Colombo Stock Market Aspirations Movement Based on Technical and Sentimental Analysis

Market Sentiment and Aspirations

Investor Sentiment

- Positive Indicators: The market has seen renewed interest from domestic and foreign investors, driven by economic reforms and improved political stability. The “Golden Cross” and high trading volumes reflect growing optimism.

- Challenges: Despite optimism, uncertainties related to global economic conditions, interest rate changes, and geopolitical tensions could impact market aspirations.

Economic Aspirations

- GDP Growth: Sri Lanka’s economy is projected to grow steadily, with key sectors such as tourism, agriculture, and manufacturing showing promise. This growth is expected to translate into positive stock market performance.

- Policy Reforms: Government initiatives aimed at improving the business environment and attracting foreign investments are expected to bolster market performance.

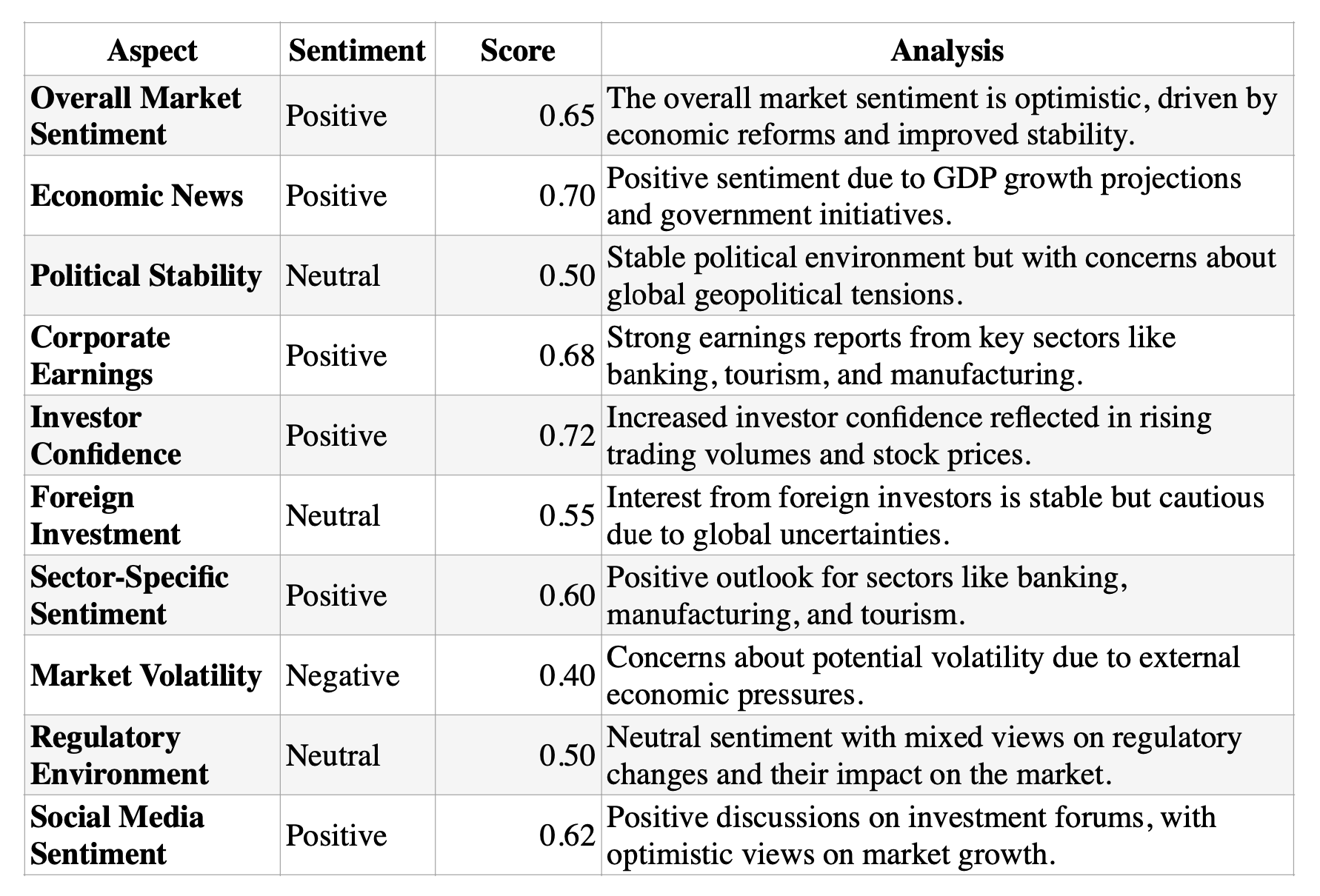

- Overall Market Sentiment: The overall sentiment in the Colombo Stock Market is positive, with a sentiment score of 0.65. This indicates optimism among investors and market participants, driven by recent economic reforms and stable political conditions.

- Economic News: Positive sentiment is reflected in economic news, with a sentiment score of 0.70. The GDP growth projections and government initiatives to boost economic activity are viewed favorably by investors.

- Political Stability: The sentiment score of 0.50 for political stability indicates a neutral stance. While the domestic political environment is stable, concerns about global geopolitical tensions have led to cautious sentiment.

- Corporate Earnings: Strong corporate earnings, particularly from key sectors like banking, tourism, and manufacturing, contribute to a positive sentiment score of 0.68. Companies have reported robust financial results, supporting investor confidence.

- Investor Confidence: With a sentiment score of 0.72, investor confidence is high. Rising trading volumes and stock prices reflect growing optimism about the market’s future prospects.

- Foreign Investment: The sentiment score of 0.55 indicates a neutral stance on foreign investment. While interest from foreign investors remains stable, caution prevails due to global uncertainties.

- Sector-Specific Sentiment: The sentiment score of 0.60 for sector-specific sentiment highlights positive expectations for sectors like banking, manufacturing, and tourism, which are anticipated to drive market growth.

- Market Volatility: Concerns about market volatility are reflected in a negative sentiment score of 0.40. External economic pressures, such as global interest rate hikes and trade tensions, contribute to apprehension about potential volatility.

- Regulatory Environment: The neutral sentiment score of 0.50 for the regulatory environment indicates mixed views on recent regulatory changes and their potential impact on the market.

- Social Media Sentiment: Positive discussions on social media platforms, with a sentiment score of 0.62, highlight optimistic views among retail investors about the market’s growth prospects.

The sentiment analysis of the Colombo Stock Market reveals an overall positive outlook, supported by strong corporate earnings, economic growth projections, and high investor confidence. However, caution is advised due to potential market volatility and global uncertainties. Investors should remain vigilant and consider both domestic and international factors that could impact market sentiment in the coming months.

Trend

- Positive Trends: Overall sentiment, economic news, corporate earnings, and investor confidence show positive trends, reflecting a generally optimistic outlook for the Colombo Stock Market.

- Neutral Factors: Political stability and market volatility are areas of concern, with neutral to negative sentiment indicating cautiousness among investors.

- Implications: Investors are encouraged to focus on sectors with strong earnings potential while remaining vigilant of external economic pressures that may introduce volatility.This sentiment trend analysis provides valuable insights into the factors driving investor sentiment and market behavior. By understanding these trends, investors can make informed decisions aligned with the prevailing market sentiment.