The ongoing economic and financial crisis in Bangladesh poses significant challenges and opportunities for Commercial Bank PLC (COMB.N0000). This analysis will explore the bank’s exposure and dependency on the Bangladesh market, as well as the broader implications of the crisis on its future profitability.

1. Political Crisis in Bangladesh

Bangladesh is currently facing a significant political crisis, primarily characterized by increasing tensions between the ruling government and the opposition parties. The political instability is exacerbated by mass protests, strikes, and allegations of electoral fraud and human rights violations. The ongoing crisis has led to widespread public discontent and disrupted daily life across the nation. The government’s efforts to maintain control have resulted in stricter regulations and curtailment of civil liberties, further fueling public outrage and uncertainty. This political turmoil is taking place against the backdrop of an economy that is already struggling with inflation, a weakening currency, and challenges in key export industries such as the ready-made garment sector.

The political crisis in Bangladesh poses substantial risks to the future of the country’s banking sector and overall economy. The instability can lead to decreased investor confidence, capital flight, and reduced foreign direct investment (FDI), all of which are crucial for Bangladesh’s economic growth. The banking sector, already facing issues with rising non-performing loans and liquidity pressures, may experience further strain as businesses face disruptions and economic activity slows down. In the long term, prolonged political unrest could deter international trade partnerships and slow down the progress of major infrastructure projects. As the crisis continues, the banking sector may need to focus on enhancing risk management practices and developing contingency plans to navigate the challenges ahead, while the government must prioritize creating a stable political environment to foster economic resilience and growth.

