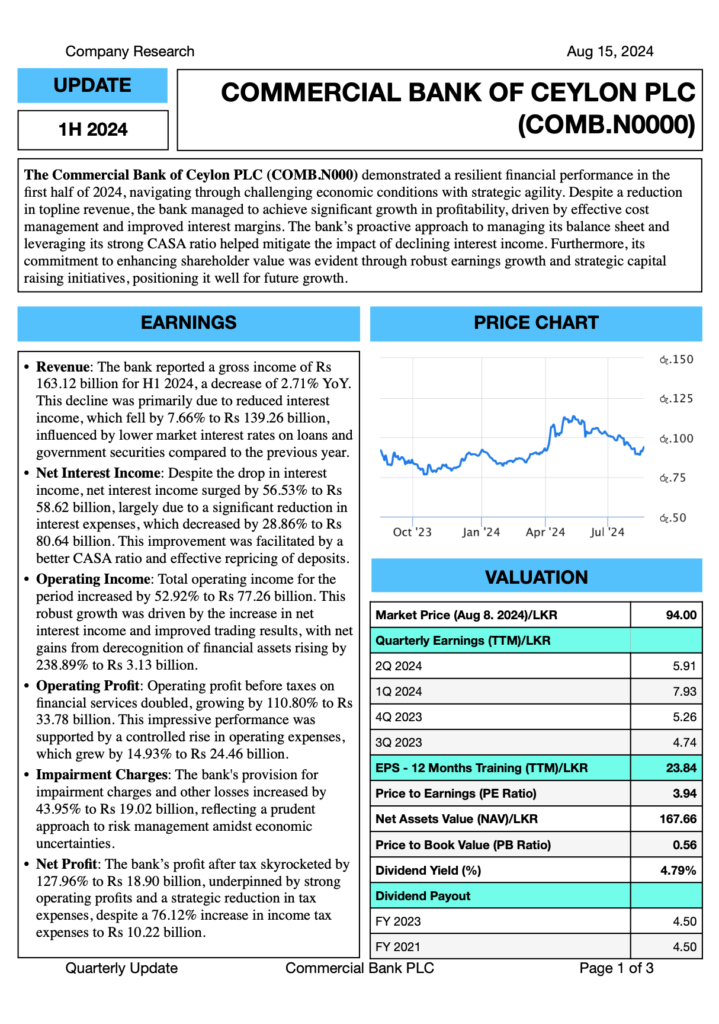

Aug 16 (LankaBIZ) Colombo, Sri Lanka. The future outlook for Commercial Bank of Ceylon PLC is cautiously optimistic, as the bank is well-positioned to navigate both domestic and international challenges while capitalizing on growth opportunities. Domestically, the bank’s robust capital adequacy, improved profitability, and strategic focus on digital innovation and SME lending provide a strong foundation for continued growth. The bank’s effective management of interest margins and cost efficiency will likely support stable earnings, even in a volatile economic environment. Furthermore, its proactive approach to managing asset quality and maintaining strong capital buffers will be critical in sustaining its financial health.

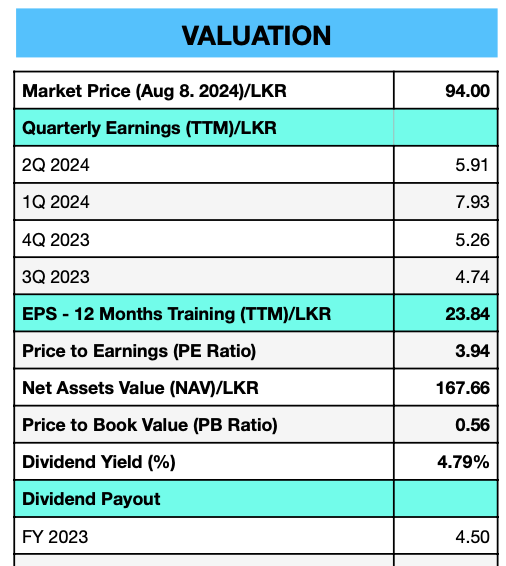

Profitability and Earnings (EPS) of Commercial Bank PLC has fallen to LKR 5.91 from LKR 7.93 (Q2 Vs Q1) decline more than 25.5%, mainly due to crisis in Bangladesh.

