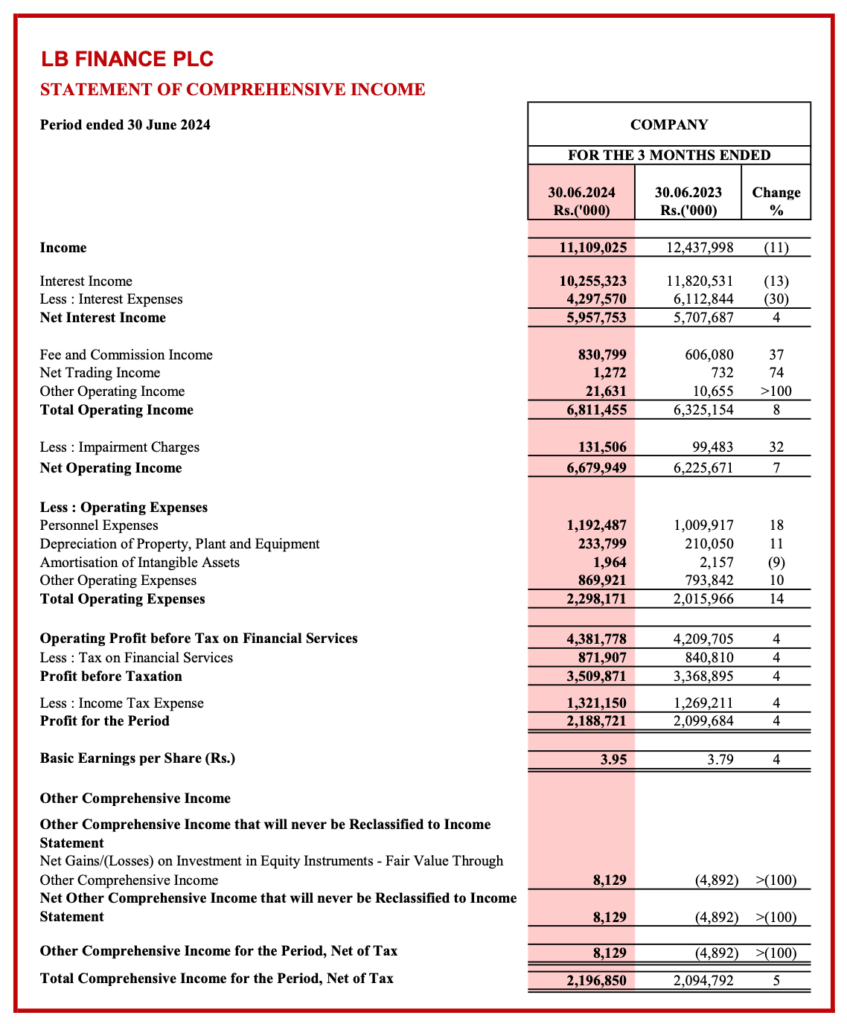

Statement of Comprehensive Income (Group)

Key Figures:

- Income: Rs. 11,109,025 (‘000), a decrease of 11% from Rs. 12,437,998 (‘000) in 2023.

- Net Interest Income: Rs. 5,957,753 (‘000), an increase of 4% from Rs. 5,707,687 (‘000) in 2023.

- Fee and Commission Income: Rs. 830,799 (‘000), an increase of 37% from Rs. 606,080 (‘000) in 2023.

- Total Operating Income: Rs. 6,811,455 (‘000), an increase of 8% from Rs. 6,325,154 (‘000) in 2023.

- Net Operating Income: Rs. 6,679,949 (‘000), an increase of 7% from Rs. 6,225,671 (‘000) in 2023.

- Total Operating Expenses: Rs. 2,298,171 (‘000), an increase of 14% from Rs. 2,015,966 (‘000) in 2023.

- Profit Before Taxation: Rs. 3,509,871 (‘000), an increase of 4% from Rs. 3,368,895 (‘000) in 2023.

- Profit for the Period: Rs. 2,188,721 (‘000), an increase of 4% from Rs. 2,099,684 (‘000) in 2023.

- Basic Earnings per Share: Rs. 3.95, an increase of 4% from Rs. 3.79 in 2023.

Statement of Financial Position (Group)

Key Figures:

- Total Assets: Rs. 210,187,014 (‘000) as at 30 June 2024, compared to Rs. 203,147,886 (‘000) as at 31 March 2024.

- Total Liabilities: Rs. 165,895,620 (‘000) as at 30 June 2024, compared to Rs. 159,139,893 (‘000) as at 31 March 2024.

- Total Equity: Rs. 44,291,394 (‘000) as at 30 June 2024, compared to Rs. 44,007,993 (‘000) as at 31 March 2024.

- Net Asset Value per Share: Rs. 79.77 as at 30 June 2024, compared to Rs. 79.25 as at 31 March 2024.

Selected Performance Indicators

- Debt Equity Ratio: 71.35% as at 30 June 2024, compared to 64.17% as at 30 June 2023.

- Quick Asset Ratio: 21.51% as at 30 June 2024, compared to 20.70% as at 30 June 2023.

- Return on Average Shareholders’ Funds (After Tax): 20.01% annualized as at 30 June 2024, compared to 22.23% as at 30 June 2023.

- Gross Non-Performing Accommodations Ratio: 3.29% as at 30 June 2024, compared to 6.69% as at 30 June 2023.

These figures illustrate a stable financial performance for LB Finance PLC with improvements in net interest income, fee and commission income, and net operating income, despite a decrease in overall income. The company has managed to control its interest expenses significantly, contributing to the positive net interest income growth. Additionally, the balance sheet remains strong with a healthy equity position and adequate liquidity ratios.