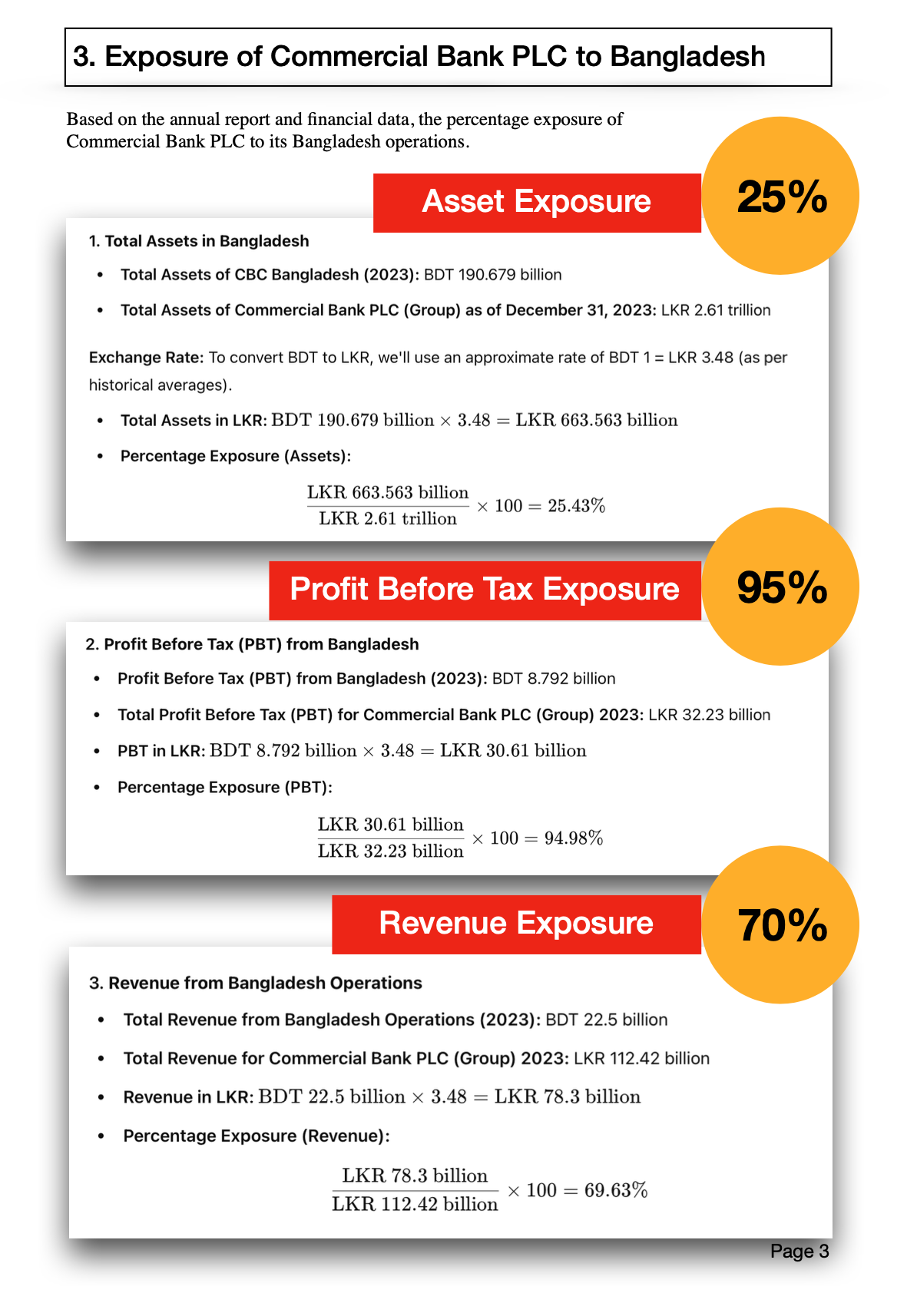

2. Exposure and Dependency on Bangladesh Market

Commercial Bank PLC has a substantial presence in Bangladesh through its subsidiary, CBC Bangladesh. The bank has been operating in the country since 2003 and has established itself as a significant player in the banking sector, focusing on corporate banking, consumer banking, treasury management, and digital banking.

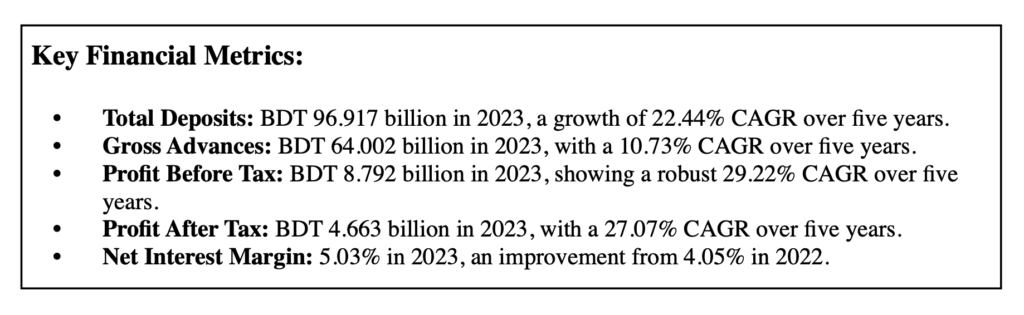

CBC Bangladesh’s impressive financial performance indicates a strong dependency on the Bangladesh market for growth and profitability. The bank’s operations in Bangladesh accounted for a significant portion of its international operations, contributing to 78.57% of the consolidated profit before taxes for the year ended December 31, 2023.

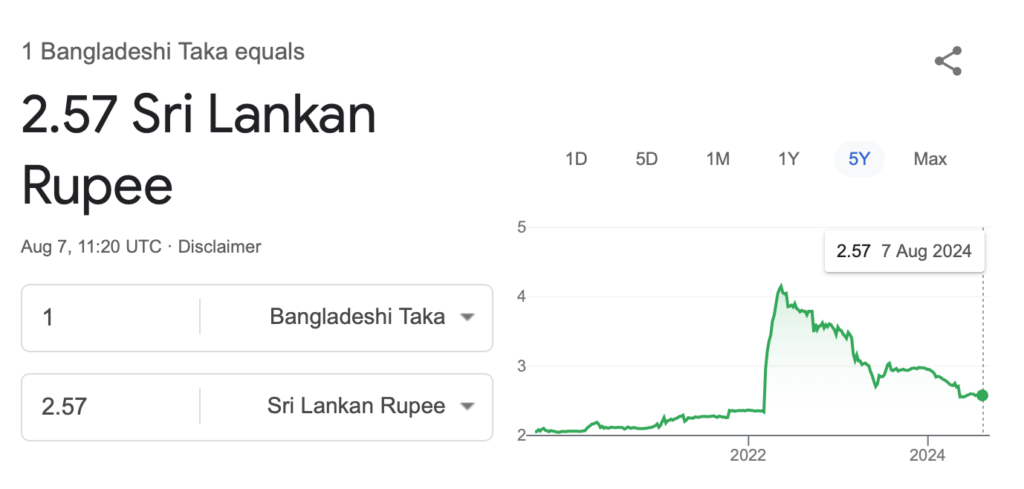

Asset Exposure: 25.43% Profit Before Tax Exposure: 94.98% Revenue Exposure: 69.63%.

The Exposure is calculated based on Exchange Rate of BDT 1 = LKR 3.48 as prevailed in 2023 . Current Exchange rate is BDT 1 = LKR 2.57 (Aug 2024)

Implications of Exposure

- High Profit Dependency: With nearly 95% of PBT coming from Bangladesh, Commercial Bank PLC is heavily reliant on the profitability of its operations in Bangladesh. This makes the bank vulnerable to economic and financial instability in the country.

- Significant Revenue Contribution: Bangladesh contributes almost 70% of the total revenue, indicating that any adverse economic developments in Bangladesh could significantly impact the bank’s revenue streams.

- Asset Exposure: Although the asset exposure is relatively lower at 25.43%, it still represents a substantial portion of the bank’s total assets. The impact on asset quality due to rising non-performing loans could be a significant concern.

Download Full Report