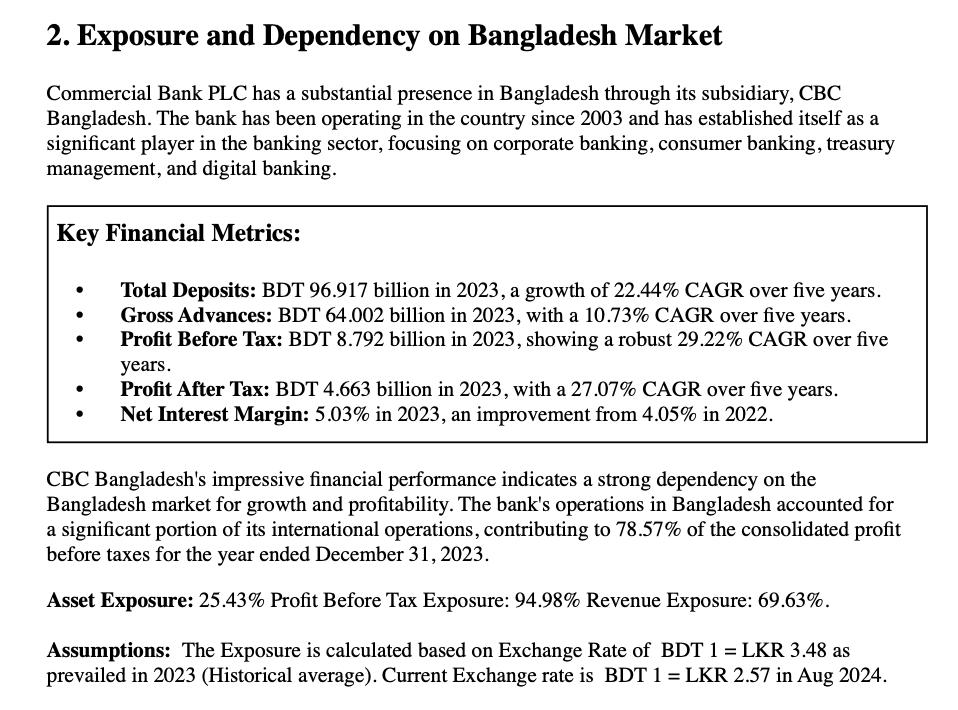

Commercial Bank of Ceylon PLC’s significant exposure to the Bangladesh market introduces a layer of uncertainty. While the economic and political instability in Bangladesh poses potential risks, the bank’s strategy to diversify its international portfolio and strengthen its presence in other markets could help mitigate these risks.

Commercial Bank of Ceylon PLC’s Exposure to Bangaldesh:

The bank’s ability to adapt to changing market conditions, manage external risks, and execute its growth strategies will be key determinants of its future performance. Overall, with prudent risk management and strategic expansion, Commercial Bank PLC is poised to maintain its leadership position in the Sri Lankan banking sector while cautiously navigating international challenges.

Latest Financial Performance of Commercial Bank of Ceylon PLC: 2Q 2024

- Return on Assets (ROA): The bank’s ROA improved significantly to 2.17%, up from 1.27% in 2023, indicating better asset utilization and profitability.

- Return on Equity (ROE): ROE surged to 16.76% from 9.78% in the previous year, reflecting enhanced profitability and effective equity management.

- Cost-to-Income Ratio: The cost-to-income ratio improved to 37.82%, down from 40.31% in 2023, demonstrating efficient cost management despite rising operational expenses.

- Net Interest Margin (NIM): NIM improved to 4.41%, compared to 3.32% in 2023, driven by effective management of interest-bearing liabilities and improved CASA ratios.

- Loan-to-Deposit Ratio: The loan-to-deposit ratio slightly increased to 57.77%, reflecting the bank’s strategic focus on growing its loan book while maintaining deposit growth.

- Impaired Loans Ratio: The impaired loans (Stage 3) ratio improved to 4.87%, down from 5.85% at the end of 2023, indicating better credit quality and effective risk management.

- Capital Adequacy Ratio (CAR): The bank maintained strong capital ratios with Tier 1 and Total CAR at 11.58% and 15.12%, respectively, well above the regulatory requirements, underscoring financial stability.

Bangalseh Crisis and How Commercial Bank of Ceylon is affected