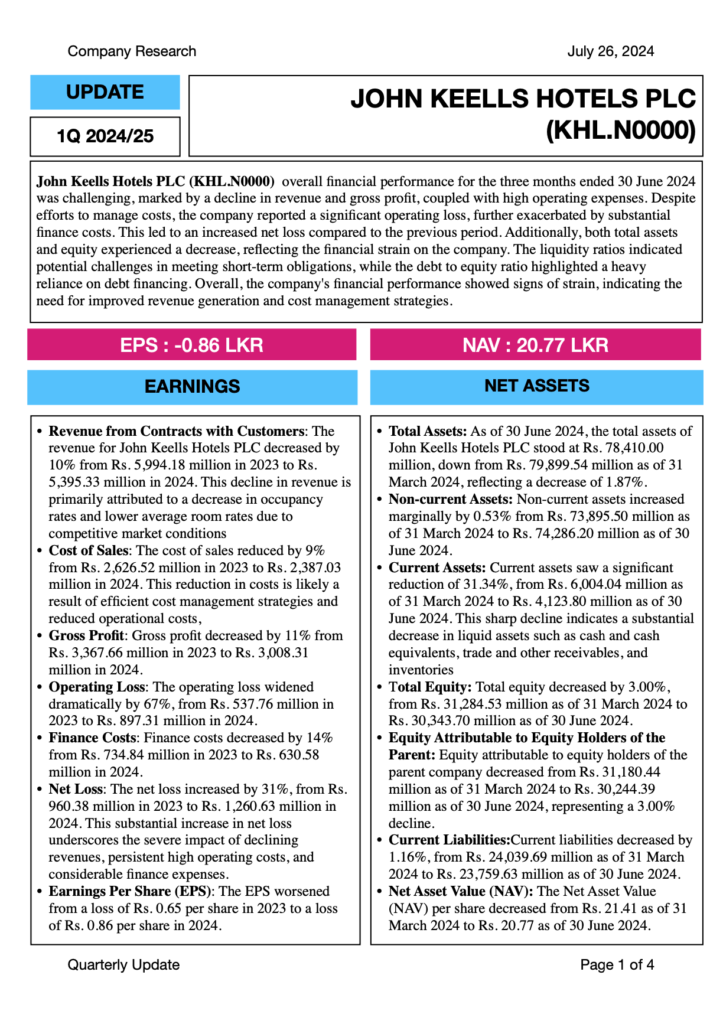

John Keells Hotels PLC (KHL.N0000) overall financial performance for the three months ended 30 June 2024 was challenging, marked by a decline in revenue and gross profit, coupled with high operating expenses. Despite efforts to manage costs, the company reported a significant operating loss, further exacerbated by substantial finance costs. This led to an increased net loss compared to the previous period. Additionally, both total assets and equity experienced a decrease, reflecting the financial strain on the company. The liquidity ratios indicated potential challenges in meeting short-term obligations, while the debt to equity ratio highlighted a heavy reliance on debt financing. Overall, the company’s financial performance showed signs of strain, indicating the need for improved revenue generation and cost management strategies.

- Revenue from Contracts with Customers: The revenue for John Keells Hotels PLC decreased by 10% from Rs. 5,994.18 million in 2023 to Rs. 5,395.33 million in 2024. This decline in revenue is primarily attributed to a decrease in occupancy rates and lower average room rates due to competitive market conditions

- Cost of Sales: The cost of sales reduced by 9% from Rs. 2,626.52 million in 2023 to Rs. 2,387.03 million in 2024. This reduction in costs is likely a result of efficient cost management strategies and reduced operational costs,

- Gross Profit: Gross profit decreased by 11% from Rs. 3,367.66 million in 2023 to Rs. 3,008.31 million in 2024.

- Operating Loss: The operating loss widened dramatically by 67%, from Rs. 537.76 million in 2023 to Rs. 897.31 million in 2024.

- Finance Costs: Finance costs decreased by 14% from Rs. 734.84 million in 2023 to Rs. 630.58 million in 2024.

- Net Loss: The net loss increased by 31%, from Rs. 960.38 million in 2023 to Rs. 1,260.63 million in 2024. This substantial increase in net loss underscores the severe impact of declining revenues, persistent high operating costs, and considerable finance expenses.

