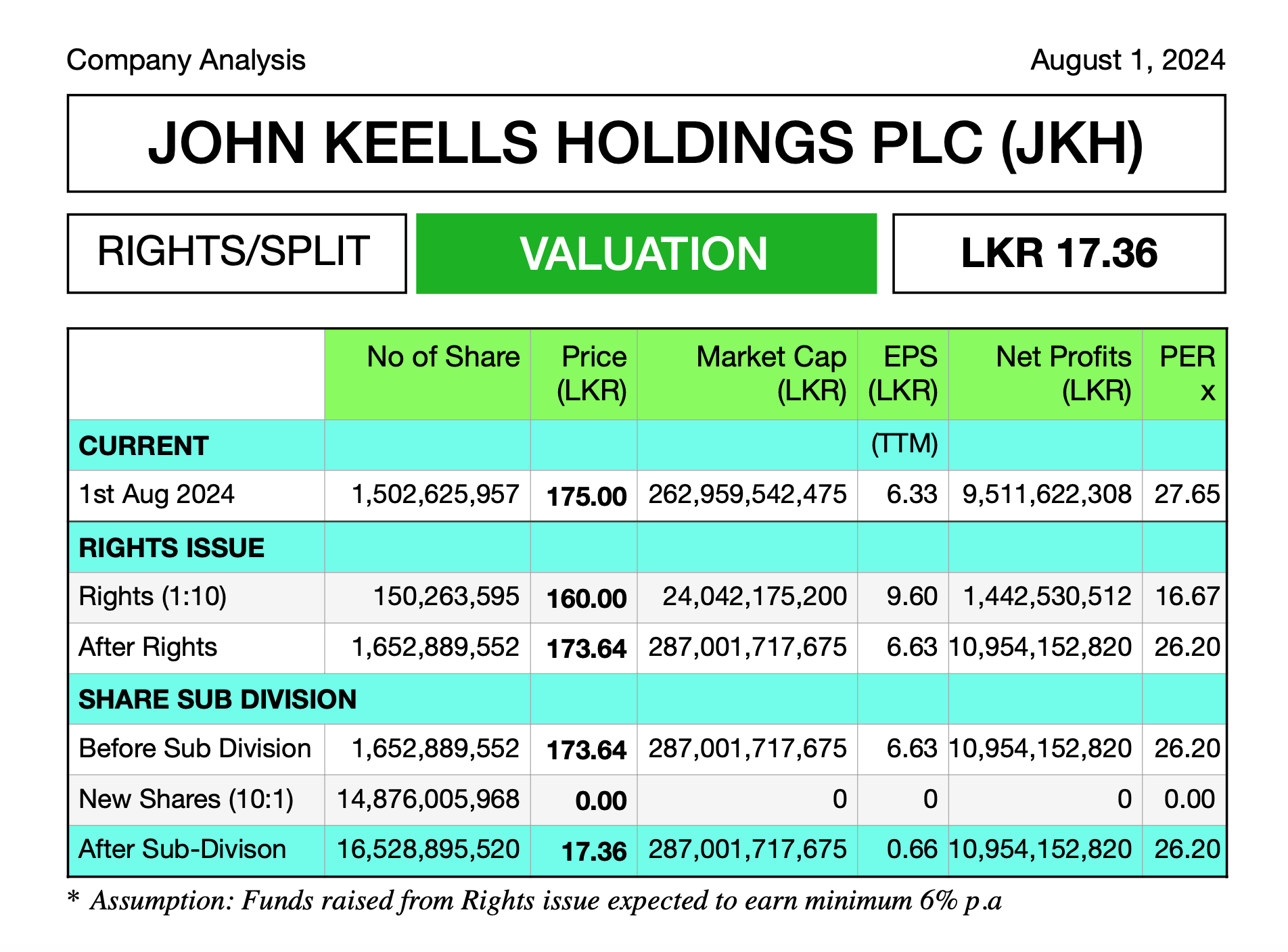

Share Price of John Keells Holding PLC (JKH.N000) after the proposed Rights Issue and Subdivision of Shares expected to be around LKR 17/= per share according theoretical (Ex Rights. Ex Sub-division) calculation.

