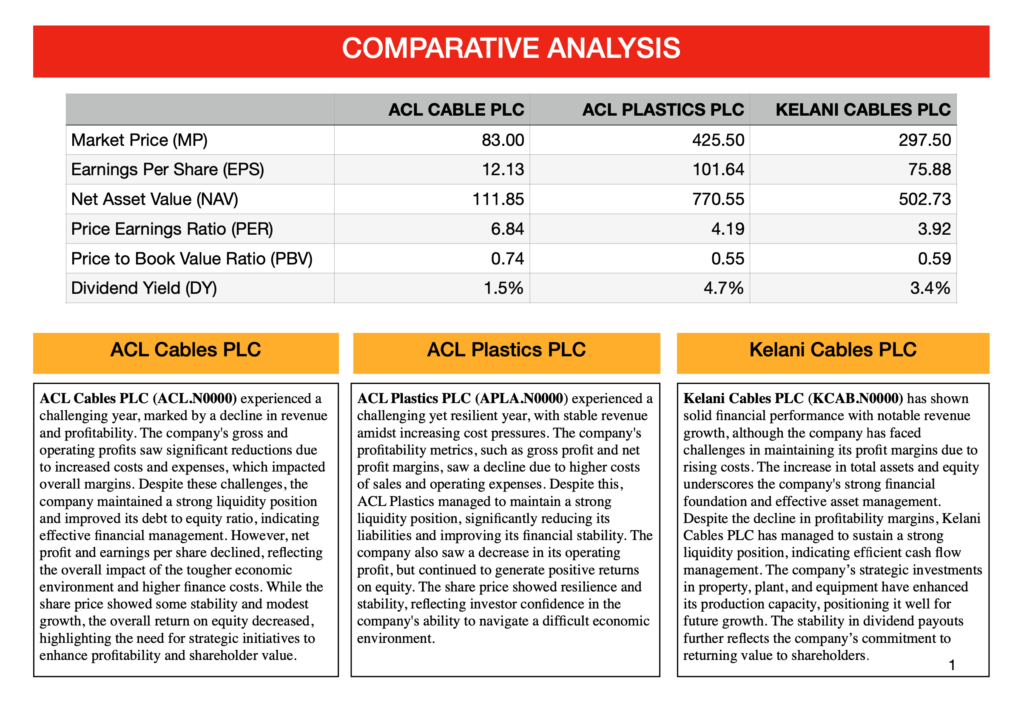

Comparative Analysis of Wire & Cable Sector Companies listed on the Colombo Stock Exchange for year ended 31st March 2024.

ACL Cables PLC

ACL Cables PLC (ACL.N0000) experienced a challenging year, marked by a decline in revenue and profitability. The company’s gross and operating profits saw significant reductions due to increased costs and expenses, which impacted overall margins. Despite these challenges, the company maintained a strong liquidity position and improved its debt to equity ratio, indicating effective financial management. However, net profit and earnings per share declined, reflecting the overall impact of the tougher economic environment and higher finance costs. While the share price showed some stability and modest growth, the overall return on equity decreased, highlighting the need for strategic initiatives to enhance profitability and shareholder value. Read More

ACL Plastics PLC

ACL Plastics PLC (APLA.N0000) experienced a challenging yet resilient year, with stable revenue amidst increasing cost pressures. The company’s profitability metrics, such as gross profit and net profit margins, saw a decline due to higher costs of sales and operating expenses. Despite this, ACL Plastics managed to maintain a strong liquidity position, significantly reducing its liabilities and improving its financial stability. The company also saw a decrease in its operating profit, but continued to generate positive returns on equity. The share price showed resilience and stability, reflecting investor confidence in the company’s ability to navigate a difficult economic environment. Read More

Kelani Cables PLC

Kelani Cables PLC (KCAB.N0000) has shown solid financial performance with notable revenue growth, although the company has faced challenges in maintaining its profit margins due to rising costs. The increase in total assets and equity underscores the company’s strong financial foundation and effective asset management. Despite the decline in profitability margins, Kelani Cables PLC has managed to sustain a strong liquidity position, indicating efficient cash flow management. The company’s strategic investments in property, plant, and equipment have enhanced its production capacity, positioning it well for future growth. The stability in dividend payouts further reflects the company’s commitment to returning value to shareholders. Read More

Download Full Report

Download Full Report: https://lankabizz.net/product/comparative-analysis-of-cable-sector-companies-fy-2023-24/