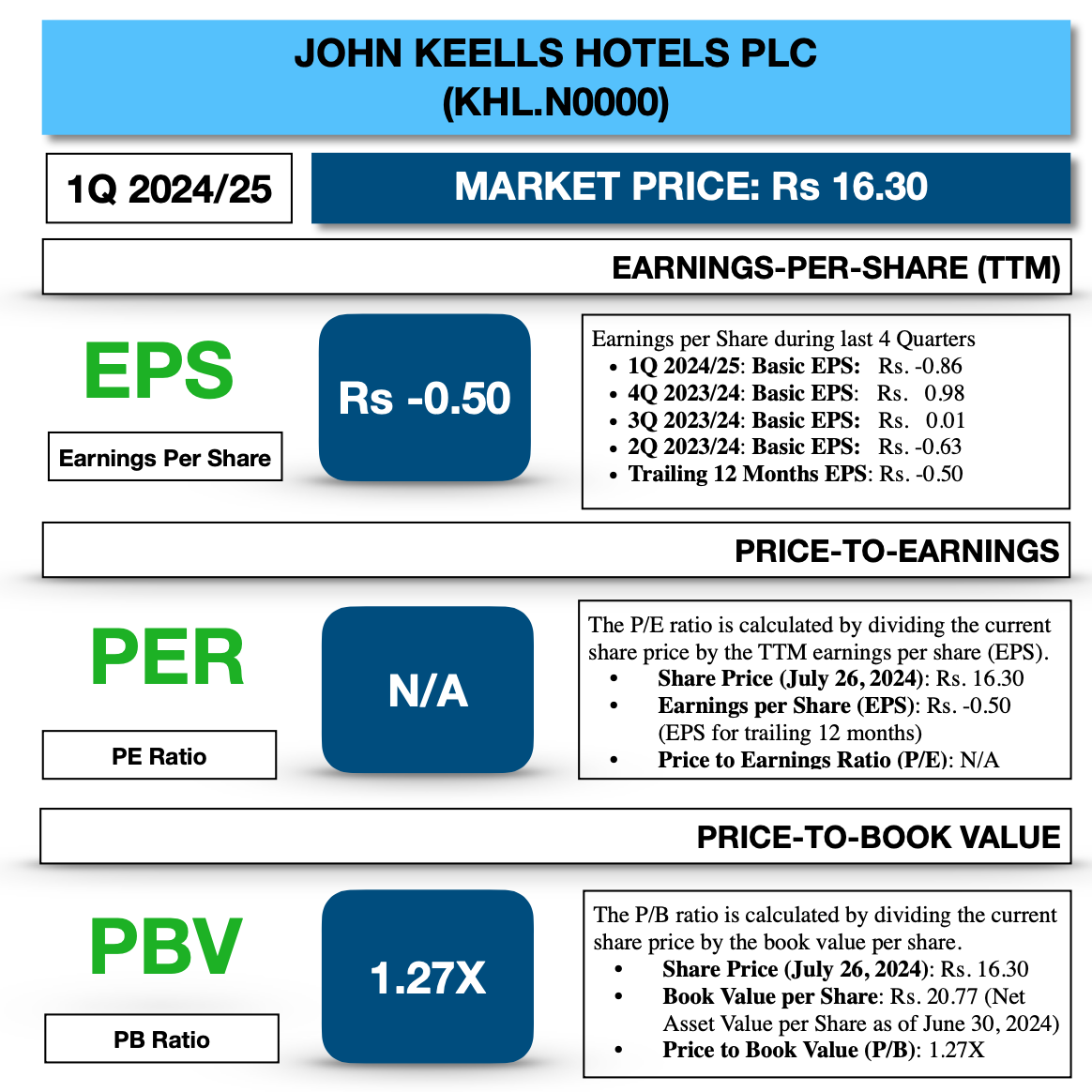

- Earnings Per Share (EPS): The EPS worsened from a loss of Rs. 0.65 per share in 2023 to a loss of Rs. 0.86 per share in 2024.

Download full Report: https://lankabizz.net/product/john-keells-hotels-plc-1q-fy-2024-25/