Download Report: https://lankabizz.net/product/john-keells-holdings-plc-undefined-future/

SUMMARY

Current Market Status (as of August 1, 2024):

John Keells Holdings PLC (JKH) is a leading player in the Sri Lankan market, with a robust market capitalization of LKR 262,959,542,475, driven by an outstanding share count of 1,502,625,957 and a share price of LKR 175.00. The company’s financial strength is highlighted by its Earnings Per Share (EPS) of LKR 6.33 and net profits totaling LKR 9,511,622,308. With a Price-to-Earnings Ratio (PER) of 27.65, JKH is perceived as a high-value investment, demonstrating investor confidence in its growth trajectory and market positioning.

Rights Issue Details:

In a strategic move to bolster its financial standing, JKH conducted a rights issue, offering one new share for every ten existing shares at a price of LKR 160.00. This initiative led to the issuance of 150,263,595 additional shares, raising LKR 24,042,175,200 in capital. The rights issue was designed to strengthen JKH’s balance sheet by reducing leverage and supporting strategic projects. Following the issue, the company’s EPS adjusted to LKR 9.60, reflecting an immediate impact on shareholder value and a new PER of 16.67, indicative of the company’s enhanced market attractiveness.

Market Position Post-Rights Issue:

After the rights issue, JKH’s total shares outstanding increased to 1,652,889,552, and the share price adjusted to LKR 173.64. The company’s market capitalization rose to LKR 287,001,717,675, signaling strong investor confidence in its strategic direction. The adjusted EPS stood at LKR 6.63, with net profits climbing to LKR 10,954,152,820, showcasing JKH’s improved earnings capacity. The PER of 26.20 post-rights issue reflects sustained investor optimism about the company’s future prospects and ability to generate value.

Share Sub-Division Strategy:

Following the rights issue, JKH implemented a share sub-division, splitting each existing ordinary share into ten new shares. This action increased the total number of shares from 1,652,889,552 to 16,528,895,520, significantly enhancing share liquidity and accessibility for a broader investor base. Despite this increase in shares, the company’s market capitalization remained stable at LKR 287,001,717,675, ensuring that the overall company value was not diluted. The share price adjusted to LKR 17.36 post-sub-division, aligning with the new share structure.

Financial Impact of Share Sub-Division:

Post-sub-division, JKH’s EPS adjusted to LKR 0.66, reflecting the expanded share count. This adjustment maintains the company’s earnings efficiency, supporting its financial stability amidst a larger shareholder base. The consistent net profits of LKR 10,954,152,820 underscore JKH’s ability to sustain strong financial performance. With the PER remaining at 26.20, the market’s confidence in JKH’s earnings potential and valuation remains robust, demonstrating the success of the strategic financial maneuvers.

Strategic Financial Outcomes:

The capital raised through the rights issue is projected to generate a minimum annual return of 6%, highlighting JKH’s focus on optimizing its capital structure and financial resources. This initiative aligns with the company’s strategic goals of funding key projects and enhancing operational capabilities. By reducing leverage and improving liquidity, JKH is better positioned to capitalize on growth opportunities and deliver sustained value to shareholders. These strategic financial adjustments underscore the company’s commitment to maintaining a strong market position and achieving long-term growth.

Market Outlook and Investor Appeal:

With the successful execution of the rights issue and share sub-division, JKH has significantly improved its market appeal and financial flexibility. The increased share liquidity and enhanced capital structure position the company favorably to pursue its growth objectives in a dynamic market environment. These strategic initiatives reflect JKH’s proactive approach to managing market challenges and opportunities, ensuring it remains a top choice for investors seeking stable and promising returns. As JKH continues to implement its growth strategies, it is well-equipped to drive sustainable shareholder value and maintain its leadership position in the industry.

ANALYTICAL REPORT